Consumer Sentiment: Caution Holds, Optimism Split By Demographic

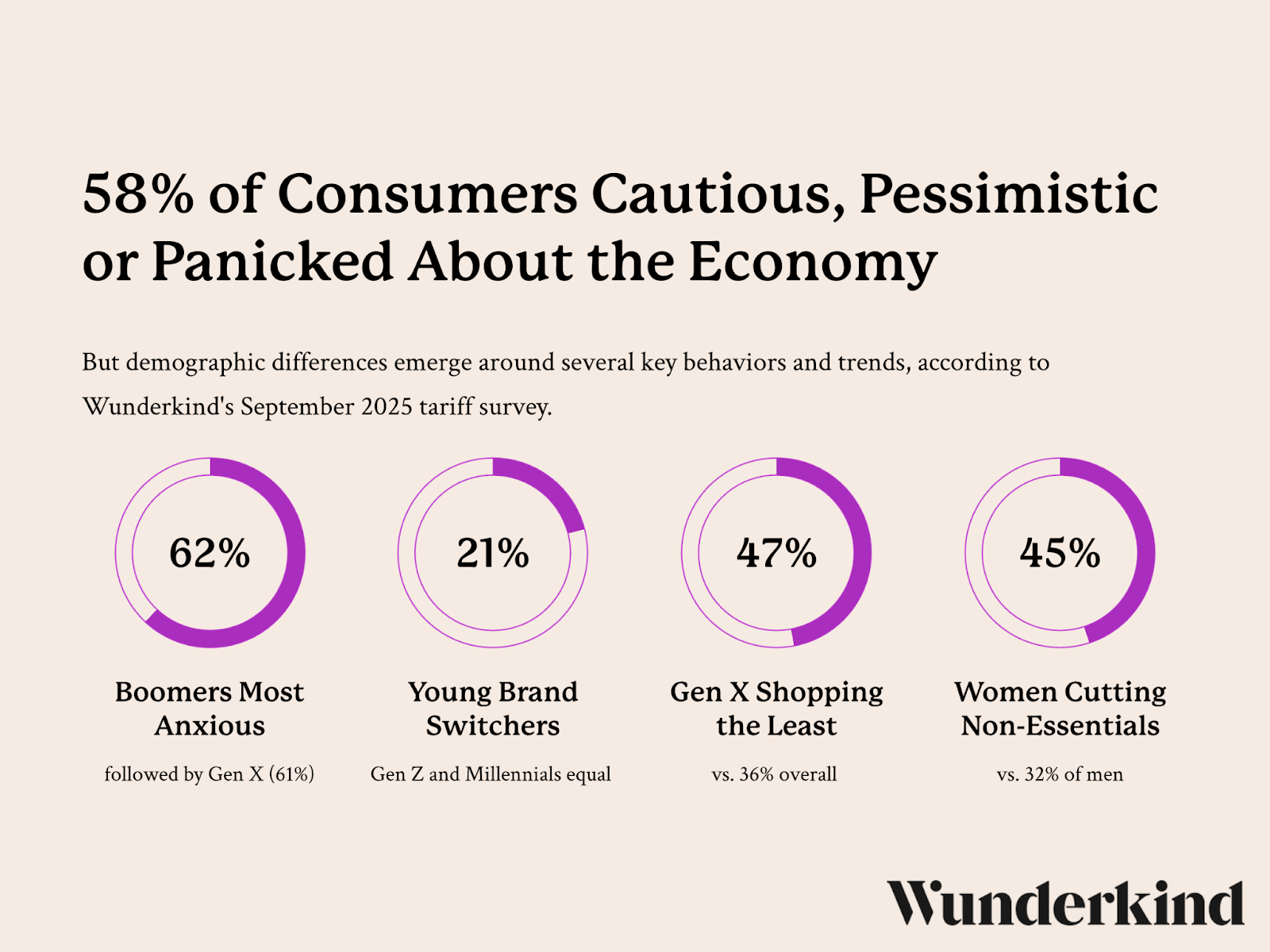

58% of consumers feel cautious, pessimistic or panicked about the economy, per a Wunderkind survey.

With inflation and tariffs squeezing household budgets, consumers are feeling cautious — and it’s showing in the way they spend. A September study by Wunderkind finds that while caution leads the way, optimism and pessimism look different depending on age and gender. For brands, that means finding the right balance between reassurance and value, with strategies tailored to different groups

- 58% of total U.S. consumers say they feel cautious, pessimistic or panicked about the economy, with 21% saying they are optimistic compared to January.

- Men are nearly twice as likely as women to feel upbeat, while Boomers and Gen X now rank among the most anxious groups (62% and 61%, respectively).

- A majority of shoppers are pulling back in one way or another: 38% are making fewer non-essential purchases, 37% prioritize deal-seeking and 36% have reduced shopping overall.

- Women are most likely to cut non-essentials (45% vs 32% of men), while 47% of Gen X say they are shopping less overall.

- Gen Z and Millennials show the highest rates of switching brands (21% each). Boomers, by contrast, are least likely to change retailers (10%).

What does this all mean for brands? Wunderkind says, “Reassurance and transparency are essential. Stability, affordability, and trust resonate most with women and older cohorts, while aspirational messages may better engage men. Flexible, real-time offers could help Gen Z shift from neutrality into action.”

Get more insights by downloading Wunderkind’s September tariff report here.