Measuring FAST: Nielsen Puts Share of Viewing at 6.8%

Measuring individual channels is being looked at, says Brian Fuhrer of Nielsen

Viewing via streaming is growing, but measuring that viewing remains a challenge. This is especially true in the world of free ad-supported streaming television.

A lot of data is closely held by streaming platforms, which means the people who program channels feel they are trying to monetize them with one hand tied behind their backs. Advertisers also must deal with sketchy data and continually complain about the state of cross-channel reach and frequency measurement.

U.S. ad spending on FAST was projected to reach $5.7 billion, according to Statista and is expected to grow at an annual compounded rate of 2.73% to $6.61 billion by 2030. Industry executives believe growth could be faster with improved measurement.

So it was very interesting when Brian Fuhrer, senior VP, product strategy & thought leadership at Nielsen, spoke last month at a FAST conference run by Amagi, which provides the backroom technology for many of the free ad-supported streaming television channels.

Fuhrer had charts and graphs showing the growth of FAST viewership, raising the possibility that Nielsen might be getting ready to provide measurement of FAST channels as it tries to become as dominant measuring streaming as it has been with traditional broadcast and cable TV.

“We see a lot of opportunity now with this FAST landscape,” Fuhrer told The Measure in an interview. “It’s expanding rapidly but it’s got a lot of runway to go. We want to be able to facilitate that. And I think by adding measurement, more incremental measurement, we should help the ecosystem.”

Viewers are moving from cable to FAST. “Once the TV set is set up to stream, suddenly you’ve got all these free services that are kind of frictionless,” Fuhrer said. “You don’t have to sign up, you don’t have to pay anything. There’s no credit card. You just download the app and open it and you’re watching TV.”

The quality of programming on FAST channels is improving, he added. “If you watched any of these services back in 2019-2020, there was a lot of remnant content. Now, almost everyone I know goes out there and samples this and they’re kind of stunned at how good it is.”

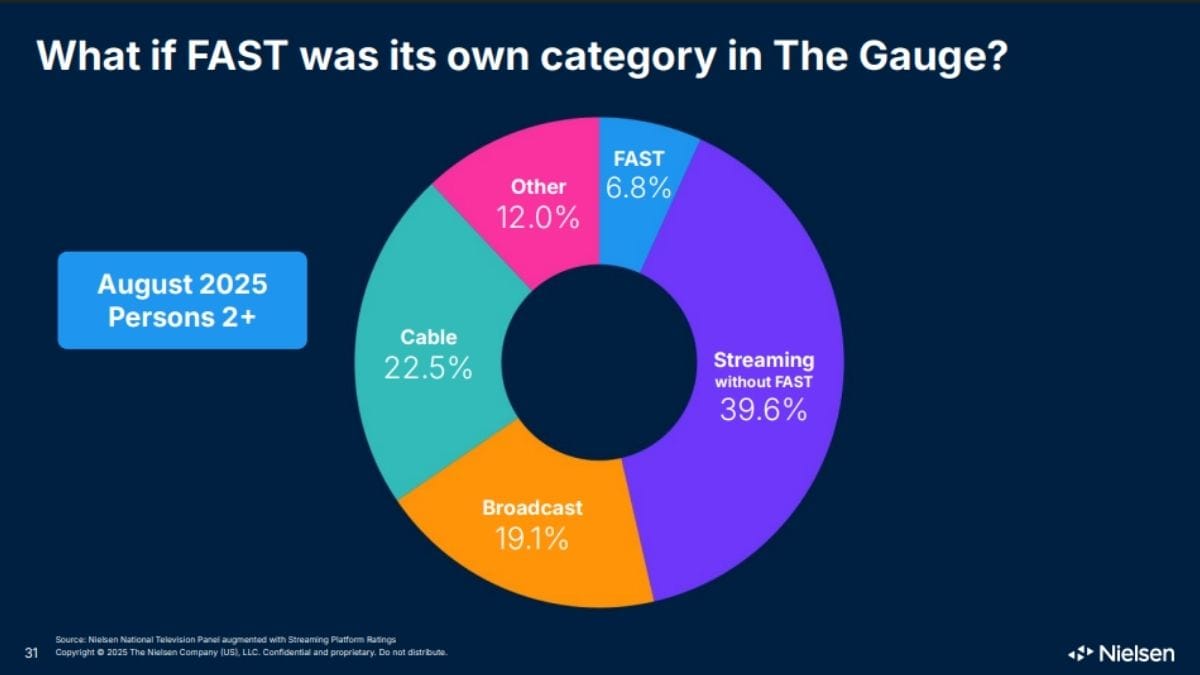

During the Amagi conference presentation, Fuhrer said that if FAST was a category in Nielsen’s monthly The Gauge report, it would have accounted for 6.8% of television usage in August. That figure included free ad-supported linear and on-demand viewing. Paid subscription streaming without FAST would have had a 39.6% viewing.

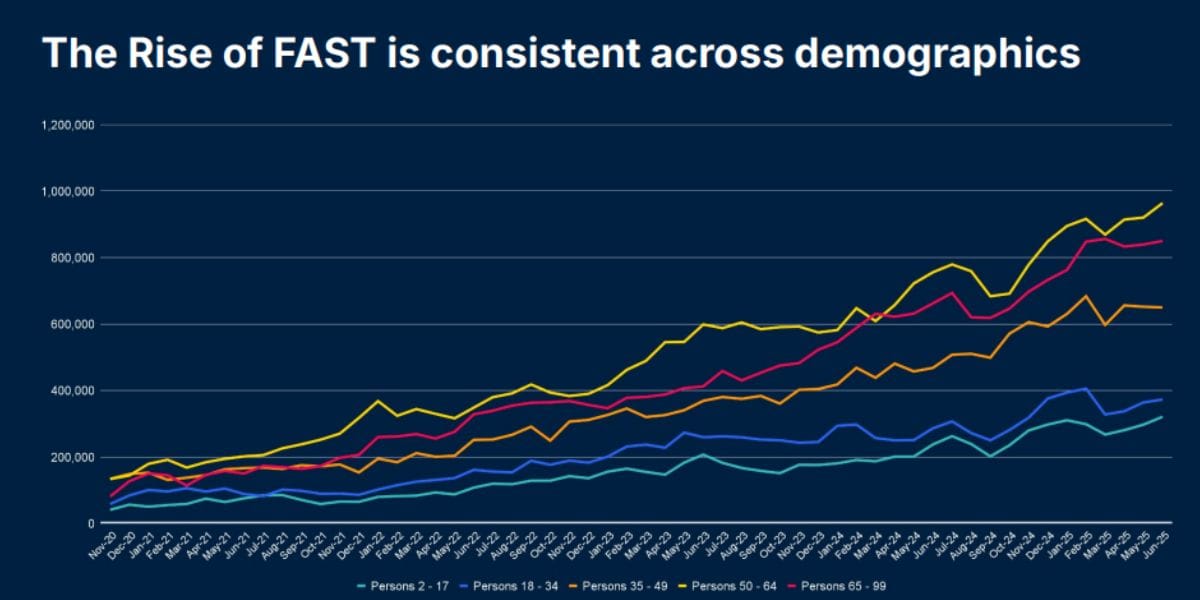

Fuhrer noted that at the same time as cable TV has seen declines across demographics, the rise of FAST has been consistent across demos and across providers.

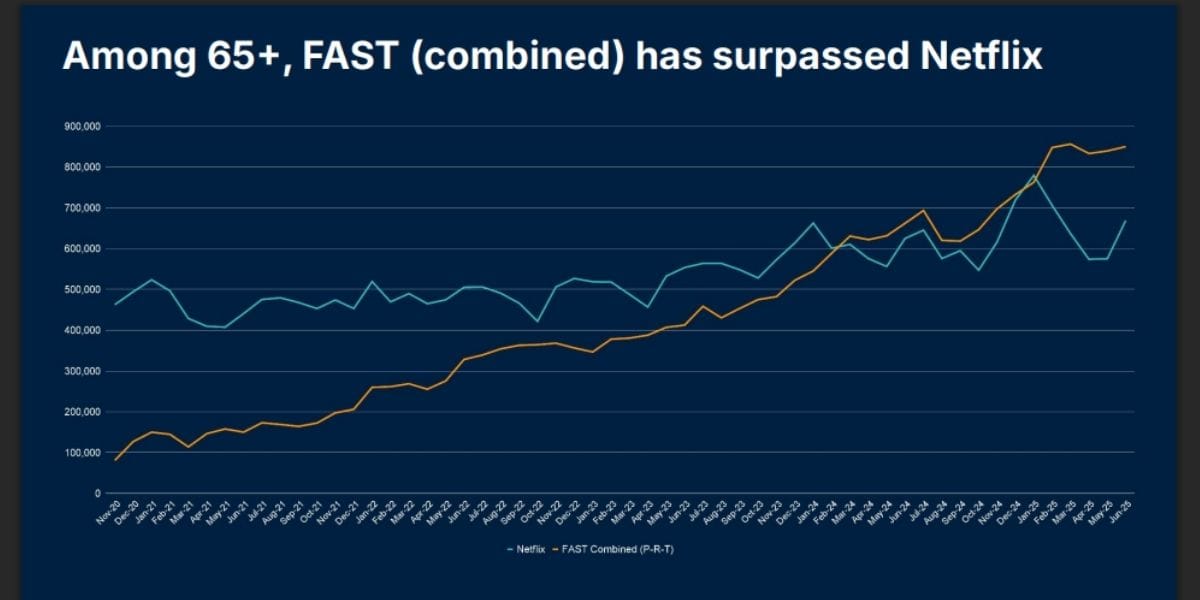

Among viewers 65 years and older, FAST as a group has surpassed Netflix in terms of TV usage, he said.

Overall, Fuhrer said, the FAST audience skews at 35-plus years old, which is significantly younger than traditional linear TV viewing, which has a majority of its viewers in the 65-plus age bracket.

FAST is resonating with Black audiences and has an opportunity to be popular among Hispanics as well, Fuhrer told the conference.

At this point, most of Nielsen’s measurement of free ad-supported TV focuses on the big streaming platforms that carry FAST channels, outlets including The Roku Channel, Tubi, Xumo, Pluto TV, Plex, Samsung TV Plus and Vizio.

“Right now we’re looking at the big buckets of the platforms, but over time we’re going to be looking at the channels,” Fuhrer said in the interview.

Most FAST channels turn over a large share of their ad inventory to platforms in exchange for distribution. The channel operators receive a share of the ad revenue their channels generate. But channel operators note that this results in level pricing across all of the channels on a platform and that means the most popular channels can’t command a premium price.

Nielsen is able to measure FAST channels using the same technology it uses to measure other linear services including cable TV, Fuhrer said.

Nielsen has a streaming meter panel of 25,000 homes, 100,000 people and 75 million devices that provides streaming data. In a typical month, Nielsen measures more than 1 trillion minutes of viewing across all streaming apps.

Fuhrer said Nielsen can insert an audio code into a FAST channel’s programming and follow that wherever it goes, reporting viewing the same way it does now with linear networks or live streaming events.

“Some [channels] already are [getting measured] and we’re absolutely ready to expand. The technology is well proven. That’s the advantage. It’s not like we have to build a completely new mousetrap,” he said.

Last June, Nielsen announced a deal with Lionsgate that made Lionsgate’s MovieSphere FAST channel to be measured by Nielsen. The channel is available on about 20 streaming platforms.

Derek Turk, senior VP, ratings & research at Lionsgate, said that having more FAST data has been helpful in programming and monetizing channels.

“[Data] provides us with valuable strategic insight across all of our channels and offers flexibility in business-to-business conversations,” Turk said.

“We’re working in a space where there are gaps in what the data can tell us,” he added. “Anytime that we can expand the use of our data and expand what the data can tell us, it’s really helpful. It gives us another perspective.”

Nielsen has been able to provide viewer demographic data that census-level measurement can’t.

“Nielsen is really good at measuring the linear space, and this capability extends to measuring performance on some of these FAST channels,” Turk said.

In the future, a syndicated service that enables FAST channel operators to show advertisers competitive information about the size and composition of their audiences would enable them to get more appropriate pricing for channels that put more resources into programming and promotion.

“Hopefully we do get to a place where we get to have that conversation about sharing our data, so we get to see other people’s data,” Turk said. “We’re looking at other sources of data in addition to Nielsen, but they’re definitely providing something that is not available in the marketplace currently.”