FAST’s Final Frontier is Live Sports, Says Report from Amagi

Tubi launches ad campaign emphasizing the 'free' as streaming prices rise

Live events–especially sports—are the final frontier for streaming as it takes over the television business.

Amagi, whose pipes power more than half of the free ad-supports streaming TV (FAST) business in the U.S., surveyed 500 consumers for its recent Global FAST Report.

Live is the premium programming that FAST channels have lacked. For consumers live events become the kind of appointment viewing that drives demand for streaming services, not to mention advertiser interest.

“Over the last five years, we’ve seen numerous articles and discussions written about the Streaming Wars' between the major streaming services, and there still isn’t a consensus on who won and who lost. But you could make an argument that live programming is the last battle to be won,” the Amagi report, entitled The Power of Live Programming: a Catalyst for Streaming Success, said.

Amagi notes that paid streaming services such as Netflix, Amazon Prime Video and Apple were early to stream sports, including the mighty NFL. YouTube joined their ranks last week, streaming the Chargers-Chiefs game from Brazil.

FAST channels have been slower to add sports, especially major sports, which can be expensive. But earlier this year, while Fox broadcast the Super Bowl, Fox’s Tubi streamed the game. According to Nielsen, during the game Tubi represented a third of all streaming usage and its audience grew 16 times from its January 2025 average.

“The appointment-based viewing experience and flexibility of incorporating live events within linear programming, similar to cable, may be why content providers and FAST services gravitate toward live programming and single-live events,” the report said.

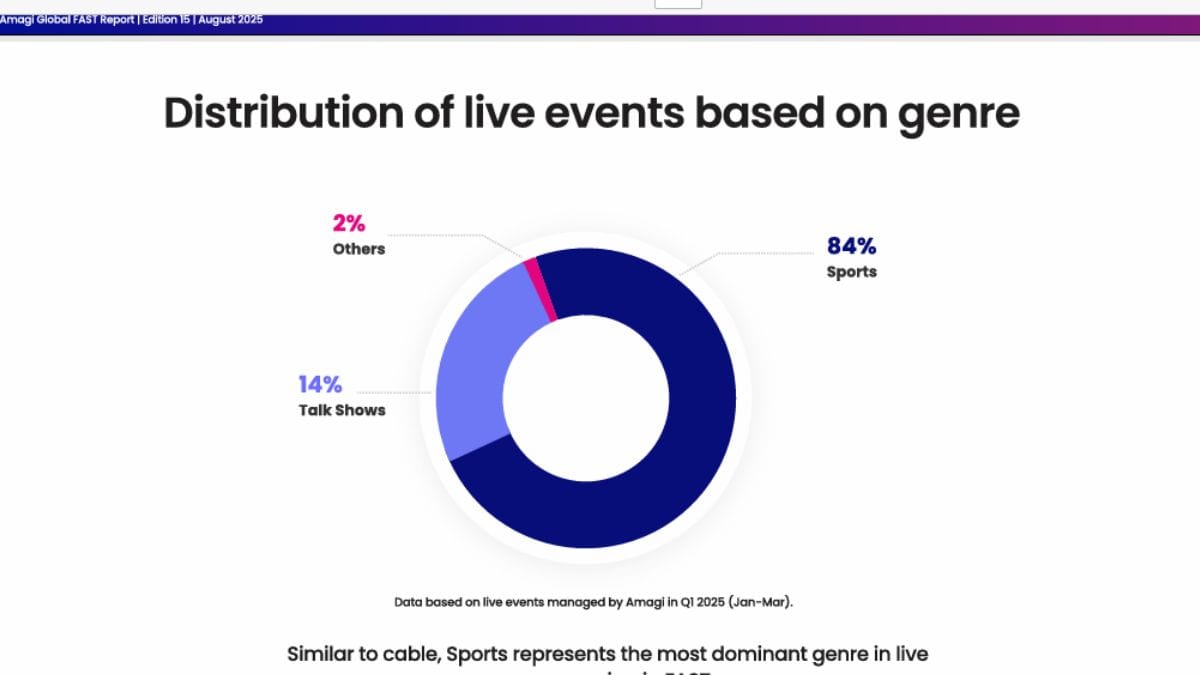

Based on internal Amagi data, 84% of the live events on FAST channels managed by Amagi during Q1 of this year were sports, with talk shows accounting for 14% and 2% other.

The Amagi survey found that 70% of consumers responding said they watch live events daily or weekly. Another 16% said they watch live events monthly, while 24% replied rarely.

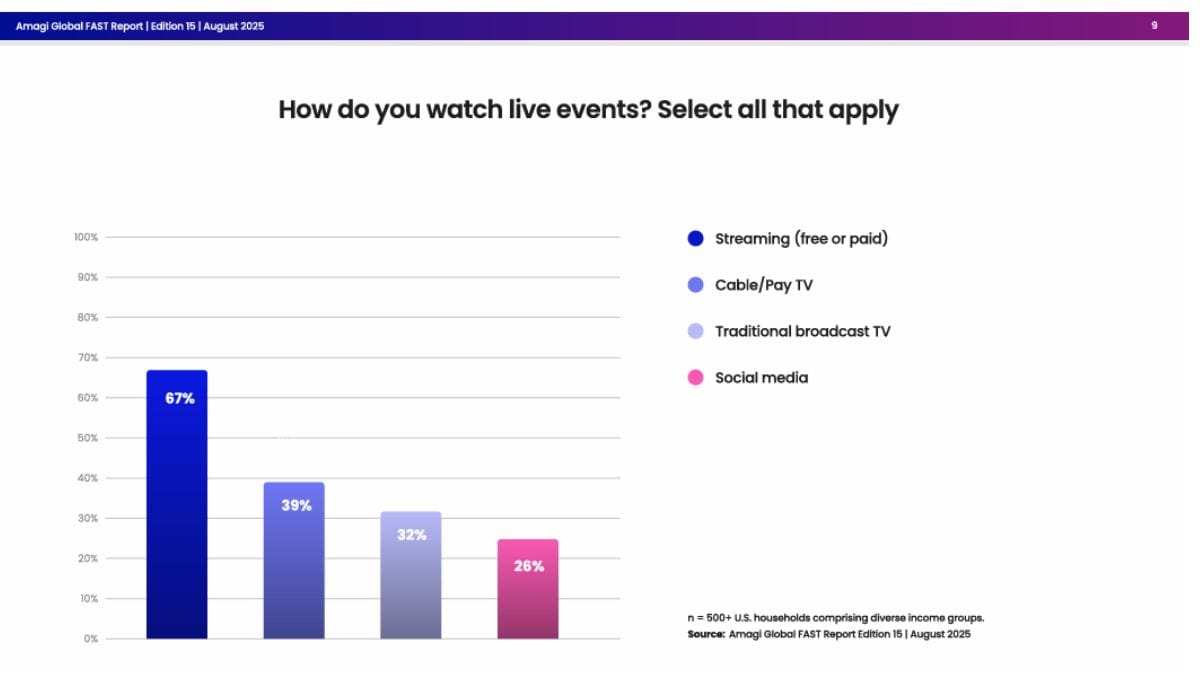

When asked how they watched live events, 67% said with free or paid streaming. Cable or pay TV was what 39 of those surveyed said they did, with 32% saying they watched on traditional broadcast TV and 26% viewing via social media.

In what might seem to be discouraging news for Netflix, Amazon and Peacock, who have all shelled out big bucks for exclusive NFL games this season, less that half of those surveyed (47%) said that a free live event would encourage them to sign up for a trial period of a streaming service. (But that 47% number is not trivial. Peacock streamed an exclusive NFL Playoff game in January of 2024 and parent company Comcast said it added 3 million subscribers that quarter, giving it the biggest haul of new subscribers since the launch of Disney+.)

The notion that streaming services have live events hasn’t broken through to all streamers yet. While 38% said streaming services “clearly show what is on,” 16% said they had “no idea” these services had live events and 26% said they use streaming services mainly for on-demand content. Another 18% said they discovered content through ads, social media or other events.

Among those surveyed, 67% said they’ll watch live events on streaming only if they’re free. On the other hand 18% said live events play a large role in whether or not they subscribe to a paid platform or service and 20% said they’ll subscribe to a new service if it’s the only way they can watch the event. Another 11% said they’ll pay of the event, but not the service.

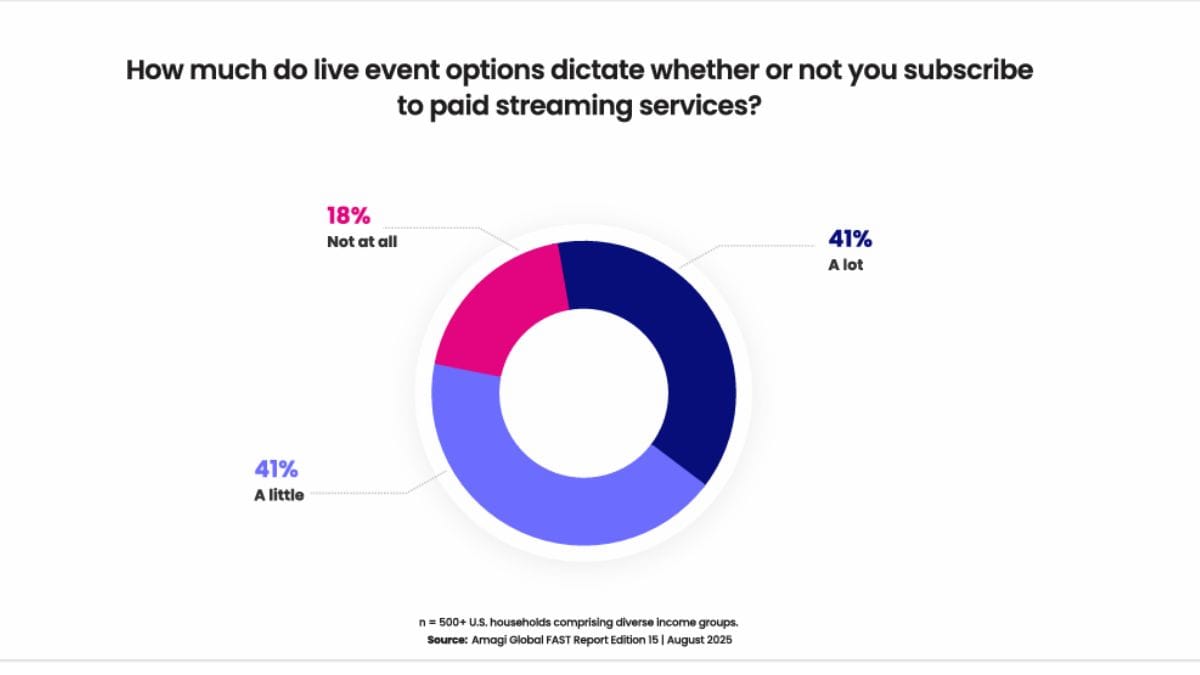

When asked how much do live event options dictate whether or not they subscribe to a paid streaming service, 41% said a lot, 41% said a little and 18% said not at all.

Major sports were the kind of live event that most influenced viewing across both free and paid streaming platforms at 56%. Concerts and news update were both named by 46% of consumers, while awards shows were cited by 27%, minor sports by 24% and talk shows by 17%.

Finally, streaming still has some technical hurdles to overcome when it comes to live events. When asked if they thought live events looked better on cable than streaming because of buffering or eas e of watching, 62% said yes and 38% said no.

# # #

At a time when streaming services seem to be hiking their prices faster than you can spell SVOD, Tubi is launching a new ad campaign that focuses on the fact that it is free now, and will remain free forever.

Tubi's “Free Forever” campaign shows snippets of scenes that look like they come from movies of various genres: romance, crime, fantasy and noir. In each spot a character reacts to Tubi’s “free” claim and asks if their stuck in that role “forever.” As in “do you mean I have to stalk these people forever?”

“Tubi offers unparalleled access to the world’s largest collection of movies and TV shows—it feels too good to be true—which is why we’ve seen some fear among consumers that we're going to start charging,” said Nicole Parlapiano, Chief Marketing Officer at Tubi. “But our promise is clear: Tubi isn’t just free today, it’s free forever. At a time when price hikes and bait-and-switch models have eroded trust across streaming, we want viewers to feel confident that we’re putting them first. We’ve built a service that engages fandoms through the familiar and adventurous—whether it’s the shows you know and love or an out there movie you couldn’t find anywhere else—without the price tag.”

The campaign was created in partnership with an ad agency called Mischief @ No Fixed Address.

“Free is one thing—and something we’ve had fun showcasing in past work with Tubi—but free forever is basically unheard of in this day and age. It’s usually free for a little while until you’re hooked and suddenly, whoops, not so free anymore. And we thought, if Tubi can stand by that claim, we can have a ton of fun with it,” said Kevin Mulroy, founding partner and EDC at Mischief. "As we started talking about concepts, we circled around the idea of characters being stuck in that role for all of time. Not actors, but the characters themselves, trapped in the content that will be free for all eternity. Sorry, mafia rat, you’re getting pummeled forever.”

Tubi, owned by Fox, claims more than 100 million monthly active user and is streaming about 1 billion hours a month. Viewing is 95% on demand. More than half of its audience is made up of members of GenZ and millennials,Tubi said.

In July Tubi accounted for 2.2% of all TV usage, according to Nielsen.

Video courtesy of Tubi