The Short Report: Short-Form Video Finding Greater Favor With Viewers

Media.net study names YouTube Shorts leader in growing format

Maybe attention spans are getting shorter. Or people are spending more time on mobile devices. Either way, there seems to be greater acceptance of short-form video among consumers, and not just on social media. Publishers and advertisers probably should be paying attention to the trend.

A new poll conducted by Media.net found that 90% of consumers said they are open to seeing short-form video content on publisher sites.

Not only that, but 73% said they already watch short-form video multiple times per day, with 42% saying they watch a few times daily and a whopping 32% seeing multiple short videos per hour.

The big winner: YouTube Shorts, which was called the most popular destination for short-form video by 56% of those surveyed. Next up was TikTok with 50% and Facebook with 40%. Instagram Reels got 42%, with Snapchat's Spotlight getting just 7%. Folks also watch short-form video on news or entertainment sites.

“Consumers have made it clear: short-form video isn’t just for social platforms anymore,” said Vaibhav Arya, CEO at Media.net. “They want the same vertical video experience everywhere they spend time online, creating a powerful opportunity for publishers to capture attention and drive deeper engagement.”

More from the survey: 60% of respondents said the watch while relaxing or unwinding at home and 81% watch primarily on smartphones in vertical format.

Only 7% said the rarely or never watch short-form videos.

Consumers find short-form videos highly engaging for a number of reasons, and many prefer them to reading articles (oh no!), listening to podcasts or sitting through long-form videos.

More specifically, 72% said that the quick and easy-to-watch format was a big draw for short-form video, while 58% said they enjoyed their entertaining or humorous content. They were called visually engaging with creative formats by 28%, and many find them through personalized platforms that increase their relevance.

Ad engagement within short-form environments is also strong, Media.net said. In the study, 68% of respondents said they engage with ads, with 28% saying they do so very often. Only 11% of short-form video viewers said they never engage with ads.

Short-form video enables advertisers to reach consumers at high-intent moments, benefit from contextual relevance, leverage trusted publisher environments and connect with audiences beyond the big digital company walled gardens.

“Vertical video works for everyone,” said Karan Dalal, COO at Media.net. “It engages audiences, keeps them watching, and helps publishers drive more meaningful interactions—ultimately creating better outcomes for advertisers.”

Viewers appear to like short-form video, but they want more news recaps or quick updates, more lifestyle or how-to videos. They’d also like to see more entertainment or celebrity clips, product or shopping content and sports highlights.

The Media.net survey was commissioned in September 2025 and polled more than 1,000 U.S. adults aged 18 and older through an online questionnaire For the purposes of the study, short-form vertical video was defined as video content under one minute, optimized for vertical, mobile-first viewing.

# # #

Magnite said it introduced Live Scheduler, which is designed to help media owners plan, activate and measure ads around live events.

Live Scheduler gives buyers and DSPs visibility into upcoming live inventory so that campaign can reach engaged audiences.

"Live TV continues to be one of the most powerful mediums for engaging audiences, especially during high-impact moments," said Charlie Goodman, Head of Video Ad Product at Roku. "As Live TV shifts to streaming, monetization is key. Magnite's expanded live capabilities will help Roku connect advertisers to live audiences more efficiently, while Roku's leading identity framework ensures effective ad experiences without compromising viewing quality.”

# # #

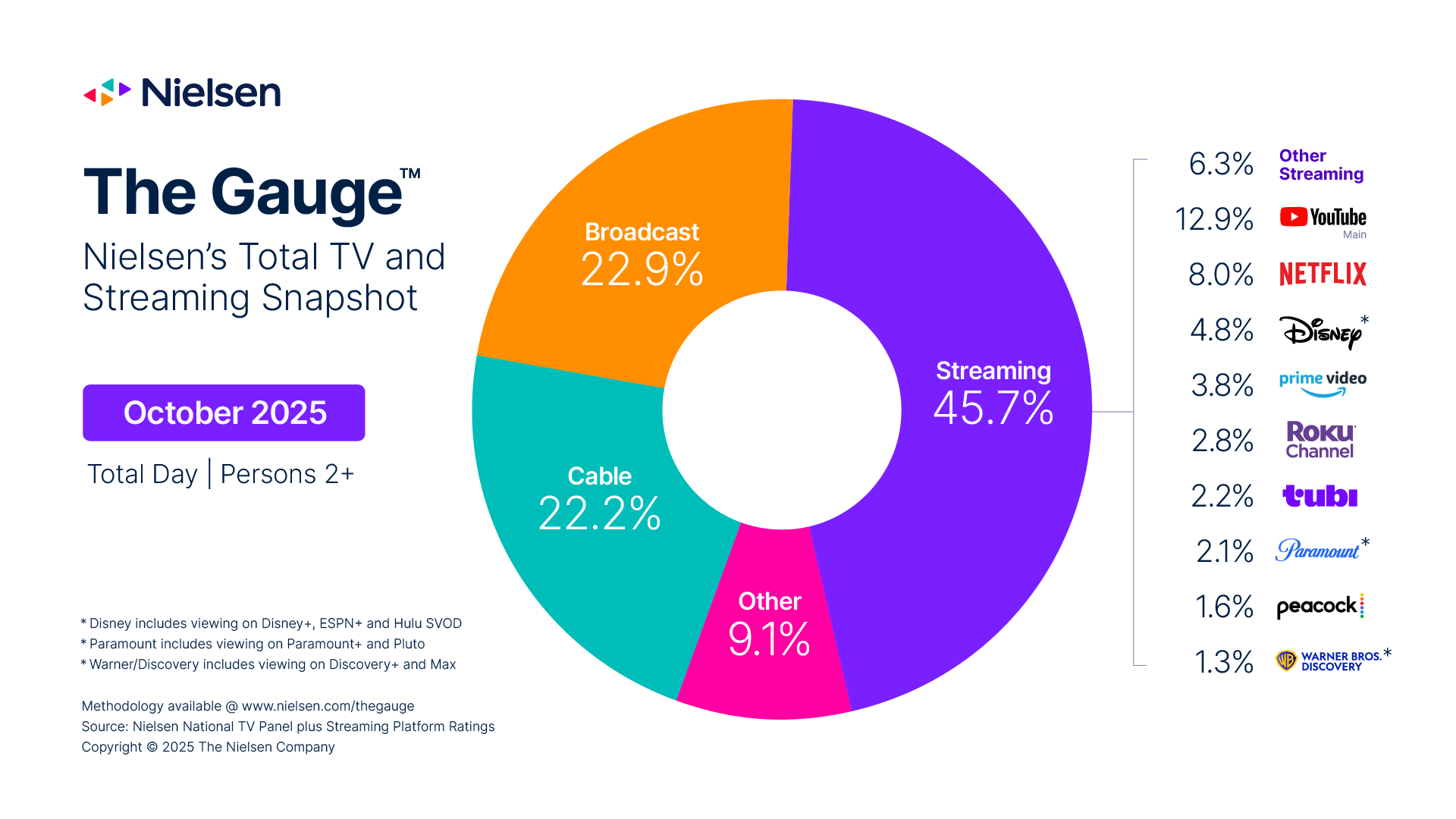

The popularity of the National Football League boosted broadcast share of TV viewing in October, according to Nielsen. Also getting a tush-push from the NFL are streamers that carry NFL games.

Broadcast viewing jumped 4.3% in October from September. To highlight just how big an effect the NFL has on broadcast viewing, Nielsen measured viewing share on Sundays compared to the rest of the weeks. On Sundays in October. broadcast had a 27.3% share, compared to a 22% share from Monday through Saturday.

For the whole month, broadcast had a 22.9% share of viewing, up from 22.3% in September. The return of first-run programming also helped broadcast, with shows like Tracker, High Potential and Chicago Fire showing gains.

Streaming’s share of viewing dropped 1.3 percentage points on Sundays; cable’s share was down 2.7 percentage points.

For the month, streaming viewership was up 2.4%, increasing its share to 45.7%. Big gainers included the services that carry football, with Peacock up 19%, Paramount+ up 8% and Amazon Prime Video gaining 3 points on nights it streams Thursday Night Football.

Cable watch time was down 1.2% and its share dropped to 22.2%