Sports on CTV Are a Bargain, For Now, Says Dan Larkman of Keynes Digtal

'This is an opportunity where you're getting lower CPMs on premium inventory because the fill is low. Next year, that’s probably not going to be the case," says Larkman

Advertisers who buy commercials on streaming sports are getting a rare bargain, as well as strong performance, according to Dan Larkman, CEO of Keynes Digital.

With more live sports moving to connected TV, viewing by consumers is way up, but ad spending has been slower to follow. The result is low fill rates and dropping ad prices on a cost-per-thousand viewers (CPM) basis.

“The number of avails have increased by about 900% and yet the fill is up about 171%. So basically there’s a surplus of about 700% growth that isn’t being filled in live sports, which effectively is driving down the CPMPs,” Larkman said.

That’s creating an opportunity for advertisers who are willing to venture into the CTV space. And while Tier 2 and 3 sports, like pickleball and karate tournaments are available on streaming, so are Tier 1 sports, including the most premium inventory of all, the NFL.

“I think what we see in our industry always is that consumer adoption comes first. Brands dip their toe in and if it works, they go two feet in,” he said. Last year medium sized brands were testing, running in sports for a weekend. Even this year, they tested by running CTV ads during Masters weekend.

“Now we’re seeing people saying we know live sports is a revenue driver for us, let’s run this consistently throughout the NFL season,” Larkman said.

But that situation won’t last long. “I’m telling brands this is an opportunity where you're getting lower CPMs on premium inventory because the fill is low. Next year, that’s probably not going to be the case. Therefore, you need to invest now to see that growth,” he said.

Keynes Digital, which launched in 2018, works with growing media-sized brands to manage their move into connected TV. “Our focus is to help them see the value of CTV through MMM [media mix modeling]. We've been very big on building out a lot of data analytics around how CTV performs, how it works, using identifiers, using lift studies to really show brands the total impact of the channel," Larkman said.

Clients include Zenni Optical and Nest, which sells luxury home, personal care and fragrance products.

This year, there are even more opportunities to buy football inventory in CTV, with expansion into digital by ESPN, as well as more inventory coming onto the market from set makers like Samsung and MVPDs like DirecTV and Spectrum that have made recent deals incorporated streaming into their bundles.

Here’s what the most up-to-data data and analytics are showing for the first week of the football season, compared to a year ago:

Spending for Keyes Digital clients is up 171%. Keynes Digital said that reflects its intentional investment to capture heightened demand during the season kick off. For growth brands, the momentum underscores the value of having access to premium sports inventory, which provides incremental reach and visibility.

Reach was up 900%, demonstrating that exposure can be scaled to connect with far more potential customers than last year.

All of that is translating into results. The visit rate for campaigns jumped 210% reflecting an increase in higher-intent traffic from premium sports inventory. The conversion rate improved 1,500%, because of viewing by more qualified audiences that better convert engaged traffic into customers. And the average order value grew 200%, boosting the overall revenue impact from each conversion.

Keynes Digital said the networks that got the most of its spending (it buys programmatically) were Samsung TV+, ESPN, DirecTV, Spectrum TV and Fubo TV.

That indicates a shift from more traditional premium publishers to OEMs and MVPD platforms. A year ago the top networks were NBCU, FubotTV, Pluto TV, Tubi and Sling TV.

Larkman noted that in Week 1 of the NFL season, his clients’ spending on Monday Night Football increased by 154% from a year ago because of both higher budgets and lower costs per impression.

The high quality traffic and improved on-site experience this year were factors in boosting acquisition efficiency. The visit rate increased 439% driven by stronger creative and audience strategies, including sequential messaging. The conversion rate jumped 612% and the cost per acquisition rose 95%. The average order value showed a rise of 365%.

These stats are encouraging advertisers to increase their CTV spending. That decision is different, depending on whether the advertiser is used to buying linear TV, or is moving from other digital media to digital video and streaming, Larkman said.

While linear TV advertisers have questions about measuring cross-channel reach, frequency and CPMs that need to be overcome, most digital brands are more used to wall gardens, they’ve probably tested CTV before and are looking for ways to get the most out of CTV, he said.

In some cases, CTV advertisers are able to target a specific audience when they buy an ad in a high-profile sports property, Larkman said. For a number of clients, there is value in that, but others are more interested in reaching a broad audience.

Keynes recently posted a case study for its client Zenni Optical, which aggressively ramped up its media investment, including premium CTV advertising. Its goals including expanding first-time buyer acquisition and boosting profitable conversions on its search, social, email and affiliate channels.

It refined its audience targeting, bought inventory on NBC’s GolfPass and CBS Sports, and tested key sports moments including The Masters, the NFL and the NBA.

The company executed a six-week incrementality test to isolate CTV’s influence on customer acquisition and total order efficiency.

The Results: As investment scaled, Zenni’s performance outcomes exceeded expectations: Independent incrementality testing demonstrated that CTV drove efficient, profitable total order performance in test markets compared to control. ROAS consistently outperformed efficiency benchmarks, even as spend increased substantially. More than 5x growth in new customer contribution. Keynes’ share of total new customer acquisitions climbed from just 2% early on to over 11% within a year.

By integrating smarter targeting, cross-channel coordination, using outcome-based creative and rigorous incrementality testing, Keynes helped Zenni elevate CTV from a foundational channel to a core engine of efficient, measurable, and sustainable growth, the case study concluded.

# # #

In these economically fraught times, consumers are coping in different ways as prices rise. In its latest Consumer Pulse Survey, TransUnion found that 35% of Americans said they are keeping up with inflation, while 43% said they are not.

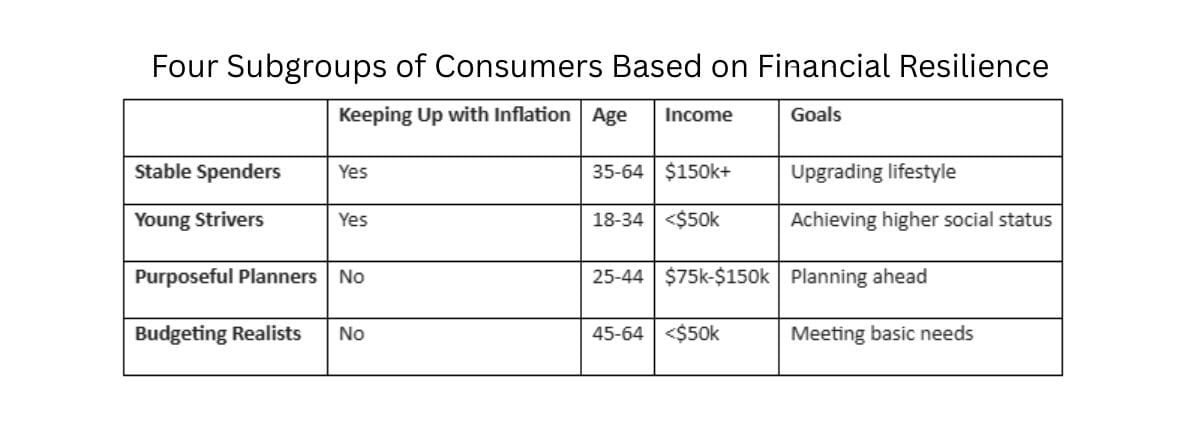

TransUnion took each of these groups and identified two segments in each. Among those keeping up, some were labled “Stable Spenders” and some were “Young Strivers.” In the group not keeping up, some were designated “Purposeful Planners” and others were “Budgeting Realists.”

“Our research found that even among those who feel they are doing OK financially, there are vast differences in how they behave in the market,” said Brian Silver, executive VP of global marketing solutions at TransUnion. “Consumers’ individual life stages, expectations, and environments help determine their spending as much as their income levels—which underscores just how important it is for marketers to really know their audiences and the numerous personas they present in market.”

Here’s a chart showing some of the characteristics of each group:

# # #

Two AI-driven ad-tech companies focused on connected TV announced a merger, with Rembrand combining with Spaceback.

The companies said they shared a mission: to create new video ad experiences that feel more like content than ads—more authentic, more relevant, and more effective.

Financial terms were not disclosed.

“This is a reset for what creative means in advertising,” said Omar Tawakol, CEO of Rembrand. “By fusing Rembrand’s AI and our history in virtual product placement with Spaceback’s ability to scale social content into high-performing ads, we’re giving brands the tools to move faster, connect deeper, and show up in ways that work better than traditional ads that get skipped or ignored.”

Both companies had previously been integrated into The Trade Desk and the new offering will continue to be made available via The Trade Desk.