OpenAP Adds Stations, Streamers and Ad-Tech Partners to Audience-Based Ad Platform

‘OpenAP enables advertisers to activate data-driven strategies at scale,’ said CRO Ashley Luongo

OpenAP, formed to standardize audience-based TV advertising, says it now offers media buyers a pipeline to more inventory,

It also is working with additional ad-tech partners including Yahoo DSP, FreeWheel and PubMatic and is in the cinema advertising business with Screenvision.

Owned by some of the largest traditional media companies, OpenAP aims to help the fragmented television business compete with the digital advertising giants with a combination of cross-publisher activation, measurement and optimization, identity resolution and access to targeting data.

The top advertising executives of NBCUniversal, Paramount Global, Fox Corp. and Warner Bros. Discovery sit on the OpenAP board.

OpenAP’s video footprint had 45 of what it calls endpoints. That is growing with the addition of several linear TV channels, streamers, and TV setmakers. Those include Nexstar Media Group, Scripps Networks, Reelz, Samsung, LG Ads, Hallmark Digital, Vevo, Allen Media Group’s Local Now, Future Today’s FawesomeTV, MediaCo.’s Estrella and Canela, plus Audyns, a new company specializing in data-driven linear TV advertising.

With the additional partners, OpenAP says it is better able to enable advertisers to to easily reach audiences across all of TV while offering the flexibility to activate through direct insertion order , programmatic guaranteed or private marketplace deals.

“In today’s fragmented video landscape, OpenAP is delivering on our promise of standardizing audience onboarding by giving advertisers and agencies the ability to uniformly define and efficiently distribute advanced audience segments across premium streaming and TV endpoints – all within a neutral platform,” said Ashley Luongo, chief revenue officer at OpenAP.

“Premium video remains the most effective environment for advertising to reach maximum impact and efficacy. By expanding our publisher footprint and doubling down on CTV, OpenAP enables advertisers to activate data-driven strategies at scale, through direct as well as programmatic methods of execution, to maximize reach, minimize inefficiencies and drive measurable impact across the industry’s most trusted video destinations,” Luongo said.

Open AP says its platform streamlines workflow to simplify cross-publisher activation, and delivers actionable insights pre- and post-campaign to drive real business outcomes.

“As viewership bifurcates, advertisers are looking to expand their reach beyond linear without sacrificing audience quality or consistency. We’re proud to lean in with OpenAP and bring our universe of 77 million active and opted-in Smart TV viewers into the fold, opening up new avenues for advertisers to reach impactful audiences,” said Eldad Persky, senior VP, global product, engineering and business development at Samsung Electronics.

# # #

The rise of digital advertising and its ability to claim responsibility for online sales has changed the relationship between brand advertising and performance advertising.

Many new companies, especially those focusing on direct-to-consumer sales have had continue to emphasize performance advertising when they grow large enough to graduate from online and social media to television.

Being able to attribute product sales to advertising investments is attractive to CMOs and the CFOs who review their budgets, so more and more spending is moving toward performance.

A new whitepaper from TransUnion, working with MMA Global, notes that traditional measurement methods undervalue the impact of brand marketing on sales by as much as 83%. When properly measured, brand campaigns don’t just build sentiment. They deliver performance by helping win new customers and driving long-term revenue growth, according to the whitepaper.

TransUnion and MMA Global proposes using a different metric, Brand as Performance, to deliver metrics and clear evidence of the impact of brand campaigns on sales.

MMA Global first introduced Brand as Performance in 2022. It is designed to connect marketing activities to both soft outcomes–like consumer sentiment–and hard results such as sales.

“Brand as Performance gives marketers the language and evidence to prove what they’ve always known: brand drives growth,” said Matt Spiegel, execitove VP of TruAudience Growth Strategy at TransUnion. “By linking brand-building directly to measurable outcomes, we’re helping CMOs protect budgets, accelerate results, and speak to the C-suite with confidence.”

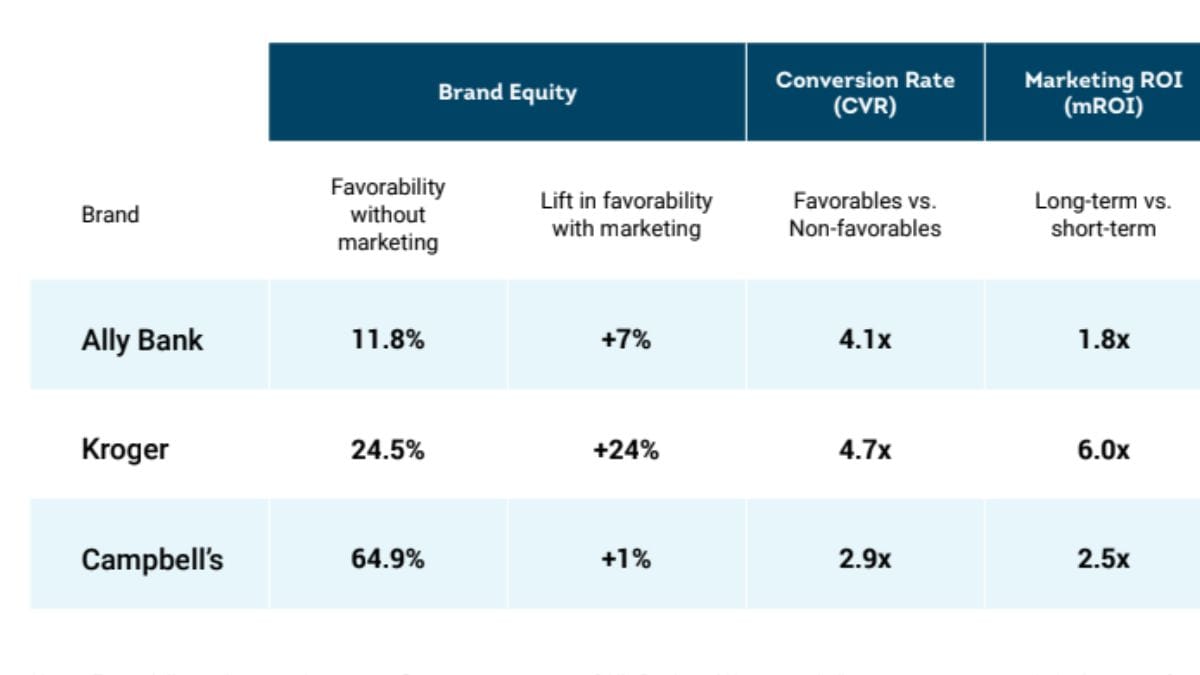

The whitepaper includes case studies looking at the brand marketing efforts of Ally Bank, Kroger and Campbell’s. In each case the percentage of sales that went unmeasured by traditional means of gauging marketing effectiveness was substantial.

Using Brand as Performance can change the way a company spends its marketing dollars. For example, a company like Ally might ask if it should shift budget away from a long-term branding strategy to a short term performance one. Based on Brand as Performance metrics, Ally believes its brand-focused strategy will yield 16% more customers and 29% more accounts over two years.

“We’ve always believed our incredibly strong brand was the foundation of our growth,” said Andrea Brimmer, Chief Marketing & PR Officer at Ally. “This work proved that a brand-first strategy not only builds equity, but also drives measurable business results — more customers, more accounts, and stronger long-term growth than chasing short-term wins.”

Kroger was able to test whether the long-term effect of its brand marketing doubled the short-term effect, as is usually taught in marketing textbooks. Using Brand as Performance, Kroger found tha the long-term effect was more than six times, with 70% of the impact due to favorable consumers.

Campbell’s wanted to know if its brand favorability really mattered. If found at that favorable consumers purchase at 2.9 times the rate of those not favorable.

“We now have a framework that proves brand investment compounds over time and drives growth in ways short-term tactics never could,” said Greg Stuart, CEO of MMA Global. “It is the kind of evidence the industry has been missing.”