New Data From TVision Shows Strength Of Streaming

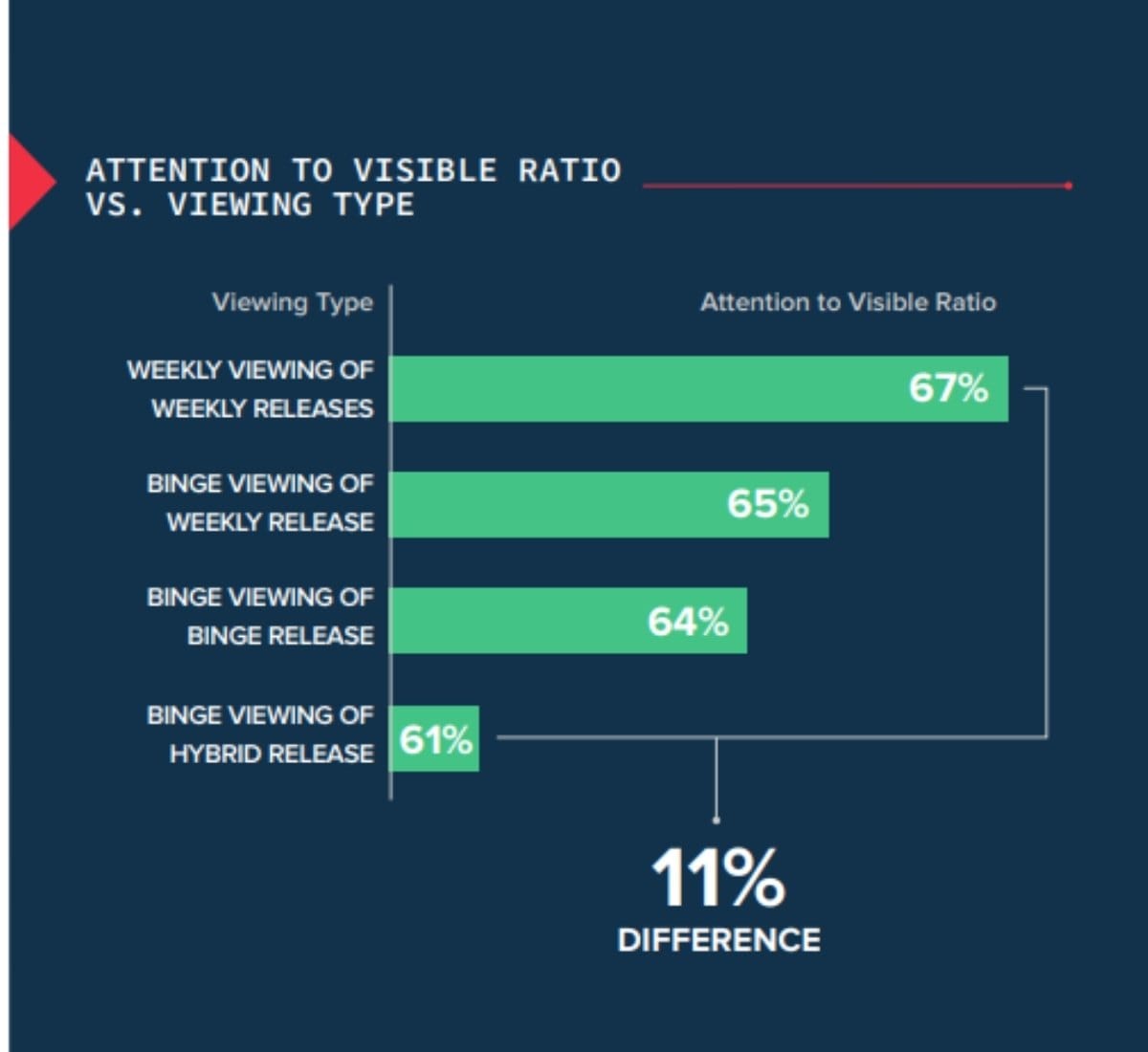

Binge releases generate less attention than shows that drop weekly

As streaming occupies a growing swath of the television landscape, data about how viewers interact with connected TV becomes increasingly valuable and a number of interesting nuggets are to be found in TVision’s new State of Streaming report.

How dominant is streaming? According to TVision, 86% of households that were streaming-enabled were actively accessing streaming content in June. That’s actually down a bit from TVision’s figure of 90% at the end of 2024. Only 69% of those households accessed cable programming, down from 72%, and just 54% accessed broadcast programming, a decline from 67%.

The still-high percentage for streaming makes sense because if you’ve cut the cord–or never had a cord–broadcast and cable programming can be difficult to watch.

TVision found that the average American household tuned in to 4.2 apps in Q2 of 2025, up from 3.9 apps in Q3 of 2024. A hard-core 8% of households tuned into 10 or more apps, unchanged from the previous report..

No big surprises in terms of which streaming apps had the most reach: YouTube, Netflix and Amazon Prime Video all reached more than 50% of households during the first half of 2025. At the end of last year, Netflix had the most reach, followed by YouTube and Hulu.

Rounding out the Top 10 this year in terms of reach were Hulu, Peacock, Tubi, HBO Max, Disney+, Paramount+ and Apple TV+. Apple TV+’s reach was just 12%.

When looking at the time people spent viewing programming on streaming apps, YouTube and Netflix remained on top, but Hulu was No. 3, followed by Amazon Prime Video and Peacock.

TVision is best known for its attention metrics, and the report has some interesting insights in how people watch streaming shows.

For one thing, TVision weighs in on the full-season binge versus weekly release of content strategy question. It found that viewers pay more attention to shows that are delivered and watched on a weekly basis within 24 hours of their release than when they binge multiple episodes of a series.

The data is unlikely to make Netflix, which favors the binge, to change its strategy. TVision Chief Product Officer Tristan Webster told The Measure. Netflix “has such a robust library of content that if you finish off one show, you’ll move on the the next show. They’re playing a numbers game.”

On the other hand, the streamers launched by traditional media companies are more likely to favor the weekly release model. “Old habits die hard, " Webster said. Also, Apple TV+ is likely better off with the weekly release schedule to ensure there is always fresh content on the service.

The worst strategy seems to be a hybrid where a bunch of episodes are released at once to hook viewers, and the rest on a weekly basis, TVision found.

Advertisers should be aware that content rated TVMA–possibly more risque and challenging fare–draws much more viewer attention (63%) than content rated TV14 (58%). Content more suitable for younger viewers, rated TVPG, TVG and TVY had even lower attention scores.

On the other hand, tamer content was more likely to generate co-viewing, TVision found.

Less surprising is the finding that viewers pay 8.5% more attention to original programming than to library content.

“It is likely that viewers make plans to intentionally find and watch original content, whereas library content may serve as familiar background television for households” the report notes.

TVision also found a difference in attention between live sports watched on streaming versus those on traditional TV. Viewers who stream WNBA games and WWE content, for example, pay more attention to those events than those who watch those leagues on linear TV.

Webster said some the divide is likely because some sports put better games on streaming, while other put their most attractive matchups on linear TV.

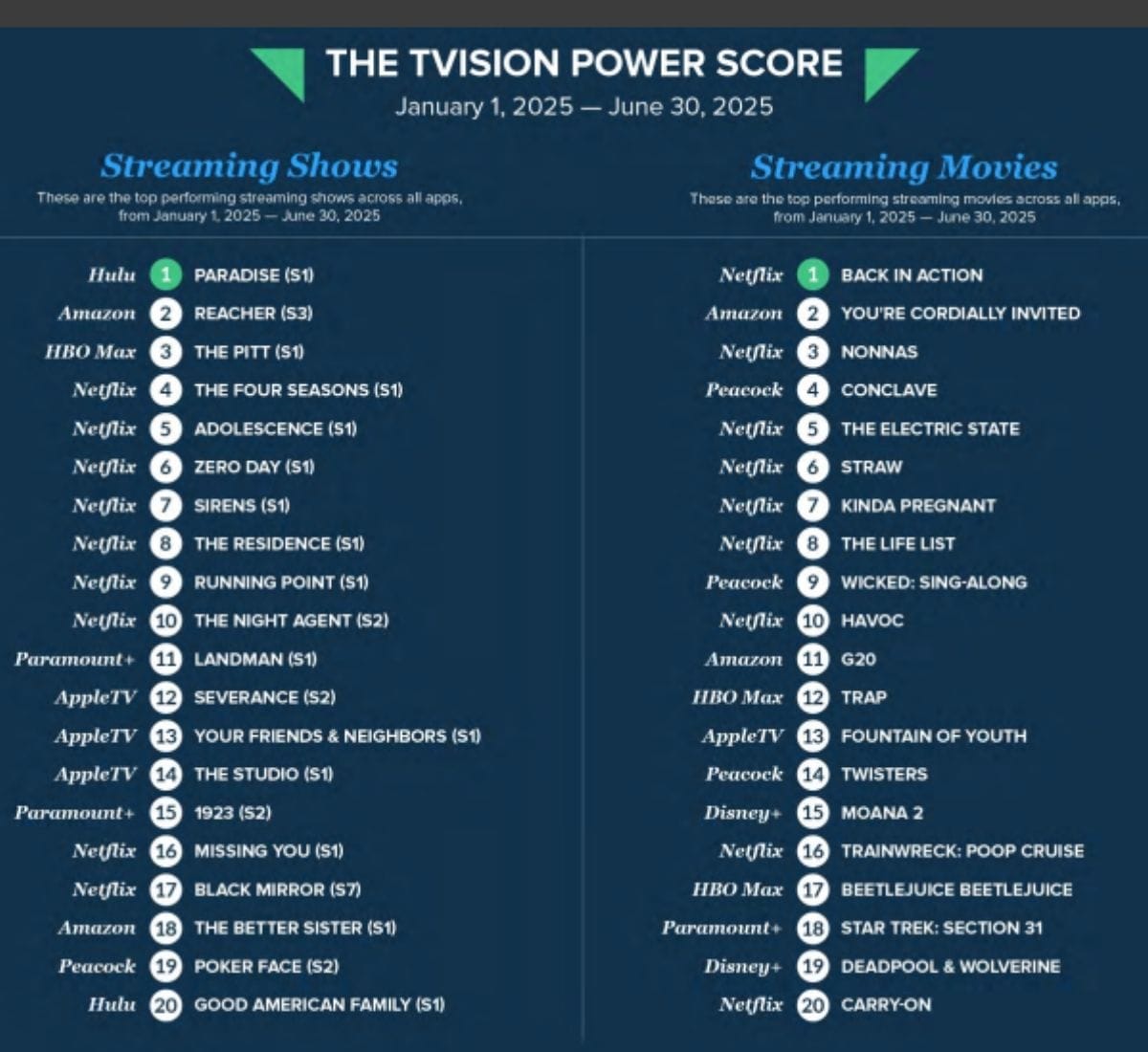

The top streaming show during the first half of 2025 was Hulu’s Paradise, according to TVision’s Power Score, which ranks streaming originals using both attention and app reach to identify the shows and movies that are best engaging viewers.

Netflix had seven of the top 10 shows, according to Power Score.

The top movie was Netflix’s Back in Action.

Finally, the brands that captured the most attention in their categories included Visit Destin-Fort Walton Beach, Canada Dry, AdventHealth. DeVaughn-James Injury Lawyers, Hardees, Discount Tire, Bose, Gorilla Glue, Timber Tech and Lancome Paris.

The report was based on TVision Panel data from January 1 to June 30, 2025.

# # #

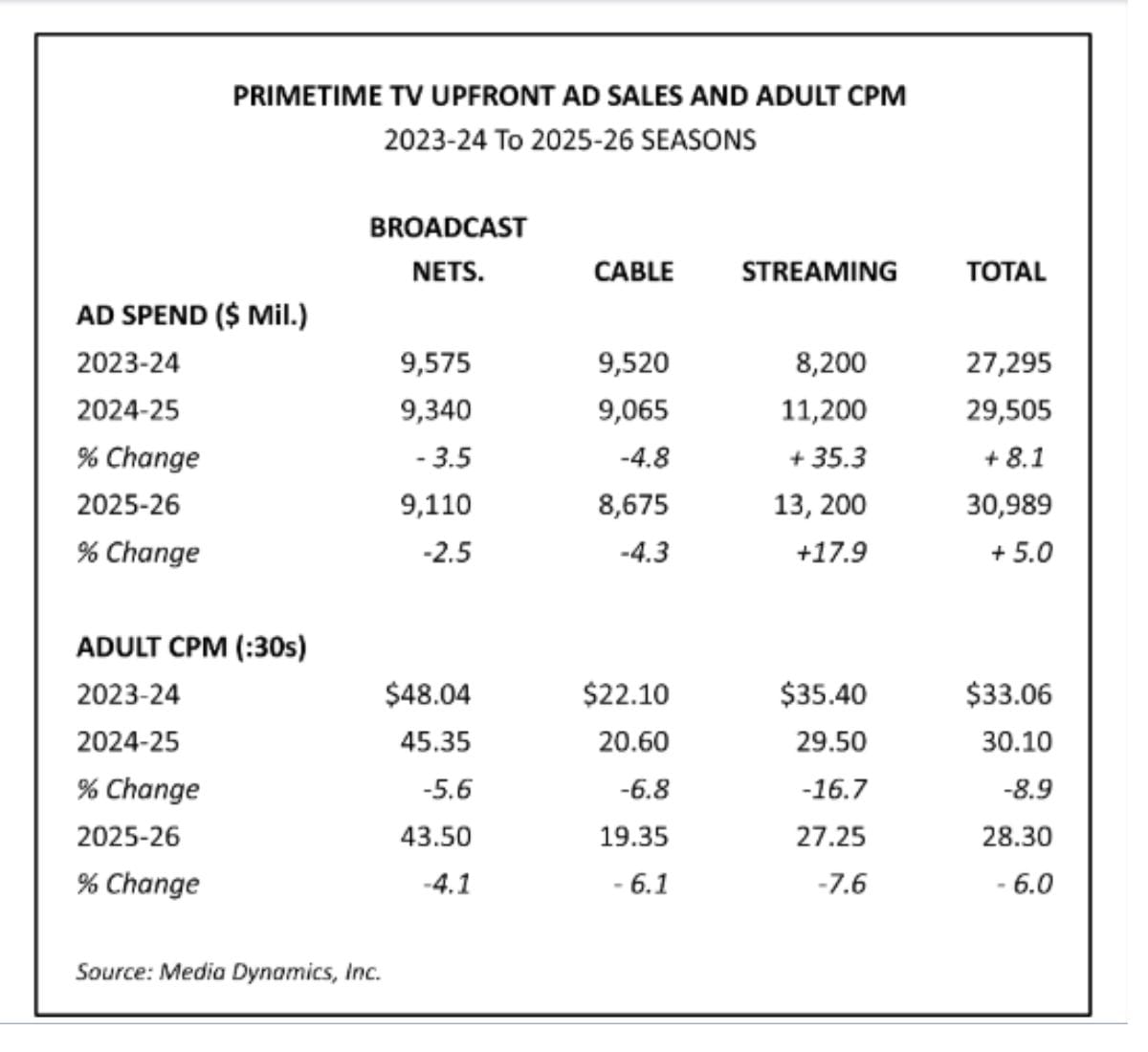

New data from Media Dynamics confirms that in the upfront, ad dollars are following eyeballs to streaming.

Media Dynamics says that in deals for the 2025-26 TV year, ad dollar volume for broadcast prime was down 2.5$ to $9.11 billion and cable was down 4.3% to $8.675 billion.

Streaming volume was up 17.9% to $13.2 billion.

Total volume in the upfront was $30.989 billion, up 5%.

The price of commercials on a cost-per-thousand adult viewers (CPM) basis were down 6% across the board, with broadcast down 4.1% and cable down 6.1. Even with increased demand, streaming CPMs were down 7.6% because of increased supply, especially from free ad-supported streaming television (FAST) channels.

The price declines were smaller than in the 2024-25 upfront, which CPMs fell 8.9%.

# # #

Ahead of its coverage of the 2026 World Cup, Comcast NBCUniversal’s Telemundo unit launched a new Spanish-language sports FAST Channel.

Telemundo Deportes Ahora will have more than 50 hours of new content weekly including live sports events from Liga FX Femenil and Youth Leagues, selected U.S. Soccer youth matches, Basquetbol LATAM, CONCACAF World Cup Qualifiers, MMA events and original studio shows.

Also TelemundoDeportes personalities including Andres Cantor, Carlota Vizmanos, Diego Balado, Luis Omar Tapia; Jorge Calvo, José Luis López Salido, and Miguel Gurwitz and Isabella Echeverri, will deliver dedicated coverage on the channel.

“With Telemundo Deportes Ahora, we’re giving Hispanic audiences another way to connect with the sports they love, complementing our sports offering and enhancing their viewing experience on the road to World Cup and beyond,” said Joaquin Duro, executive VP of Sports at Telemundo.