Netflix Nearly Done With Upfront, As Streamer Wraps A Very Profitable 2Q

Company not interested in legacy media assets, CFO Spencer Neumann says

Netflix, still relatively new to the ad business, says it has nearly completed its upfront negotiations.

Speaking on the company’s second-quarter earnings call with analysts, Gregory Peters, Netflix co-CEO and president, said Netflix has managed to close a “large majority” of deals with the major agencies.

“Those results have generally been in line or slightly better than our targets and consistent with our goal to roughly double the ads business this year,” Peters said. Netflix is on pace to achieve that goal and exceeding expectations.

The revelation came a couple of days after NBCUniversal said it had wrapped up its upfront deals. NBCU’s upfront was notable because of its focus on sports, the growing role of its streaming platform Peacock and a growing reliance on programmatic deals.

Advertisers were buying Netflix because of its growing scale and its highly attentive and engaged audience, Peters said.

Peters noted that Netflix has completed the rollout of the tech stack it has been building. (Netflix originally built its ad business using Microsoft’s ad technology.)

The rollout has been smooth, Peters said. “The most immediate benefit from this rollout is just making it easier for advertisers to buy on Netflix,” he said. “We see it in our overall sales performance. We've seen increased programmatic buying.”

Netflix plans to add additional sources of programmatic demand, including the Yahoo DSP

“That will further open up the market for us. Long term, being on our own stack improves the speed of our execution to deliver this pretty significant road map of features that we have in front of us. It's things like improved targeting and measurement. There's also leveraging advertiser and third-party data sources, which we definitely hear demand for as well,” he said. Netflix will be adding more interactive ads in the second half of the year

The tech stack will also enable the insertion of more personalized ads. “The ads that I see are increasingly different from the ads that, say,Ted [Sarandos, co-CEO at Netflix] would see, and they're more relevant for each of us, which is good for us as users and it's good for the brands.”

One analyst on the call noted that the TV business is expected to go through another round of consolidation. With Netflix making money and possessing a strong balance sheet, the analyst wanted to know if Netflix would be interested in buying legacy media assets?

“We agree. Continued consolidation of studio and network assets is likely,” said CFO Spencer Neumann. “But at least with respect to consolidation within legacy media, we don't think it materially changes the competitive landscape. As you also know, we've historically been more builders than buyers, and we continue to see a big runway for growth without fundamentally changing that playbook.”

Neumann added. “We've been pretty clear in the past that we also have no interest in owning legacy media networks. In general, we believe we can and will be choosy.”

That approach is working out pretty well. “We've got a great business. We're predominantly focused on growing that organically, investing aggressively and responsibly into that growth and returning excess cash to shareholders through share repurchase. And I think you'll see us continue on that path,” he said.

How good is Netflix’s business? A few numbers. In the second quarter, the company surpassed Wall Street expectations by racking up net income of $3.1 million, or $7.19 a share, up from $2.1 billion, or $$.88 a share a year ago. Revenue rose 16% to $11.1 billion.

The company’s operating margin increased to 34.1%. (Remember when people asked if Netflix would be profitable?)

The good times will keep rolling. Revenues are expected to rise 17% in Q3, with a 31% profit margin. And Netflix raised its forecast for the full year, saying that revenue will be in the $44.8 billion to $45.3 billion range, with profit margins hitting 29.5% from the previous expectation of a 29% margin.

It would seem the only world still worth conquering for Netflix would be YouTube, the only player with a larger share of TV usage than Netflix. But Netflix executives turned down a chance to overtake YouTube as their objective.

“it's worth remembering there's about 80% of total TV view share that neither Netflix or YouTube are winning right now. We think that represents a huge opportunity for which we are competing aggressively and we aim to grow our share,” said Peters.

“The vast majority of our money and attention is focused on that 80%,” added Sarandos.

Netflix also released a bunch of data about what its subscribers watched during the first half of the year. Netflix said that when it comes to its original programming, half of the viewing came from titles that had their debut in 2023 or earlier. That means the library Netflix is viewing continue title that will remain popular.

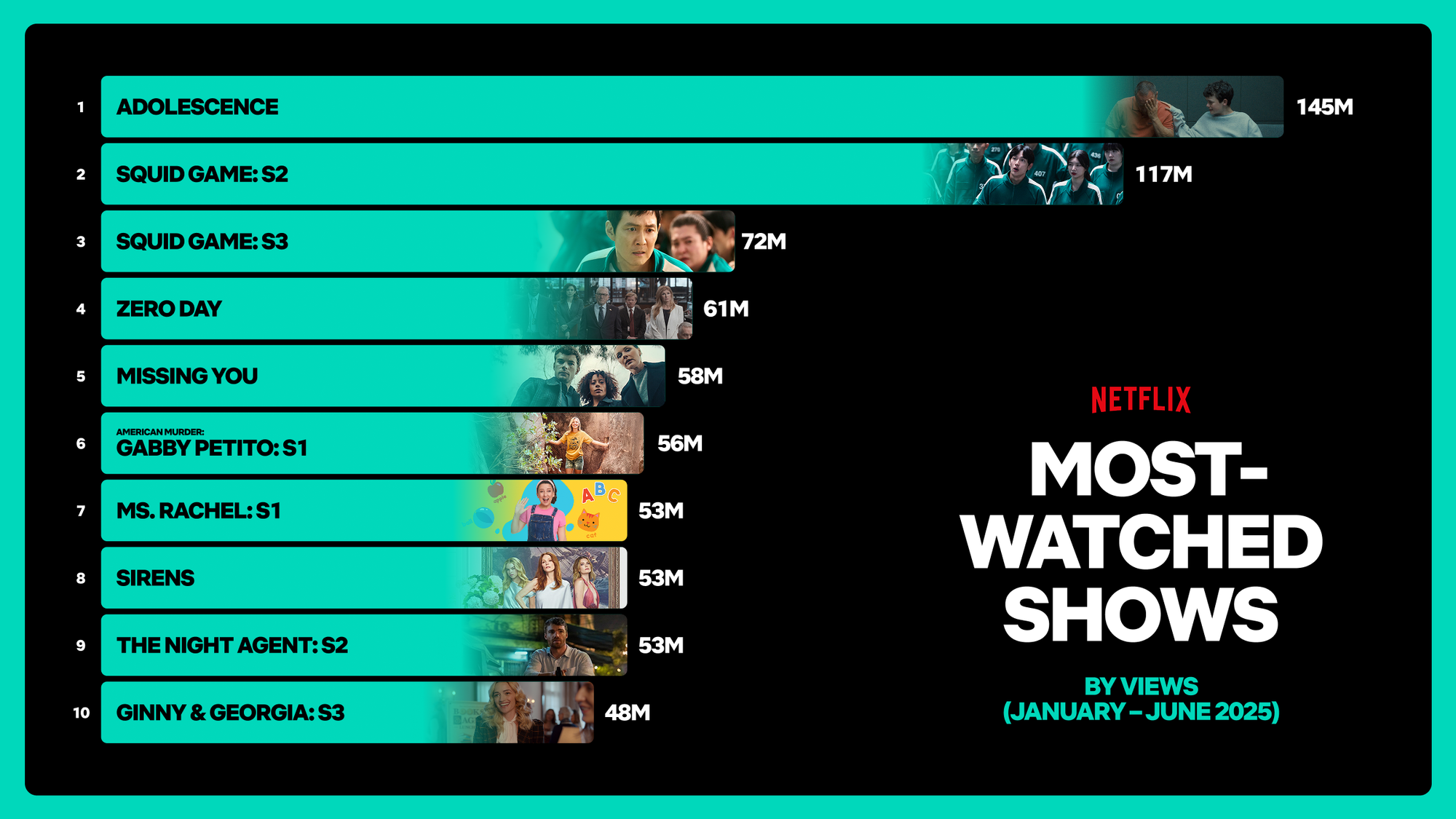

The most watched shows on Netflix in the first half of the year were Adolescence, Season 2 of Squid Game, the recently released Season 3 of Squid Game, Zero Day and Missing You.

The top moves were Back in Action, Straw, The Life LIst, Exterritorial and Havoc.

# # #

Two former Nielsen executives are out at VideoAmp, which announced executive changes on Thursday.

Pete Bradbury, who had been chief commercial officer, and Jeff Schmidt, senior VP, buy-side strategy and growth, are no longer with the measurement, a VideoAmp spokesperson confirmed.

Bradbury had been chief commercial officer at Nielsen. He left during a management restructuring in 2023 and joined VideoAmp the next year. He was an important spokesperson for VideoAmp and the main speaker during some of VideoAmp’s upfront-style presentations.

“Pete brought tremendous focus and structure to VideoAmp during a critical phase. He was instrumental in reshaping the team, streamlining operations, and building the foundation for scalable success,” a VideoAmp spokesperson said.

Schimdt joined VideoAmp in March 2024 after 20 years at NIelsen.

As part of its new executive lineup, Bryan Goski was promoted to Chief Revenue Officer; Sharon Lee was elevated to Chief Legal Officer and Megan Opp joined VideoAmp as Chief People Officer.

Also Dustin Jackson will join as Chief Technology Officer from Google.

“These appointments are not just about leadership changes; they signal that VideoAmp is doubling down on delivering the industry’s most trustworthy, high-fidelity data, cutting-edge innovation, and, above all, client success,” said Peter Liguori, who had been executive chairman but will now serve as CEO.

# # #

Speaking of Nielsen, the ratings company said it will not be making adjustments to its Household Demographic Assessment Model (HDAM), which generates demographic audience estimates for Nielsen’s new Big Data+Panel ratings system.

Traditional networks, represented by the VAB, complained that compared to Nielsen’s traditional panel-only ratings, Big Data+Panel was undercounting how many people in the adults 25-54 demo in particular were watching them, something that would impact ad sales, particularly in the upfront. Nielsen agreed to study the situation and then suggested a fix might be included in data available on July 11 in its NPower system.

On July 10, in a note to customers, Nielsen said it “does not plan to pursue an implementation of an HDAM enhancement at this time and will not be releasing the data in NPower.”

Why? Nielsen said it thinks HDAM is providing accurate numbers. Also, with the upfront in progress, this was not a good time to give buyers and sellers more change to deal with. Nielsen said it wanted to avoid “piecemeal enhancements that will add more disruption than benefit.”

VAB CEO Sean Cunningham, who has spearheaded the networks’ criticism of Nielsen, was not pleased by the development.

”Their 11th hour reversal to not provide impact analysis on HDAM-enabled demographic audiences broke a promise they made four times in writing to their national customers over the previous month,” he said, adding that the “irrational defects and flaws” in the BD+P ratings have yet to be addressed and are causing market uncertainty.

Nielsen's decision will be expensive, Cunningham said, because of “the loss of ad revenue to many TV sell-side players that BD+P flaws, uncertainty and unpredictability will lead to.”

Nielsen maintains that its new BD+P ratings have been well received by the industry and that the complaints are coming from a small set of its customers. (Several networks declined to comment.) The complaints have not stopped Nielsen from being the most used currency during this upfront market

“Big Data + Panel is the best and most accurate product for measuring TV viewing. The vast majority of clients on both the buy and sell sides support and encourage Big Data + Panel as currency,” Nielsen said in a statement. “We’re thrilled that Big Data + Panel is being embraced. We’ve worked hand in hand with clients for years to get to this point and we’re proud to be the first company to earn accreditation for this new frontier in measurement. We remain committed to our clients so that we can help them achieve their goals.”