NBCU Putting More Data at Clients' Fingertips With Performance Insights Hub

“We effectively prove that premium video really hasn’t gotten the credit it deserves for driving full-funnel impact,” said NBCU’s Gina Reduto

NBCUniversal plans to offer more advertisers more measurement and better measurement of how campaigns perform. In a preview of that they’ll be showing off next month during the annual Consumer Electronics Show in Las Vegas, NBCU also said it is offering new ad formats and making more of them available to any programmatic buyer with a laptop.

Used to be, there was nothing more powerful than TV advertising. And the only data people who sold it had to worry about were their bar tab and their golf score.

Then digital technology came and changed everything. Not all of the changes were good. And it was really bad for legacy media. Those digital guys had all kinds of data that allegedly proved online advertising worked. There were page views, click rates and other metrics, but it turned out even when they were accurate, they barely correlated to sales and profits. All the TV networks had was Nielsen.

Nevertheless, having anything that seemed to prove that this new kind of advertising was effective made CFOs more comfortable with the millions of dollars their marketing wizards were spending. It wasn’t long before those tech companies got into the video business, combining data, targeting and interactivity with sight, sound and motion. Nowadays, digital accounts for 82% of the total advertising pie.

Good old TV is trying to fight back. One strategy could be summed up as if you can’t beat them, join them. The companies that own NBC, ABC and CBS got into the streaming business–Disney Plus, Hulu, Peacock–leaving linear TV with little to brag about other than live programming, especially sports, especially football.

Companies like Comcast NBCUniversal and Disney also must compete with the Alphabets and Amazons on ad tech, the ability to put the right ads in front of the right people and measure the results.

“Really what advertisers want is they want to be able to prove the value of their investments and get a return on that,” said Mark Marshall, Chairman, Global Advertising & Partnerships, NBCUniversal at the company’s presentation.

“It's no secret that premium video has always provided great results for marketers. The challenge was they didn't exactly know why that was. We just knew TV worked. We didn't know exactly why,” Marshall said.

NBCU has been at work to fix that. It has built audience graphs to know who’s viewing its shows and being exposed to its clients’ commercials.

The TV company has forged relationships with Instacart and Walmart that let it see what happens to orders and sales after advertising runs. That gives advertisers a better taste for their return on investment.

Technology has also allowed TV companies to create new ad formats. We’ve seen pause ads, that come onto the screen with cheeky messages when the viewer pushes the pause button. (A remarkable ad for Trojan claims to know why you’re pausing.) Now NBCU is selling what it calls Arrival Ads that appear on the Peacock home screen. It also has a gimmick called Live in Browse that puts a brand’s logo in the live event preview on the Peacock home page.

NBCU is also upping its game in contextual advertising, using artificial intelligence (what else) to find the moments in programming when a product is most likely to make a personal connection with the viewer. It already happens in on-demand programming and it’s on deck in increasingly valuable live programming. One example: during a football game if a team fumbles, an ad for using paper towels to clean up after something gets dropped can appear.

Echoing something the digital companies have gotten good at, NBCU is now offering to help advertisers who pay big bucks to be in live programming re-target those viewers later in other programming in the NBCU portfolio. Ryan McConville, chief product officer, advertising products & solutions, for NBCU, said its Live Total Impact means that advertisers get not only the awareness and reach of big event programming, but they can also follow the consumer down the “marketing funnel” as they consider making a purchase and eventually decide what to buy by delivering the right ad to the right person at the right time.

A beta test showed that with Total Impact Live, a telecom brand saw a 10% lift in awareness and memorability, 77% higher search engagement and 1.8 times greater website visitation. Retargeted viewers visited the website 6.8 times more than those not exposed.

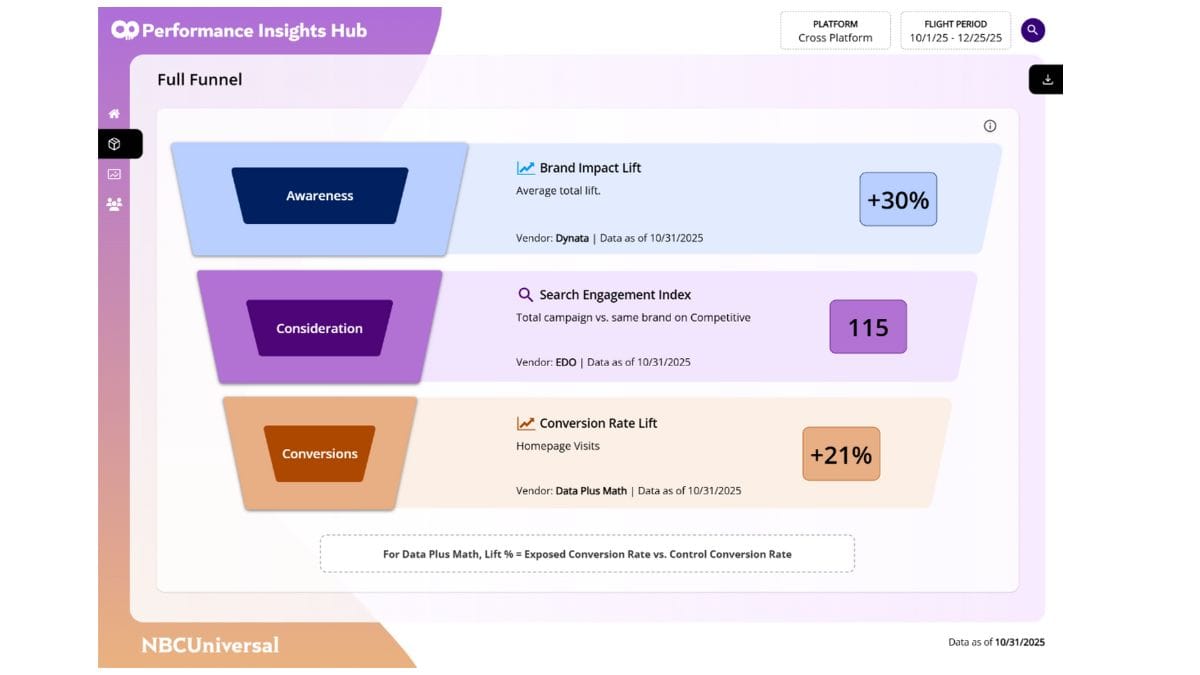

But the biggest deal for NBCU was something it is calling the Performance Insights Hub.

The Performance Insights Hub will be available after the 2026 upfront in the fourth quarter. It is designed to give advertisers all sorts of real-time data about how campaigns are delivering impressions and generating reach, which shows consumers are responding to as they move from awareness to purchase.

“We effectively prove that premium video really hasn’t gotten the credit it deserves for driving full-funnel impact,” said Gina Reduto, executive VP, strategy, advertising & partnerships, for NBCU.

This is the kind of thing that the Amazons and the YouTubes of the world offer clients. NBCU execs argue their Performance Insights Hub covers more than just streaming, which is important in a world where the majority of ad impressions are still delivered by linear networks.

Reduto said the Performance Insights Hub was developed after conversations with advertisers on its advisory committee.

“The number one factor influencing buying and planning decisions is proof of performance,” she said. “And the majority of marketers actually expect in-flight insights, or actual hands-on-keyboard access to a dashboard to be able to pull those results themselves.”

Marshall, NBCU’s ad sales head, noted that the company is spending more than ever on content and will be airing the Super Bowl, Olympics, NBA All-Star Game and the World Cup in the coming months. That programming helped NBCU to a record-setting upfront.

But to sell content, you need data and gobs of it. NBCU says it’s got the goods.

“We can deliver more measurement to more clients more frequently,” Reduto said.

# # #

Gracenote says it is expanding its sports hub beyond live games, enabling TV providers, streamers and device makers to help viewers find highlights, analysis, documentaries and other sports-related content.

The sports related content includes shoulder content, such as pre- and post-game shows.

Gracenote says that demand for sports documentaries was up about 260% in 2024 from 2021.

“From casual viewers to passionate fans, consumers are engaging with sports content in every way possible,” said Tyler Bell, senior VP of product at Gracenote. “Platforms have big opportunities to become go-to sports hubs for these valuable users, and Gracenote is uniquely positioned to help them realize these ambitions.”

# # #

Commerce data platform Attain said it made a deal that will enable media buyer dentsu to access Attain’s data through its dentsu.Connect system.

The arrangement brings closed-loop measurement and in-flight optimization to media buyers by combining Attain’s real-time purchase signals with dentsu’s person-based identity graph to deliver more accurate, outcome-driven campaigns at scale.

“This partnership brings the power of verified purchase data directly into the heart of media activation,” said Brian Mandelbaum, CEO at Attain. “By combining dentsu.Connect’s person-based consumer IDs and data with Attain’s scale and fidelity of purchase data, we’re redefining what’s possible in performance-driven marketing.”

“By integrating best-in-class technologies and data like Attain's, we’re building bridges, not walls, giving clients first-mover access that delivers measurable growth when every brand is looking for an edge,” added Gerry Bavaro, chief solutions officer, dentsu data & technology.

# # #

Lots of streaming platforms are looking to get sponsors to buy ads on their home screen, catching all of their viewers before they select what they’re going to watch.

A new report from Xumo claims that viewers like home screen ads–at least more than other video ads.

In a survey, 58% of viewers said the home screen ads fit “seamlessly” into the experience (vs. 50% for standard video ads and 44% for banners) and 59% find them “unique and novel,” outperforming both banners (47%) and standard video ads (44%).

And they work for advertisers. For one streaming service, viewers who were exposed to home screen ads on Xumo devices were 142% more likely to sign up compared to those who didn’t seem them. Almost half of all signups were from viewers who had seen the home-screen ad units.