Magnite Leaps Into Providing Pause Ads Programmatically

Also: Charter's Spectrum Reach buys ShowSeeker and streamers conitnued to dominate Nielsen's TV distributor rankings in July

Programmatic isn’t just for remnant spots and dots any more.

Magnite said that those pause ads you’ve heard so much about are now available on its sell-side platform.

Pause ads are activated when a viewer watching a show presses the pause button. Instead of a frozen screen an ad pops up. In the best-case scenario, the ad is relevant to what the viewer was watching. In many cases, the ads offer a bit of a joke about the viewer running to the kitchen or bathroom, just to show a sense of situational awareness.

Viewers seem to like pause ads because they don’t interrupt the shows they’re watching. Also studies have shown that pause ads are effective for marketers. According to DirecTV’s internal metrics, on average, pause ads drove 34% higher unaided ad recall compared to traditional addressable advertising and 6% more incremental reach when paired with addressable.

Magnite added that pause ads are especially impactful in live viewing scenarios when audience attention is at its peak

“When someone hits the pause button, they are directly engaging with what they’re watching, making pause ads a unique, non-disruptive opportunity for brands to reach people at a moment of peak interest,” said Rose McGovern, head of programmatic at DirecTV Advertising. “By enabling this popular, high-impact ad format to be bought programmatically, Magnite is unlocking tremendous value for both traditional TV and digital advertisers looking for effective ways to get viewers’ attention in a highly fragmented streaming marketplace.”

Pause ads are among the formats that are becoming more commonplace, which brings standardization and makes it easier to buy and sell them using programmatic technology.

“Pause Ads create a new class of high-value ad inventory without disrupting the viewer experience,” said Mike Laband, group senior VP, U.S. revenue at Magnite. “As buyers seek more effective ways to engage streaming audiences, we expect growing demand for ad innovations such as Pause Ads to unlock meaningful revenue for media owners as the CTV ecosystem matures.”

Magnite said it has worked to make buying pause ads fully compatible with automated workflows such as Magnite’s ClearLine. It is currently undergoing testing with third-party DSPs, to help reduce operational complexity, making it easier for brands to invest confidently and get data on how much impact pause ads add to their CTV campaigns.

Laband added that publishers working with Magnite can already leverage audience - and contextual based targeting for CTV. That data can also be used to place pause ads, giving advertisers an opportunity to blend awareness and precision, he said.

Previously, Magnite has been able to sell Home Screen and Tiles ad formats on its platform.

In addition to DirecTV, Magnite said it is getting pause ad inventory from a number of streamers including Dish Media and Fubo.

Agencies and DSPs that are working with Magnite to help marketers buy Pause Ads include KERV.ai, MNTN and Yahoo DSP.

“Pause Ads are built for how people actually watch TV – no disruption, just results,” said Marwan Soghaier, chief product officer at MNTN. “Our job is to turn attention into outcomes, and this experiment into additional innovative formats is another way we’re making performance TV work harder for every brand.”

# # #

Charter Communications's Spectrum Reach ad sales unit said it acquired ad-tech company ShowSeeker.

Spectrum Reach was one of the largest users of ShowSeeker’s Pilot cloud-based order management system. ShowSeeker also works with a majority of U.S. cable operators.

Financial terms of the transaction were not disclosed.

ShowSeeker was started in 2023 to help ad sales departments identify appropriate commercial availabilities across an expanding range of programming options. More recently it has become a platform for planning and executing campaigns, incorporating viewing data from multiple sources.

Spectrum Reach said the acquisition will help ShowSeeker further automate ad buying and selling, with capabilities including research, proposal and campaign negotiation and approval processes, automated ad trafficking, creative rotation, media delivery and inventory optimization available across all media types, including linear, streaming and other CTV inventory.

“Bringing the ShowSeeker team’s extensive order-management expertise into the Spectrum Reach family is a meaningful step forward in our goal to enhance the advertising experience for our clients,” said Rob Klippel, senior VP, product, technology & operations for Spectrum Reach. “In a fragmented media landscape, the integrated solution will streamline planning and execution to save agencies valuable time.”

Dave Hardy, ShowSeeker’s founder and CEO, will join Spectrum Reach as VP and general manager.

“We are excited for this opportunity to integrate our technology with Spectrum Reach and to contribute to their transformative vision for the advertising industry. This acquisition will further enhance ShowSeeker’s capability to deliver innovative AdTech solutions to all of our current and future customers,” said Hardy. “Our team is dedicated to innovating and enhancing order management processes, and with Spectrum Reach, we will achieve even greater milestones in delivering value to advertisers.”

# # #

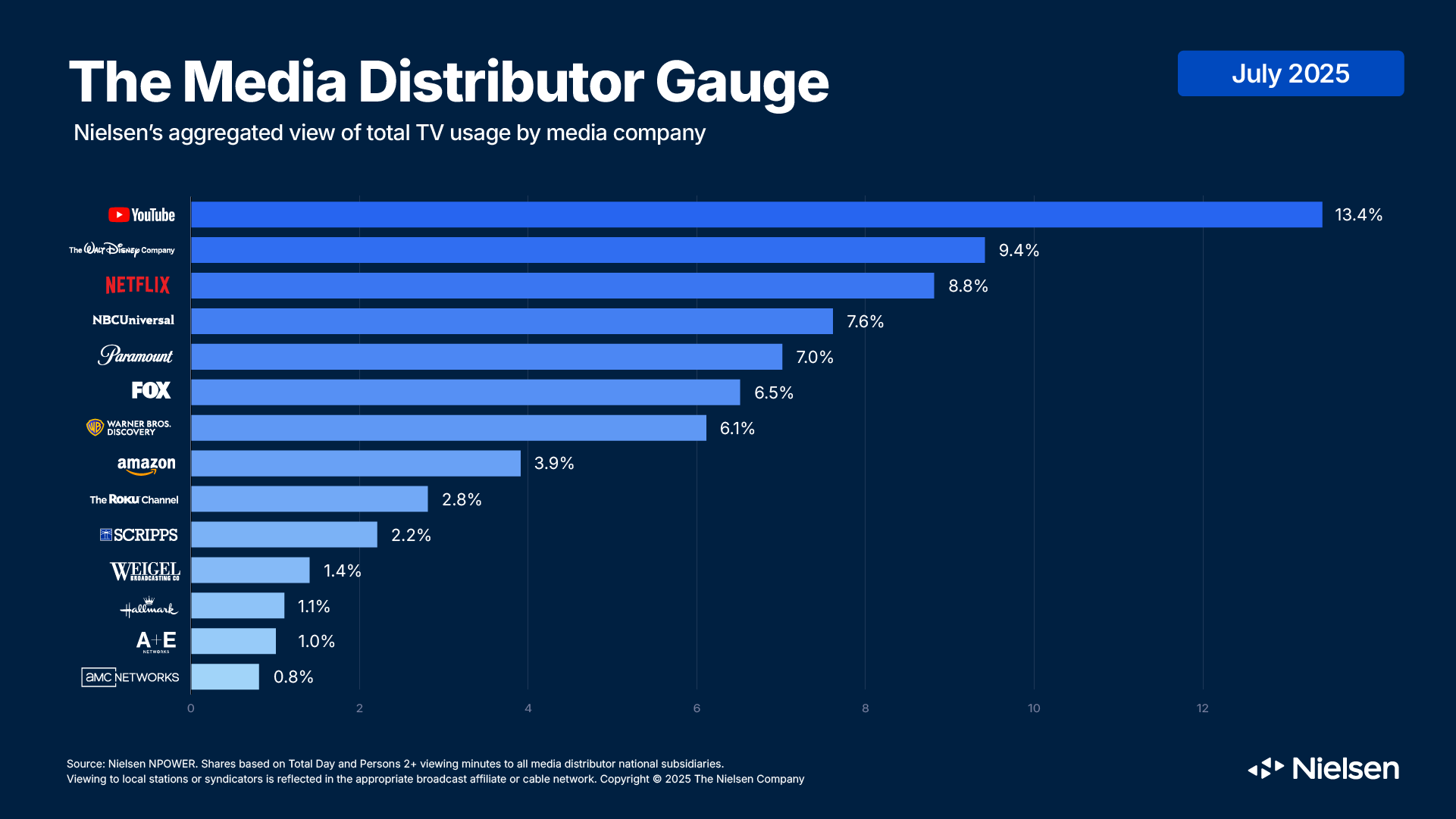

Summertime and the streamers continued to add share, according to Nielsen’s Media Distributor rankings for July.

YouTube, Netflix and the Roku Channel all hit new records in the month. YouTube was No. 1, increasing its lead over The Walt Disney Co., the No. 2 distributor in the rankings.

No. 3 Netflix’s share rose to 8.8% from 8.3% last month, with the largest volume gain across all streaming platforms. Its average minute audience rose by 215,000 viewers.

Roku’s usage was up 7.5% for the month.

Also posting a gain was Amazon Prime Video, which rose to nearly record levels in July with a 3.9% share of TV usage. Amazon tends to get a boost in the fall, which it streams the NFL’s Thursday Night Football. This summer, Amazon is getting boost from original programming aimed at very different demographics. Ballard, a spinoff from Bosch, attracted viewers aged 50 plus and generated 2.5 billion viewing minutes. For the younger set, Amazon had new episodes of The Summer I Turned Pretty, which accumulated 1.5 billion minutes of viewing.

This month's rankings were largely unchanged with one exception. Hallmark rose to a 1.1% share to the No. 12 spot, leapfrogging A+E, which had a 1% share.

Nielsen attributed Hallmark’s gain to its Christmas in July programming stunt. The premier of Unwrapping Christas, Holidazed and Christmas at Sea powered a 19% viewership increase for Hallmark.

The summer of streaming is likely to subside once fall arrives.

“Despite a relatively static set of rankings over the past couple of months, things should start to break loose in the second half of August, with the return of football season and the viewing that drives back the linear channels,”said Brian Fuhrer, senior VP, product strategy and thought leadership at Nielsen.