Linear Still Dominates TV Ad Impressions, But Connected TV Gains In 1H 2025, Says iSpot

'Fragmented viewing calls for a true read on incremental reach and conversions to understand where–and how–ads are having an impact, iSpot said

Linear TV is not dead. But the grim reaper–connected TV–is coming quickly.

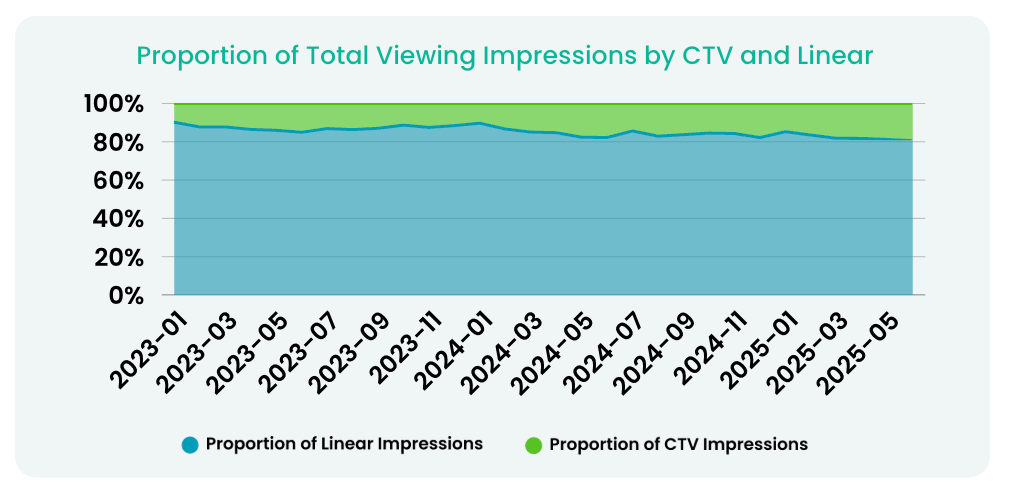

Traditional TV still generates an overwhelming 80.5% of a shrinking pool of TV advertising impressions, averaging nearly 17 billion impressions per day, according to measurement company iSpot’s new transparency report for the first half of 2025.

All that reach remains valuable to advertisers, who spent $21.9 billion for those impressions, up 3.29% from a year ago. Primetime might feature more reality and less scripted programming, but Big 4 ad impressions were up 4.18% to $241.1 billion in that daypart, and advertisers paid $4.21 billion for those primetime eyeballs.

But the shift in viewing and increase in fragmentation is having a growing impact on advertising. CTV had a 19.48% share of impressions in June, up from 14.76% in January 2025 , iSpot said.

Total TV impressions were down 5.54% in the first half of the year (vs. 1H 2024).

What’s that mean? While linear TV remains the primary driver of ad impressions, “with CTV-first strategies on the rise and FAST (free ad-supports streaming television) platforms expanding, streaming is becoming less of a complement and more of a core component” of ad plans, the iSpot report said. iSpot added that “fragmented viewing calls for a true read on incremental reach and conversions to understand where–and how–ads are having an impact.”

In its report, iSpot also noted that advertisers are focusing on outcomes when it comes to review campaigns and the performance of commercials. This is something iSpot is doing with Paramount Global, in particular.

Another trend is media and agency consolidation. As a result, “control and clarity are in high demand. More advertisers are building direct data pipelines to power faster insights,” said iSpot.

In the report, iSpot lists the top networks in terms of TV ad impressions. CBS was the leader with an 8.1% share and a 2.37% increase in ad impressions from a year ago.

The rest of the top 10 networks were Fox News (up 35.13% in impressions), ABC, NBC, ESPN, Ion, HGTV, Univision, CNN and Hallmark. Impressions were down at Ion, HGTV and Hallmark.

The top individual programs in terms of share of impressions were all sports. The NBA was No. 1, followed by men’s college basketball and the NFL. Ad reach for NBA games was up 9.6% year-over-year; men's college basketball grew 11.6%.

The rest of the Top 10 were Law & Order: SVU, The Big Bang Theory. SportsCenter, NCIS, The Price Is Right, Friends and Good Morning America.

Advertisers who spend big on linear are among those also making the biggest bets on streaming. The company that garnered the most linear ad impressions in the first half, Progressive, was also tops when it came to streaming ad impression share. Burger King, which was No. 2 in linear impressions, was No. 13 in streaming impressions, while Liberty Mutual was No. 6 in streaming impressions.

Other advertisers with the biggest share of streaming TV ad impressions included AllState, Hyundai, McDonald’s, Chick-fil-A, Walmart, Capital One, Nissan and Intuit’s Credit Karma brand.

In some categories, like insurance, the company that bought the most liner impressions also bought the most streaming impressions. In the auto category, Hyundai led in linear and digital, as did Febreze among CPG brands.

But in the pharma category, AbbVie’s Skyrizi was the top brand in linear impressions, while Novo Nordisk’s Wegovy was the top brand in streaming. Among quick-service restaurants, McDonald’s was top in linear, while Burger King led in streaming impressions.

The most likeable commercial in the first half of the year was "Knock Out" for Pfizer. The spot first aired during the Super Bowl and generated brand recognition that’s 9 percentage points above the norm.

The second most likeable commercial was "Mother’s Day: Hey Mom" for Hallmark. The spot aired exclusively across Hallmark’s networks.

The other most likeable ads were for Rocket Mortgage, Bombas, Subaru, Fidelity Investments, Budweiser, Icy Hot, Acorns and Aflac.

The most humorous commercial was another Super Bowl spot – this one for Doritos – showing a human wrestling with aliens over a bag of chips.

The other ads scoring highest for humor were for PayPal, GorillaGlue, Pringles, Jack Link’s, Mountain Dew, Hellman’s, Little Caesar’s, Taco Bell and Reese’s.

As iSpot notes, advertisers are focusing more on business outcomes. In the retail category the ads that generated the most foot traffic were Dick’s Sports Goods’ Soccer Cleats spot. The commercial drew a 581.71% increase in foot traffic airing in programs including The Big Bang Theory. A Macy’s Mother’s Day Ad provided a 205.99% lift in foot traffic, while a Father's Day spot for Kohl's lifted foot traffic 131.01%.

The full report from iSpot can be accessed here.