iSpot Provides Data for Advertisers Huddling Over Their NFL Gameplan

During the regular season and playoffs, the NFL accounted for 23.22% of all ad impressions across ABC, CBS, Fox and NBC

With another National Football League season about to start, measurement company iSpot has released a new Ad Playbook full of data that marketers can use to set their gameplans for taking advantage of the most-watched programming on TV.

The NFL’s dominance is mindblowing. During the regular season and playoffs, the NFL accounted for 23.22% of all ad impressions across ABC, CBS, Fox and NBC. That’s more than two times the next most-popular programming. Selling those NFL commercials on linear channels generated $6.76 billion in ad revenue for the networks, according to iSpot.

Among all household TV ad impressions in 2024, the NFL was responsible for delivering 3.28%.

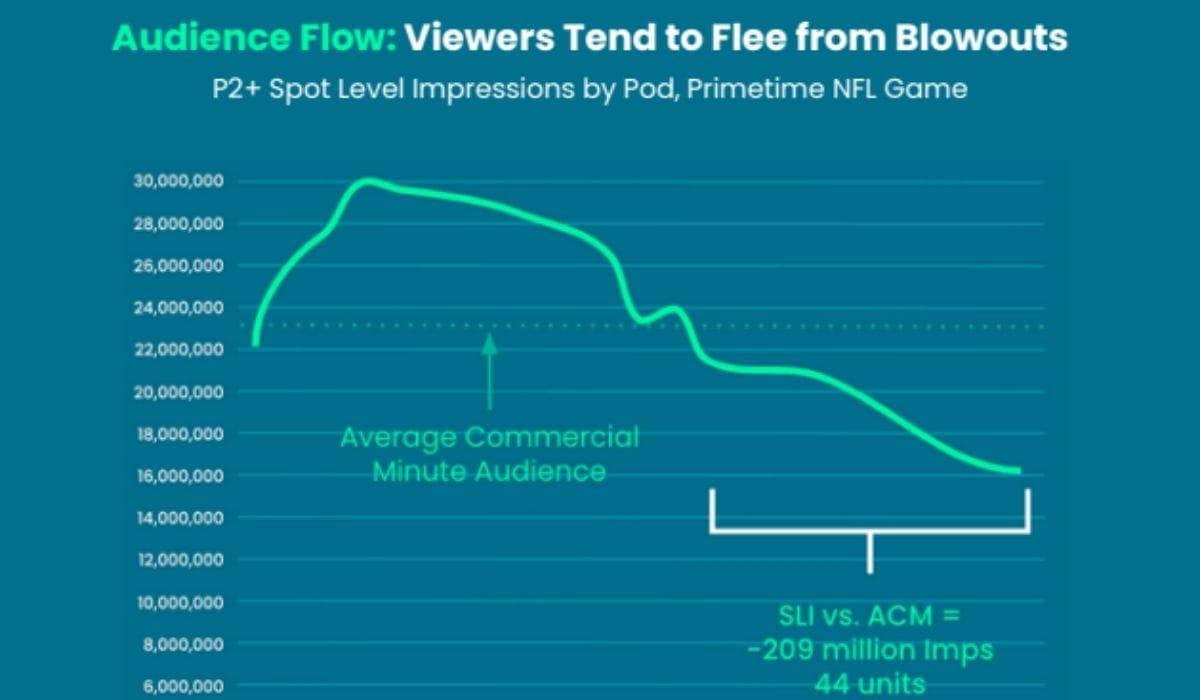

NFL advertisers have to be careful about where they put their ads within games. While most NFL games start with high ratings, viewers tend to flee blowouts. That creates risk when buying spots after halftime because spots are bought based on average commercial minute ratings for the whole game, but spots are actually seen by the people still tuned in.

During one primetime game, iSpot found that 18 different brands only ran commercials from the14th ad break pod through the final whistle. That group represented more than a third of all of the advertisers in that game. The game was a blowout and the ads that aired in those late pods fell short of the Average Commercial Audience by an aggregate of 209 million impressions.

“Given the massive delta between the spot-level impressions and average commercial minute audience of the NFL’s 2nd most active advertisers, we examined the drivers at play. Pod placement was unequivocally the primary issue driving the difference between spot-level impressions and average commercial audience,” the iSpot report said.

On the other hand, games late in the season gave advertisers the biggest reach. The game with the most reach featured the Kansas City Chiefs and the Buffalo Bills, and aired on Nov. 17. The popular Chiefs appeared in four of the other top 10 games in terms of ad reach.

Ratings are great, but outcomes are becoming more important to advertisers. The iSpot report says that NFL-focused networks are able to charge higher premiums for ad during the NFL season because, in addition to big audiences, NFL ads drive real business outcomes.

During Q4, wireless services saw a 42% average seven-day brand lift after running commercials on NBC (which, like other networks, leans on NFL games in Q4).

On Fox, Q4 programming generated 30% lift for food delivery brands. Some of those ads drove viewers to immediately ordered a food delivery and many viewers ordered food again while watching a game the following week. And for potato chip brands, 54% of the households that saw a commercial during a game purchased chips within one day of viewing.

The "new" 2024-25 NFL advertisers (brands that didn't appear the previous season) that had the most TV ad impressions were Nationwide Insurance, Corona, PayPal, Pluvicto, VRBO, Microsoft Copilot, ServiceNow, Scopely, Tremfya and Nutrl.

Sportsbooks reduced their spending during the NFL season by 9% to $164 million. FanDuel was the leader, increasing its share of impressions by more than five percentage points.

iSpot found that there were 62 NFL advertisers that appeared only in games streamed on Amazon Prime Video during the 2024-25 regular season. Those included Amazon-owned brands like Fire TV and Amazon Studio, but also many unaffiliated advertisers including AMC Networks, American Airlines, Levi's, Pluto TV, Samsung, Walgreens, Volvo and Yeti.

Some of those advertisers “opted for local targeting plays, or used the younger audience to hone in on specific consumers. Others still plugged into advanced ad capabilities to create direct calls to purchase via QR codes and other interactive elements. Amazon also gave smaller brands access to NFL audiences they may not have reached otherwise,” the iSpot report said.

After the regular season, some of those brands opted to buy commercials during NFL playoff games and the Super Bowl.

The attraction of NFL ads has created work for present and former NFL stars. Excluding the Super Bowl, Kansas City Chief quarterback Patrick Mahomes was the most seen athlete during the 2024-25 season with 423 airings. Other popular players included J.J. Watt, Rob Gronkowski, Davante Addams, Derrick Henry, Case Keenum, George Kittle, Amon-Ra St. Brown and Chiefs coach Andy Reid.

Travis Kelce, Mahomes’ teammate and Taylor Swift’s finance, was just outside the Top 10 with 99 commercial airings.

Last season, the NFL sponsor commercial that generated the most positive purchase intent was for Little Caesars. After watching the pizza chain’s “A Piece of Me” spot, 75% of viewers felt they were more or much more likely to make a purchase. Other top spots for generating increased purchase intent were for Domino's, Taco Bell, JCPenney and King's Hawaiian.

The Little Caesar’s “A Piece of Me” spot was also the most likeable NFL sponsor ad, according to iSpot. The ad was 21% more likable than the norm for new sponsor ads last season. Other likeable ads were created for Taco Bell, Pringles, Visa and Dick’s Sporting Goods.

But man does not live by football alone, and the iSpot report notes that during the offseason, NFL fans regularly watch news shows, such as ABC World News Tonight, 60 Minutes, the CBS Evening News and NBC NIghtly News. They also tune into Law & Order; Special Victims Unit, Saturday Night Live, Tracker,American Idol and The Late Show with Stephen Colbert.

# # #

Speaking of sports, SportsGrid said it will launch The Craig Carton Show, a new daily sports talk program.

Carton, a long-time New York radio veteran until his career was derailed by personal issues, was most recently a co-host of Breakfast Ball on FS1. The show was canceled this summer.

The new Craig Carton Show will have its premiere September 4 on the SportsGrid FAST channel and air weekdays from 11 a.m. till noon ET.

"SportsGrid is about delivering compelling, original live sports programming to fans wherever they watch, and bringing Craig Carton into our lineup is a perfect example of that mission. His voice, personality, and deep connection with sports audiences make him a tremendous fit for the SportsGrid FAST Channel," said Louis Maione, SportsGrid founder and president,

The show is being produced by Fox Sports and Red Seat Venturers.

"I couldn’t be more excited to launch The Craig Carton Show on SportsGrid. Studio 34 is an incredible stage in the middle of New York City, and I can’t wait to deliver a new program format that’s smart, authentic, and most importantly, fun for sports fans everywhere." said Carton.