Interactive Ads Generate Engagement and Lift Sales Intent: Study

'As viewers increasingly expect TV to be more than a passive experience, brands have a rare opportunity to turn curiosity into connection through interactivity,’ said Jacqueline Corbelli of BrightLine

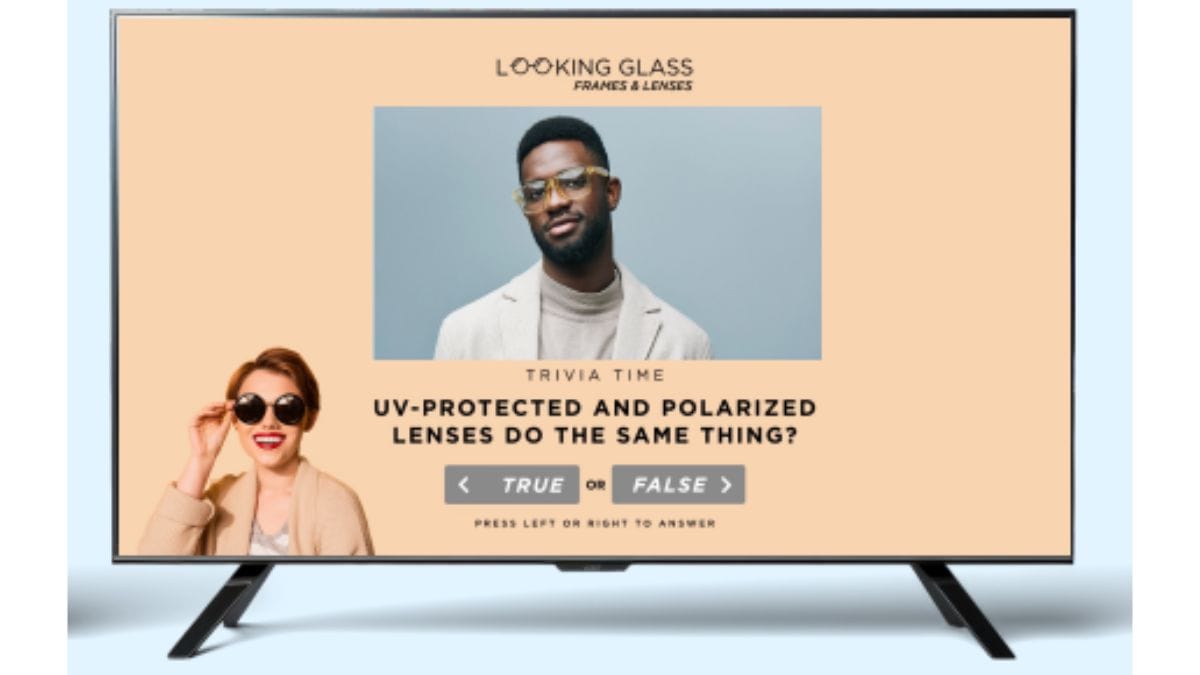

Interactive commercials that compel viewers to participate in activities like polls and trivia using their remote controls are more likely to generate brand recall, brand favorability and purchase intent, according to a new report from BrightLine.

The report is called The Engagement Effect: How Interactivity Predicts CTV Success. BrightLine, which bills itself as the industry leader in interactive CTV advertising, conducted the research behind the paper with MediaScience.

Interactive ads are designed to build viewer engagement, and as engagement rates increased, brand recall rose. The study found ads with the highest engagement rates averaged about 33% higher recall than those with the lowest score.

Regardless of the engagement rate, interactive ads lead to measurable positive brand outcomes when they are engaged with, including a 12% lift in ad likeability, an 8% jump in brand interest and a 4% gain in brand favorability.

Maybe most importantly, as engagement rates rose, purchase intent also increased. “This indicates that an ad that is highly engaging is not only memorable but also encourages viewers to purchase the product,” the report said. Interactive ads delivered a 8% lift in purchase intent when engaged with.

The report builds on earlier research from BrightLine that found that interactive ads deliver a 36% lift in unaided brand recall compared to standard video ads.

“At a time when advertisers are demanding accountability from their media investments, this research confirms what we've long believed - interactivity drives stronger recall, deeper affinity, and higher purchase intent,” said Jacqueline Corbelli, co-founder and CEO of BrightLine. “As viewers increasingly expect TV to be more than a passive experience, brands have a rare opportunity to turn curiosity into connection through interactivity.”

The study involved 700 participants who watched a 30-minute streaming experience featuring ad breaks embedded with 64 interactive ads alongside standard, non-interactive control versions. Each ad was assigned an engagement tier (high, moderate, low) and evaluated across key metrics including aided and unaided recall, brand attitudes, and purchase intent.

“As our research shows, when an ad combines smart creative with engaging interactivity, it delivers better results in every way,” said Phillip Lomax, executive VP at MediaScience. “Interactive formats that empower viewers to engage directly, using something as simple as their remote are key. We found that every measurable indicator, from awareness through purchase intent, improved through remote-control engagement. These findings suggest that interaction strengthens emotional and cognitive connections to a brand—helping advertisers build affinity, not just attention.”

The report offers three takeaways for marketers:

1. Interactivity is a must-have for CTV advertisers. The numbers don’t lie: remote-controlled interactive ads enhance the impact of standard ads. They consistently drive stronger recall, deeper brand affinity, and higher purchase intent. We have found this to be true across 1,000+ participants, in partnership with independent, third-party measurement companies over years of research.

2. Aim for higher engagement rates. Not all creative is created equal. The stronger your creative execution—both the main commercial and the interactive element—the higher your engagement rate, and the better your brand outcomes. Leveraging recognizable IP, tapping into popular trends, and designing truly engaging experiences all help drive participation.

3. Invest in remote-control interactivity. Every lift we documented comes from remote control participation. A click isn’t just a metric—it’s the moment that makes a brand stick. Our creative directors have crafted hundreds of national TV campaigns and can help bring yours to life. Quick-fix formats like QR codes fill a need, but we find that being intentional with interactive elements — like programming remote-control interactivity in—sparks more interest, and therefore leads to stronger brand outcomes.

# # #

Advertisers might have an opportunity to get a bargain while taking advantage of the explosive growth in viewing of free ad-supported streaming TV (FAST) channels, according to a new report from Wurl.

The surge in commercial inventory supply has pushed fill rates lower than in previous years, the report says, and can take advantage of less crowded programmatic auctions to reach viewers at scale while maximizing ROI.

The report says conditions in the FAST market also benefit “buyers who adopt smarter, more targeted strategies." As streaming platforms prioritize metadata, contextual segmentation, and innovative ad formats to facilitate more demand for their inventory, advertisers can align creative with content in ways that enhance attention and lift.

“As the streaming landscape continues to evolve, free streaming TV is proving itself to be an efficient and high-performing channel,” said Dave Bernath, CEO of Wurl, a division of AppLovin Corp. “We’re seeing significant growth in both audience scale and engagement. At the same time, premium ad inventory remains available, which means advertisers have a unique opportunity to secure high-impact placements as the market continues to mature.”

Over the past 12 months, the number of monthly active households watching free, ad-supported streaming channels has grown by 12%, Those households are spending more time watching those channels: Average daily hours of viewing per household have increased by nearly 16%. Taken together, the lift in average daily households and HOV per household produced nearly 29% increase in total HOV across ad-supported streaming channels.

Most households spend the lion's share of their time with a small set of favorites— typically 3 to 4 channels, depending on the platform. At the same time, households are watching more channels than they were a year ago. Channel exploration was up from 10% on the low end to 50% on the high end.

By genre, the channels drawing the most viewing are reality (10.9%), drama (9.4%), and documentary (7.6%).

But in order for an advertiser to reach 90% of CTV households, advertisers have to buy channels in the top 30 genres, the report said.

“For advertisers, these genre trends underscore the scale and diversity of audiences available on free streaming TV. High-reach genres can provide significant advertiser scale, while the wide distribution of viewing across 30 genres creates opportunities to fine-tune contextual targeting strategies,” according to the report.

While the ad fill rate—the percentage of available ad inventory that is actually filled with paid commercials—is down year-over-year, a closer look at the data reveals a consistent seasonal pattern. Every quarter starts off with lower fill rates than the quarter before, with January regularly representing the lowest point of the year.

The annual trends mirror budget seasonality, where advertiser spend ramps up toward the end of quarters as well as in the later months of the year as the winter holidays approach.

For advertisers, the decline in ad fill rates highlights a market where there are untapped opportunities to reach engaged viewers at scale. Advertisers may need to adjust their media mix more rapidly to keep pace with consumption.

“This environment also benefits buyers who adopt smarter, more targeted strategies,” the report concludes. “As streaming platforms prioritize metadata, contextual segmentation, and innovative ad formats to facilitate more demand for their inventory, advertisers can align creative with content in ways that enhance attention and lift.”