How Lilly Relies On ISpot’s Unified Measurement

"We need to make sure that we have the right measurement partners and solutions available to make good strategic decisions," said Eli Lilly's Zachary Schroll

Like other industries, the pharmaceutical business is navigating the shift of viewers from linear TV to streaming.

Traditionally pharma companies have been big spenders in linear because they’re constantly rolling out new drugs and need to reach a broad swath of consumers quickly.

In the current media environment, pharma marketers need to know that if they shift their spending to streaming, will they continue to get the lift they need. That make measurement important.

At the Association of National Advertisers’ Measurement and Analytics Conference in Chicago Wednesday, pharma company Eli Lilly talked about how unified measurement from one of its partners, iSpot, helps ensure it's reaching the consumers it needs to reach across both linear and digital.

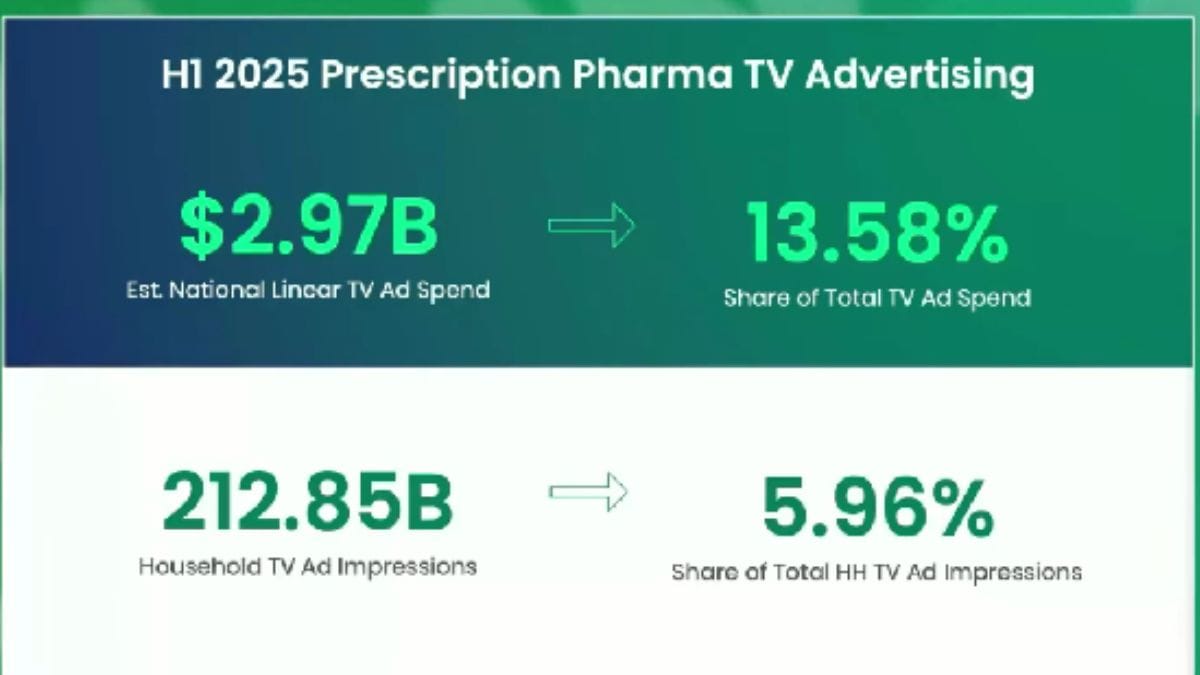

According to iSpot, in the first half of 2025, pharmaceutical companies spent $2.97 billion to advertise prescription drugs on linear TV, which accounted for 13.6% of total ad spending, said Whitney Teplitzky, senior director of brand partnerships at iSpot. Pharma linear TV spending is up 12.7% over the past eight months, she added. "It's definitely a testament to pharma believe that TV is an essential channel."

In terms of household TV impressions, pharma companies got 212.85 billion impressions for their money, and a 5.96% share of impressions.

That would indicate that “these pharma brands want to prioritize quality over quantity,” Teplitzky said.

Pharma ads are also a bit longer in order to communicate all of a new drug’s health benefits and warnings.

Measurement is crucial to a pharmaceutical business like Lilly, said Zachary Schroll, associate VP of consumer analytics at Lilly.

With new drugs the key is building awareness from zero, Schroll said.

"You're not talking about decades of advertising. You're talking about shorter periods of time, three to six years hopefully for some of the brands," he said. "With this really short period of time, you need to make sure that your measurement is dialed in. There's so much planning and R&D and time and investment that goes in before you launch, so the measurement really needs to be ready from the time you start with the launching of our brands."

Shcroll said that Lilly wants to follow consumers from linear to streaming TV, but until recently, it has been hard to get the required reach from digital.

"It's really a rapid change. A lot of us are keeping an eye on the trends month over month," he said. "And now streaming has more time spent than linear TV. This trend is really one that has exploded this year, with way more ad-supported opportunities."

That’s increased the need for cross-screen measurement. "We need to make sure that we have the right measurement partners and solutions available to make good strategic decisions," Schroll said.

He added that in the current environment it’s important to look forward at trends, rather than rely on history.

A strong measurement framework is important for making sure Lilly can measure both reach and frequency across both linear and digital.

"How we approach it is going to be dependent on the data," Schroll said. "Universal measurement is something that we’ve partnered on with iSpot for several years now."

Reach is important because the company wants to communicate with all of the people that could benefit from new remedies and treatments. At the same time, it needs a relatively high frequency to ensure that the consumer recalls the brand when they go to their doctor.

While Lilly is interested in its overall reach and frequency, it also wants to know how much it is getting from each of its investments, in linear and digital, and blending those investments across both platforms.

Lilly was an an Olympic sponsor. "I want to know what the Olympics delivered. I don’t want to know what NBC delivered. I want to know across all properties, what did that Olympic buy deliver. And so unified measurement becomes really important for us to group those together, but also look at the incremental reach associated with that," he said. "In some of those instances, you’re certainly paying a premium, right? So you’re going to want to get incremental reach out of it."

While reach and frequency are important, ultimately Lilly is looking at outcomes as well.

"Obviously we're going to look at impact, right? So what is the business impact? Are we driving revenue and are we driving interest in our brands that would lead us to believe that we’re going to be able to hit our goals or deliver against plan," Schroll said. "We are very focused with our team on business impact more than anything."

Schroll also noted that while competitive spending data about linear television has long been useful to marketers, similar data about streaming has been lacking.

He said iSpot now provides useful data.

"Kudos to iSpot on the OTT and streaming competitive data that’s now available. It gives us a different view and brings us some more confidence in measuring competitive share of voice and presence across different publishers in a similar way that we do with networks or programming across linear TV," Schroll said.

Finally, Schroll said Lilly looks at data to evaluate the effectiveness of its creative and whether it wears out when viewers see it repeatedly.

"We can deliver as much reach and frequency as we want, but when we're not seeing the impact, potentially, a lot of that comes down to the creative," he said, noting that the strength of the creative can account for 50% to 60% of that total impact of a campaign.

"We’re really interested in understanding when we are losing effectiveness of those ads over time," Scroll said. "We're tracking that monthly and triangulating that over several campaigns."