Fox Shares Data About Streaming Viewing

'We’ve already gained meaningful insights into audience engagement trends,' said Lachlan Murdoch

Fox is a latecomer to streaming, but on its second-quarter earnings call Tuesday, the company shared some of the data that’s been rolling in since its launch of Fox One last year.

Speaking on the call, Fox CEO Lachlan Murdoch said management is “encouraged by consumer reception” for Fox One. He said it has exceeded expectations, but the company has not said how many subs it has. Research company Antenna estimated it had gained 2.3 million subscribers by the middle of football season.

With its new digital product, “we’ve already gained meaningful insights into audience engagement trends,” Murdoch said. “While live sporting events continue to drive the majority of engagement, news accounts for approximately one-third of total minutes viewed on Fox One.”

News viewers engaged with the platform twice as many days per week as non-news viewers and watch nearly three times as many minutes per week on average, he said.

That kind of granular data about who is watching is harder to come by in linear media and the deeper Fox gets into streaming, the more information it will be able to analyze.

Murdoch said those numbers demonstrate that people are getting Fox One not just for live sports but for live news as well.

Fox also owns the ad-supported streaming service Tubi. Tubi had its most streamed quarter ever, with a 27% increase in total viewer view time, helped by an NFL telecast on Thanksgiving Day.

Murdoch said that 95% of the consumption on Tubi is on-demand usage.

The rise in viewing generated a 19% increase in revenue for Tubi, which has positive EBITDA for a second straight quarter.

It helps that Tubi’s audience is younger and more diverse than advertisers can find on broadcast. Most of them, you can’t find on broadcast. Murdoch said that 70% of Tubi’s user base are hard-to-reach cord-cutters or cord-nevers.

When other big media companies charged into the streaming wars, Fox held back, focusing mainly on its broadcast and cable assets. Fox prioritized live programming–sports and news–the areas where traditional media retained the most strength. As its rivals lost billions trying to build direct-to-consumer businesses, Fox’s strategy this year has resulted in audience gains.

Murdoch said across sports, news, entertainment and Tubi, Fox’s total minutes viewed is up 15% year-over-year in calendar year 2025 (which it should be noted was a Super Bowl year for Fox).

On the call Murdoch also provided an interesting breakdown of the company’s ad revenue, which was up 1% to $2.5 billion in the quarter despite 2025 being a post-election year. He said that 94% of the company's national advertising sales comes from sports, news and streaming, while just 6% comes from entertainment.

Overall, Murdoch said that the ad market is strong–for Fox at least.

Last quarter, Murdoch said that the company was experiencing the most robust market it had seen for some time. “That remained true during the second quarter, and it continues to be true today, where we are seeing unabated healthy trends and positive metrics across our portfolio,” he said.

In sports, Fox had record-breaking advertising for the Major League Baseball postseason, which was crowned by a seven-game World Series. It also saw new highs in sales with its NFL and college football regular season games.

Fox News was also in strong demand during the quarter. Murdoch said that 200 new advertisers bought commercials on Fox News in the quarter. That was on top of the 350 advertisers it added last year.

That demand has sent prices jumping an “embarrassing 56% or 47%” year-over-year in the scatter market, he said.

Across the Fox portfolio eight of the top 10 categories are significantly up, Murdoch said. The No. 1 category is financial services, led by the insurance companies.

Overall, in the second quarter, Fox’s net income was $229 million, or 52 cents a share, down 39% from $373 million or 81 cents per share, reflecting higher programming costs. Revenue rose 2% to $5.18 billion.

# # #

Speaking of Tubi, the Fox streaming service expanded its relationship with Nielsen, adding access to Nielsen’s audience measurement and streaming platform ratings. Tubi already had access to Nielsen's digital ad ratings and Nielsen One Ads.

According to Nielsen, Tubi ranks as the No. 1 fully free, fully ad-supported streaming service, the No. 2 free AVOD platform for adults 18 and up by reach and as the No. 4 streamer in 18-plus ad-supported reach.

“In the battle for attention, Nielsen’s 3P data shows Tubi is taking share and redefining streaming for audiences and advertisers with viewership that represents the scale, influence and purchasing power of the next generation,” said Jeff Lucas, chief revenue officer of Tubi.

# # #

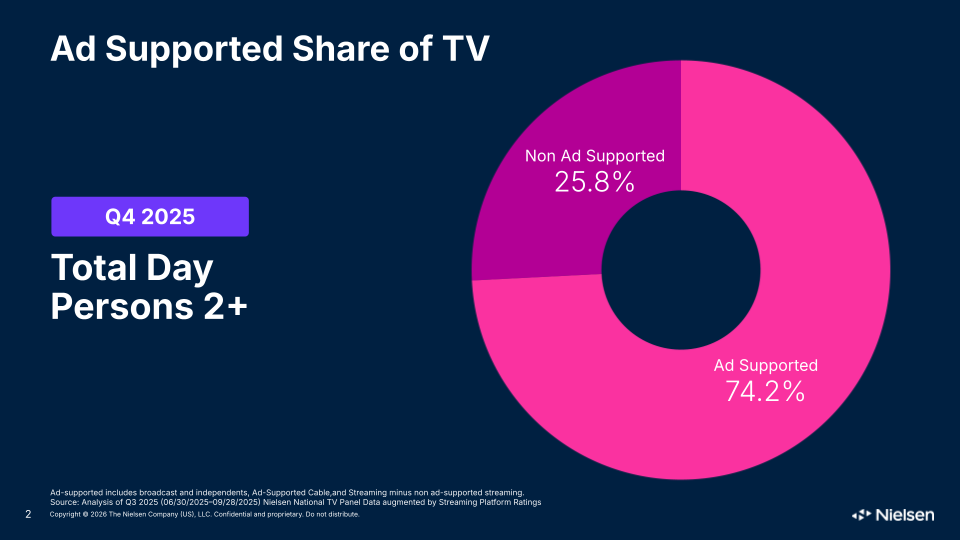

In the fourth quarter, 74.2% of all TV viewing was ad supported, according to Nielsen. That’s up from 9% from the third quarter.

Viewers spent 45.6% of their ad-supported viewing time with streaming, 29.6% with broadcast and 24.8% with cable.

Football games are ad supported, and with record viewing for the NFL and college football, the share of viewers seeing commercials grew. Ad supported viewing saw the biggest increase among young adults.