FAST Facts: Gracenote Sees 1,850 Channels with 197K Shows, Movies & Sports Programs

Nearly half of the programming now streaming on FAST channels was produced in the last five years and 80% of FAST programming was made in the last 15 years

Free Ad-Supported Streaming Television (FAST) channels are expanding, well, very fast.

Gracenote, the Nielsen unit that compiles data about content, has added information about FAST channels to its Data Hub, which previously tracked the programming available on the biggest subscription video-on-demand streaming services.

The additional data provides a more holistic view of the streaming landscape, Gracenote said.

According to Gracenote’s Data Hub, in the third quarter of 2025 there were 1,850 active FAST channels, an increase of 14% from Q1 2o25 and a 76% jump since 2023.

Those FAST channels feature more than 197,000 TV, movie and sports programs, and that number is growing.

Year to date, the number of programs on FAST channels has grown 12%, with growth of 7% in the third quarter alone.

Since Q2, the number of movies on FAST grew 8.91%, the number of TV shows rose 5.89%, while the number of sports programs fell 3.65%. But since the beginning of the year, the volume of sports programs on FAST grew 3.95%.

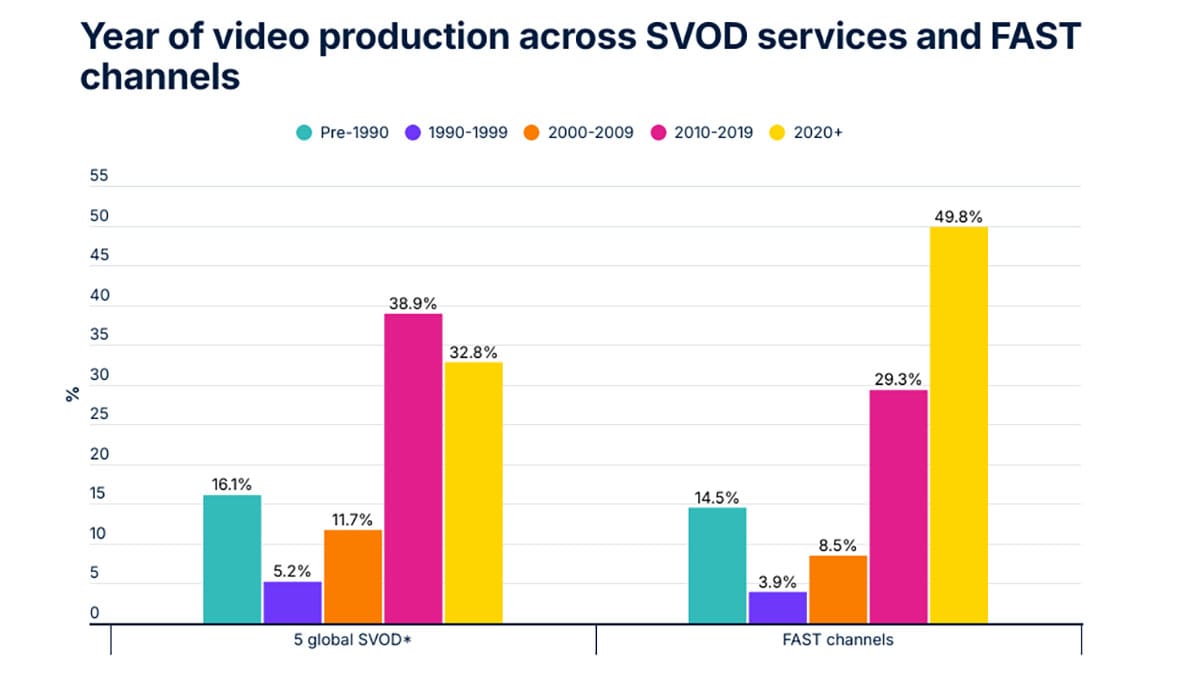

Gracenote also found that a lot of FAST programming is relatively fresh programming. Not so long ago, many FAST channels were based on “classic” shows from studio libraries. That’s no longer true, according to Gracenote.

Nearly half of the programming now streaming on FAST channels was produced in the last five years and 80% of FAST programming was made in the last 15 years.

That compares favorably to the programming on premium SVOD services, where one third of the content was produced in the last five years and just 68.5% was made in the last 15 years.

Since FAST channels mimic the linear TV experience, it makes sense that 93.1% of the content available on FAST channels are episodes of TV shows. On SVOD, TV shows account for 88.8% of available programming.

News was the fastest-growing program genre on FAST since Q2 at 37%, with that increase making it the No. 3 genre, behind drama and documentaries.

Another genre showing monstrous gains was horror, which increased 30% from Q2 and 41% from Q1.

Sports accounted for the largest increase among all content types for SVOD in the last three months, a jump of 13.2%. By comparison, movie content on SVOD grew 10% while TV content increased 9.2%. Focusing on FAST, sports programming was down 3.7% over the same period but up 14% year-to-date.

The Gracenote Data Hub also provides new data on the subscription VOD platforms it covers, which are Netflix, Disney+, Amazon Prime Video, Paramount Plus and Apple TV+.

Those platforms had 645,000 total TV shows, movies and sports programs available, up 9.8% in the quarter.

The increase was powered by a 28.5% increase in the volume of sports programming. The volume of movies rose 9.9% and TV shows were up 9.2%.

Most of that content resides on the Amazon Prime Video platform, which had 69% of the SVOD content in Q3, upfront 67% in Q2. Netflix had 19% of the SVOD content (down from 20.1%) and Disney+ had 8.8%, down from 9.1$.

Amazon Prime Video also had the most TV content (58.3) and movie content (74.5%).

When it comes to sports, Amazon Prime Video led the conference with 36.3% in Q3, up from 33.9% in the previous quarter. Disney+ had 28.2% of the sports content (down from 26.4%), Netflix had 25.5%, down from 26.4% and Paramount+ had 7.8%, up from 6.5%.

# # #

Even as streaming becomes more popular, churn remains a problem for streaming services, according to data in Samsung Ads’ new state of streaming report.

Samsung is one of the largest makers of smart TV sets and streaming devices, so it gets a good view of what’s happening in the industry overall from its proprietary ACR data.

Of the time spent watching Samsung smart TVs in Q2, 74% was spent streaming, vs. 26% consuming traditional TV. In Q1 it was 74% and a year ago, it was 71%.

Year over year, time spent per TV streaming was up 2%, while linear viewing fell 7%.

On Samsung sets, 69% of streaming is ad supported versus 31% that is ad free.

Streaming strength hasn’t solved the problem of churns. Among viewers using Samsung’s Tizen operating system, for every 10 users of a streaming app over the 12 months, nine dropped the app by the end of the second quarter.

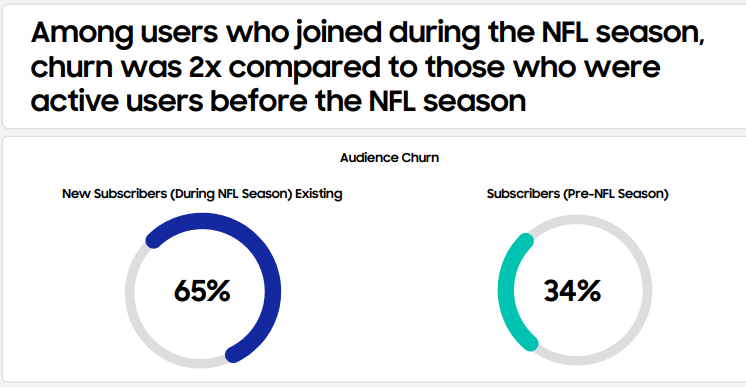

And while streaming services are pushing to add sports to their programming mix, Samsung says that sports isn’t an effective defense against churn. That includes the mighty National Football League.

Samsung data shows that the number of viewers who watch streaming services that carry NFL games climbs 28%, compared to before the start of the season. Hours spent per viewer per month jumps 57%.

But in the months after the Super Bowl, the number of viewers to those services drops 33% and hours viewed falls 59%.

Viewers who sign up for one of those streaming services were twice as like to churn out (65%) as those who signed up during the off season (34%).

“Sports can attract large audiences but without converting viewers to other content, sports audiences are twice as likely to churn as other app users,” the report says.

# # #

Seedtag, which specializes in neuro-contextual advertising, said it expanded its relationship with Human Security and enhanced its ability to ward off bots, fraud and other risks in the digital world.

Seedtag already had an integration with Human through Beachfront.

As part of the enhanced relationship, Human’s Ad Fraud Defense will be fully deployed across Seedtag’s infrastructure, which will increase Seedtag’s ability to provide clean inventory for advertisers and real-time traffic validation for publishers, the companies said.

“With the reliability of third-party data in decline and scrutiny on the rise, marketers are placing greater emphasis on accountable, transparent media supply that maintains quality at scale,” said Mike Villalobos, senior VP of strategy and commercial operations at Seedtag. “Our partnership with Human reinforces our commitment to delivering fraud-free, high-attention inventory across the open web and CTV. With this integration, clients can plan and activate campaigns with confidence, knowing impressions are fraud-filtered, and every dollar is working harder.”

Human’s capabilities are applied by pre-bid and post-bid.

“Seedtag's approach, rooted in delivering fraud-free and relevant inventory that drives genuine engagement, perfectly aligns with our mission to protect the integrity of the digital ecosystem," said Rick Holtman, senior VP, global sales at Human. “Strengthening our partnership with Seedtag is a natural evolution that further supports their mission to effectively deliver neuro-contextual digital experiences to their clients.”