Comscore, Trade Desk Team Up To Boost Audio's Share Of Digital Media

Audio, including podcasts, get 31% of time spent by consumers, but just 3% of ad spending

At the Association of National Advertisers' Measurement and Analytics Conference in Chicago Monday, executives from Comscore and The Trade Desk talked about how expanded data and programmatic technology could increase spending on digital audio and podcasts while boosting the effectiveness of ad campaigns.

It seems like everyone has a podcast and everyone is listening to and talking about their favorite podcasts. As most listeners will tell you they’re already listening to a bunch of ads even before the show starts.

The data show there is indeed a massive amount of listening going on when it comes to digital audio, said Jessica Trainor, head of partnerships at Proximic by Comscore.

Two out of three American consumers are touching digital audio today, Trainor said, pointing to statistics that 34% listen to podcasts weekly, up 5.5% and 75% stream music, up 5%. Smart speaker penetration is up to 38 million households.

Overall 31% of time spent with digital media is audio, or 2.5 hours per day. That’s more than are watching connected TV.

In the core demo of adults 25-34, 45% listen to podcasts weekly and 43% do not subscribe to a paid (commercial free) audio service.

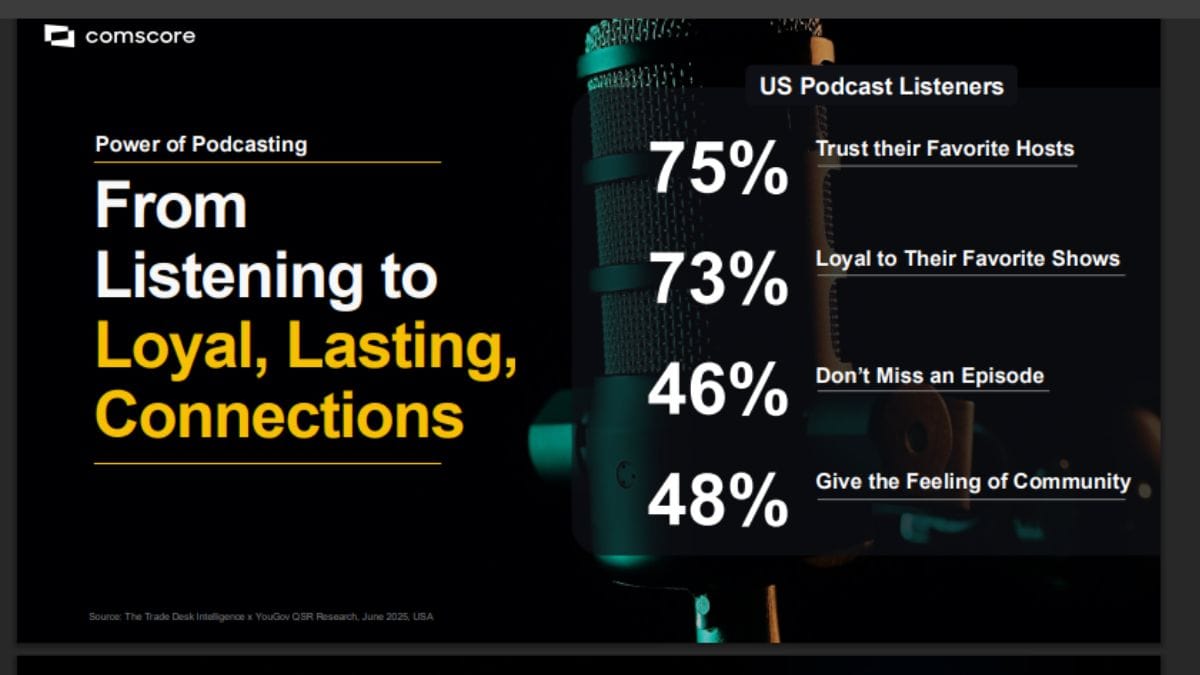

"This is a meaningful way that consumers are interacting and understanding the daily aspects of their life," Trainor said. "What that means for advertisers is that this is a valuable opportunity to reach a highly engaged audience that's emotionally invested in the moment."

Of all that digital audio listening, 64% is happening on ad supported channels "This means there's lots of opportunity for advertisers to get in front of consumers," Trainor said.

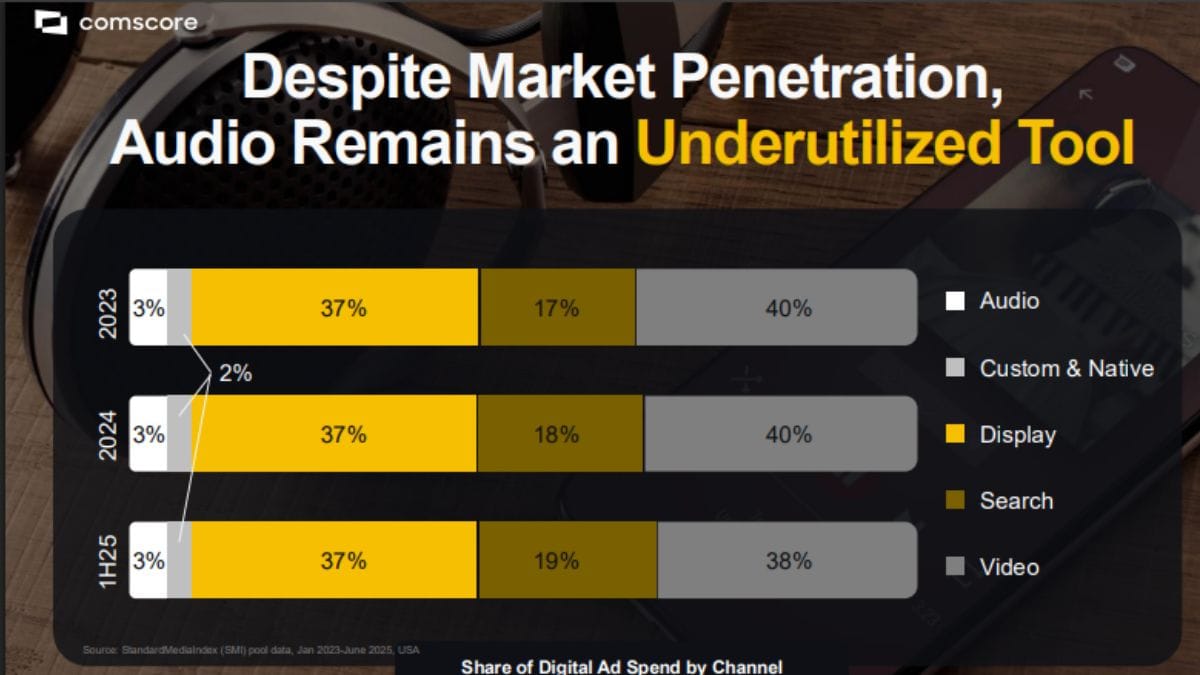

Despite those numbers just 3% of digital media spending goes to audio, said Caitlin Kirchner, senior director, data partnerships at The Trade Desk.

And while digital audio audiences are growing its share of spending has not changed over the past three years, she said.

Why? One reason was a lack of data about podcast content beyond genre. If a travel advertiser, for example, buys only travel podcasts, it’s hard to obtain the broad reach across its target audience, Trainor said.

"What we hear our partners asking for is content-level, episode-level targeting," she said. :At Comscore, we've been laser focused on unlocking content-level data so we can give the agency and advertisers what they need to feel more comfortable to dive into the audio space and feel like they're getting the message within that content to the right consumer."

Audio can also have daunting creative demands. "Audio is a different channel, a different format. We're used to display and CTV with big, bold imagery. You rely on visual and text to get your story across," Trainor said. "With audio, it's voice driven and intimate. You actually have to do storytelling to get your message across. I think partners and brands are just getting used to that format."

Kirchner added that measurement in audio has been an obstacle. "It's been hard to prove the ROI on that investment, and so there's been a little hesitancy to lean into it."

There is also a perception that audio has to be bought directly. "The reality is that's not the case, not on The Trade Desk. We make this available to all our customers alongside all the other channels they're running. And it's a huge unlock for consistency and efficiency, especially when you're chasing that ROI," she said.

As part of Comscore's cross-platform campaign measurement, "we now have audio available as part of that within The Trade Desk," Trainor said. "What this means for advertisers is that they now have the ability to understand and see a unifying view of their full campaign across over six 30 million devices, that includes TV, desktop, audio, digital."

Kirchner said that The Trade Desk believe there's so much untapped potential in the audio space.

"We are now opening up that high value, premium inventor in the open chance that can be bought programmatically alongside video, CTV and display," Kirchner said.

More brands see audio as a critical piece of their omnichannel campaigns.

"We're definitely seeing audio shift from a more niche silo of an activation strategy and moving forward to omnichannel, full end-to-end strategies," Kirchner said.

"We're also seeing a lot of advanced cross-channel strategies emerge, especially when it comes to brand messaging," she said. Advertisers are starting with a CTV message to build awareness and following up with podcasts ads to boost recalls. They then retarget consumer using display to reinforce the message.

"The great thing is you can do all that in one platform at The Trade Desk," with the same level of control, transparency and data activation as other digital media, Kirchner said.

Making audio part of an omnichannel strategy works. It's 3.4 times more likely to drive an emotional connection than when it’s used in a silo, she said.

"So if you're really going to get the most out of your audio investment, it is absolutely necessary to consider an omnichannel approach," Kirchner said.

In addition to building awareness, the intimate nature of audio can generate conversions and sales, Trainor added.

"Many more advertisers are moving down to the lower funnel metrics and thinking about conversions," said Trainor.

To illustrate audio’s effectiveness, they presented a case studio of a campaign from a cruise brand.

"Traditionally, the way that they were planning their audio podcast campaigns was leveraging broad stroke genre targeting. So oftentimes they were just targeting travel content. What that means is they were really limiting their opportunity to get one of a really valuable audience," Kirchner said.

"So they leaned in with Comscore and The Trade Desk and they decided to use our AI-enabled predictive audiences and what this did was it allowed them to reach their target audience outside of just travel-based content to other podcast content. So that drove the scale," Trainor said.

"They saw a 28% lift in brand metrics, which significantly outperformed those benchmarks, so truly showing the value of tapping into this content level targeting," she said.

Sounds good to me.