Charter Q2 Numbers Provide Snapshot Of State Of Cable Business

Despite cutting sub losses, Wall Street sent Charter stock plunging 18%

Cable company Charter Communications reported its second-quarter earnings on Friday and the way Wall Street reacted to the numbers diverged sharply from the company’s more upbeat assessment of its strategy and execution going forward.

For a while now, cable companies have been dogged by defections among their broadband customers. This hurts because broadband is a high-margin business that delivers big profits for cable companies.

The new data from Charter provides a snapshot of the state of the cable side of the cable TV business.

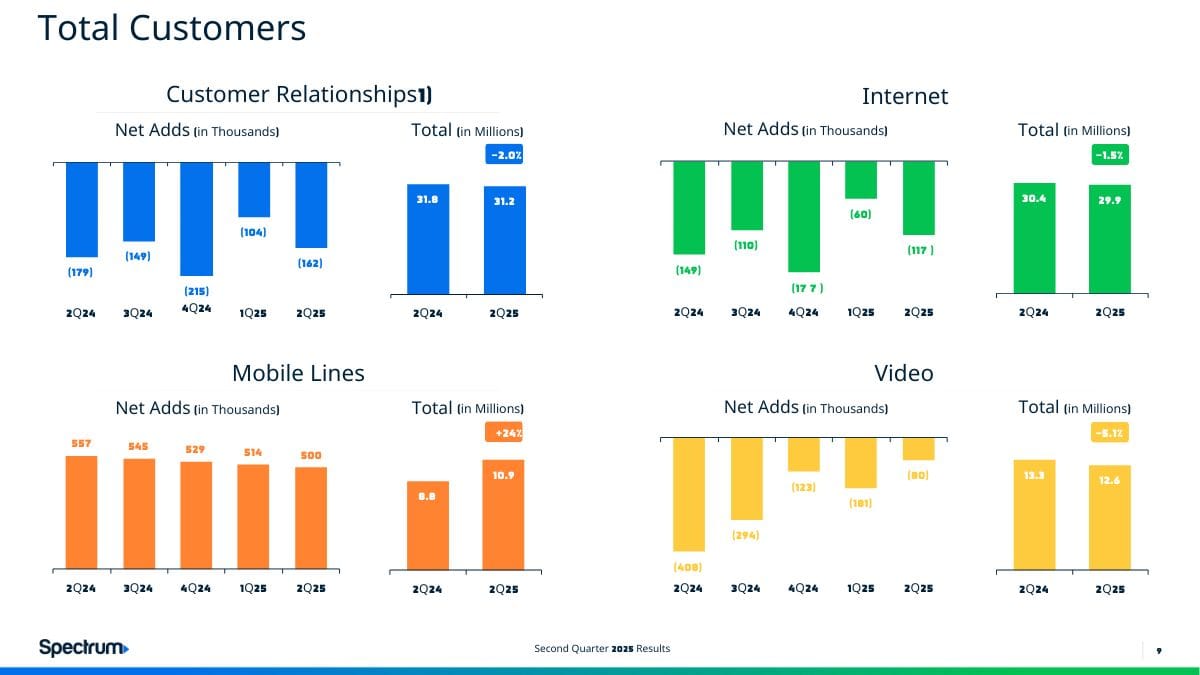

On Charter’s conference call with analysts, CEO Chris Winfrey noted that the number of lost broadband customers fell to 117,000 from 149,000 last year. The company finished the quarter with 29.9 million internet customers.

People haven’t stopped using the internet. People are leaving cable for fiber overbuilders and cheaper mobile broadband from cellphone companies like Verizon and T-Mobile.

Slowing the bleeding is a good thing for Charter, and Winfrey said he expects the red ink to stop eventually.

“We remain confident that we'll return to Internet customer growth over time through our operating strategy of delivering the best networks and products at the best value for customers, combined with unmatched service,” he said during the call.

Winfrey also called out that Charter racked up an industry-leading number of new mobile phone subscribers. “We added 500,000 Spectrum Mobile lines in the quarter and 2.1 million lines over the last 12 months for growth of nearly 25%, all because we offer seamless connectivity with the fastest speeds at the best price,” he said. That left Charter with 10.9 million mobile lines.

Nevertheless the continuing loss of broadband subscribers was the biggest reason why Charter’s stock plunged more than 18% on Friday after the numbers were released.

“They've been joking about this as ‘cell phone internet’ for years, but that cell phone internet, you know, is eating away at their subscriber base,” said Walter Piecyk, analyst at LightShed Partners, speaking on CNBC Friday, about the way cable operators look down their nose at their mobile internet rivals. “But look at the end of the day, Comcast, like Charter, the core business, what generates the EBITDA free cash flow is that broadband business.”

Comcast stock fell 5% on Friday. Comcast will report its 2Q numbers Thursday.

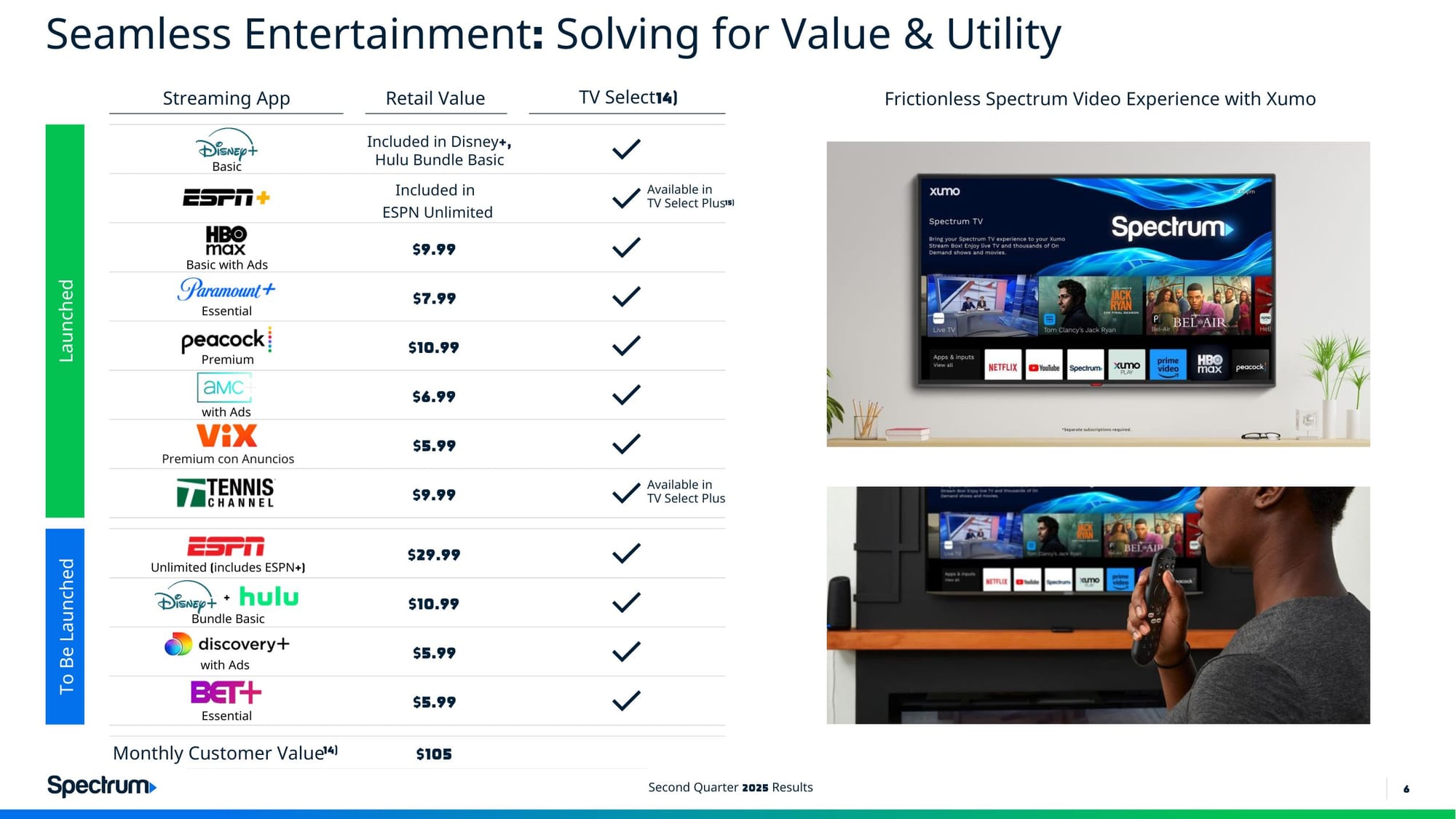

Cable companies have also been losing video subscribers. Charter has been trying to reduce churn by offering less-expensive skinny bundles that include streaming services from companies whose programming cable subscribers are already paying for.

Charter lost 80,000 video customers in the quarter, a drop in the proverbial bucket compared to the 408,000 that cut the cord in 2Q 2024. 2Q was the best video partner for Charter since 2021. Charter now counts 12.6 million video subscribers. Winfrey maintains that the video business remains important to Charter.

“Our video product continues to improve. In June, we announced the inclusion of Hulu with our traditional packages. Hulu should become available for those customers prior to the launch of ESPN Unlimited. And together with Fox One, our inclusion offer will then be essentially complete," Winfrey said. Those straming services are worth more than $100 a month to Charter subscribers, he said.

With the loss of subscribers, Charter's programming costs fell 8.8% to $2.3 billion

“In the coming months, we'll also launch our video marketplace. It's a place where customers can discover, activate, migrate, upgrade and downgrade their streaming inclusion apps,” Winfrey said.

“So why have we worked so hard to improve an ecosystem that's been in structural decline for years? The reason is because we recreated the video product into something of much higher quality with unique video packaging, flexibility and value. Together with Xumo, which solves a growing content discovery problem, our video product can be yet another competitive advantage for our Internet and mobile sales, and it drives churn lower,” he said.

And like every other company everywhere, Charter is employing AI. “We're currently focused on using machine learning and AI to take full advantage of all of our network and in-home telemetry to identify and address service issues before they ever occur,” he said.

Piecyk conceded that Charter’s moves have helped slow the departure of pay-TV customers. “They've done stuff on the video side that people are applauding because they're not losing as many subs as they used to by basically allowing customers to get much cheaper, skinnier bundles that also include your streaming services,” he said. “But that business is still a terrible business, right? The revenue is down 10% so that you're just swapping customers into lower priced products with low margins, and it doesn't seem to be having the benefit to broadband everyone thinks it is.”

Maybe, but Charter is doubling down. It is in the process of merging with another major cable operator, Cox.

“This combination offers significant benefits for customers, employees, local communities and shareholders. The transaction will marry Spectrum's operating strategy with the B2B capabilities and community investment heritage of Cox, together with our shared philosophy of long-term investment in our network and employees,” Winfrey said. “It will bring Spectrum products and prices to the Cox footprint, where we don't operate today. Increasing competition in those markets to the benefit of consumers and increasing onshore labor to the benefit of employees. This transaction is good for America. It's also a great outcome for both our current shareholders and for the Cox family.”

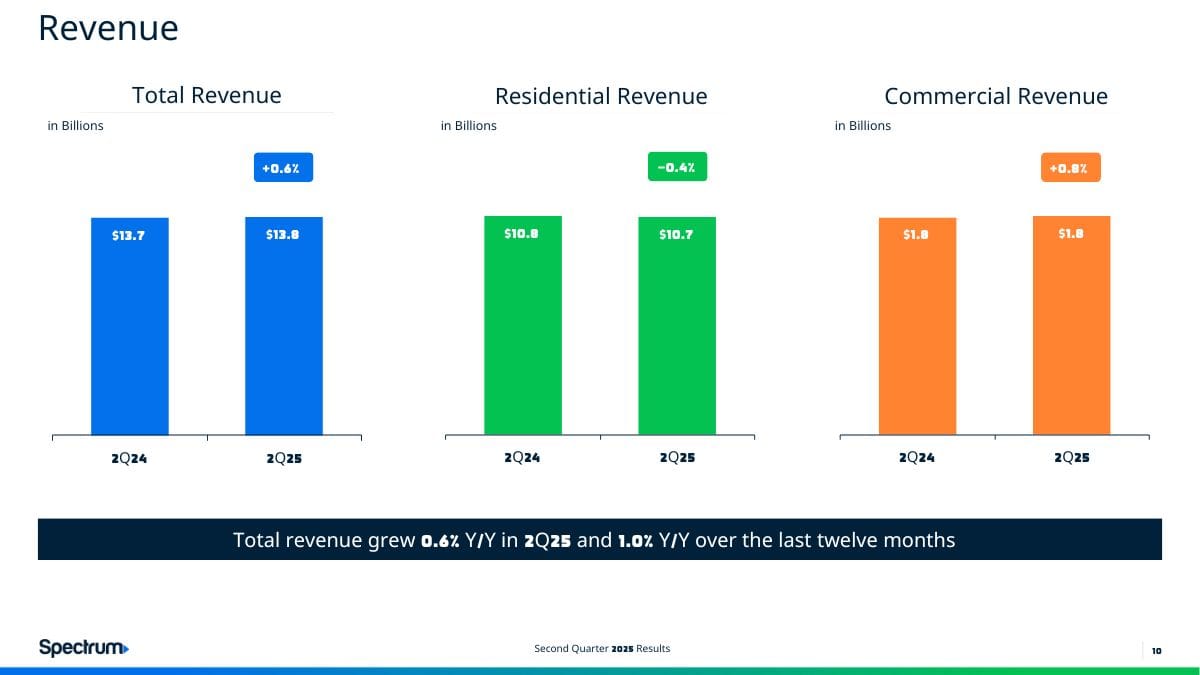

How good a business is it financially? Well in the second quarter, , Charter generated $13.8 billion in revenue, up 0.6% from a year ago. Of that, nearly $6 billion came from broadband, while $3.5 billion came from video. Mobile services accounted for $921 million in revenue.

Net income was $1.3 billion, or $9.41 a share, up 5.7% from $1.23 billion, or $8.58 a share, a year ago. Free cash flow dropped to $1 billion from $1.3 billion.

Could be worse. At least Charter doesn’t own cable networks.