Avoiding Commercials in 2026? Forget About It, and Other Predictions From Roku

'On our platform, roughly 60% of households who used to watch only ad-free streaming back in 2020, are now watching FAST,' said Roku's Jon Merkin

One of the early joys of streaming was the ability to watch TV shows and movies without those damned commercials.

We all know now that advertising has become an integral part of connected TV, but it is still shocking to hear the prediction that in 2026, no one will be able to avoid commercials while streaming.

The extinction of the ad-free viewer is one of the predictions made by Roku based on data gleaned from its users. Roku presented its predictions in a webcast Thursday hosted by Sarah Monahan, senior director, enterprise ad sales at Roku with Jon Merkin, Roku’s director of platform insights & analytics Adding their insights and opinions were Michelle Donati, executive VP at Horizon Futures, and former TV executive turned media industry pundit Evan Shapiro.

Merkin addressed how the growing amount of commercials on streaming was affecting the environment.

“Gone are the days when CTV was a haven for those people who were seeking an ad-free viewing experience,” Merkin said. “Folks today on streaming, they tolerate ads. They’re happy to watch ads in exchange for free or low-cost content.”

Among households that stream using Roku, 96% see video ads.

“Our prediction is that this is going to go to 100% and the ad-free streamer will go extinct in the next year,” Merkin said.

Merkin added that this didn’t mean 100% of content would be ad supported, but that it would be impossible for any individual viewer to totally avoid commercials.

When they started, Netflix, Disney Plus and Amazon Prime Video were ad free. But now all of the major subscription streamers have ad-supported tiers. At a time when streaming prices are going up, more consumers are opting for the cheaper ad-supported products.

They are also watching more free ad-supported streaming television (FAST) channels. “On our platform, roughly 60% of households who used to watch only ad-free streaming back in 2020, are now watching FAST,” Merkin said.

Even viewers who pay to get the ad-free tiers still will see commercials during live programming like sports and news.

Merkin said that streamers now need to be careful not to overload their programming with commercials. “We don’t want that to happen,” adding that “consumers are definitely willing to watch a lot more ads than we’ve been thinking even a couple of years ago.”

Shapiro noted that many people who make their living at ad-supported TV go home and subscribe to ad-free streaming services.

“But we also have to realize that’s a rich person’s experience. We have to understand that we are not the audience,” he said, and most consumers either aren’t willing, or can’t afford to, pay the prices for ad-free streaming.

Shapiro added that the ad-free subscription business model has proven to be unprofitable. “Netflix made it work for a while. Congratulations. That time is over,” he said. “The ARPU of an ad-free viewer is just not enough to sustain the level of programming necessary to keep subscribers subscribed.”

Streamers are raising the prices of their ad-free tiers to drive subscribers to their ad-supported products, which are more profitable.

In addition, when viewers turn on their TV sets, more and more they’re seeing ads on the home screens of their devices and streaming services.

“It’s really valuable real estate,” Shapiro said. “That’s how you reach the ad-free viewer.”

Roku made four other predictions.

Merkin said TV will get more personalized. That will mean viewers will spend less time looking for what they want to watch. It also means commercials will be more relevant and therefore more effective.

YouTube and Netflix are already seeing big chunks of viewership that are being guided by their platforms’ recommendations. This is important to platforms because it means users are more likely to find the niche titles in their portfolios, rather than setting for “comfort food” programming like Friends reruns.

“On our platform, we've added a recs content mode to our home screen, which is already driving almost 10% of all streaming on our platform,” Merkin said.

The next prediction was that CTV would offer a safe space as AI eats the internet.

Merkin said that AI and large language models were making the internet–and particularly social media and search–less attractive to advertisers.

AI-generated content summaries provide advertisers with less data about what users are doing. And generative AI is flooding social media with offensive content that can’t be trusted. That raises questions about brand safety.

On the other hand, CTV is largely safe from the most disruptive aspects of gen AI, Merkin said, giving advertisers a safe and high-intention environment, along with a strong ability to measure outcomes.

What does that mean? Merkin said brands will shift spending from search and social to CTV.

“We’ve already seen the migration toward CTV,” said Horizon’s Donati. “The AI slop that we’re seeing on the internet is only going to accelerate that more.”

Donati added that human viewers feel a bit disrespected when they see content that is generated by AI with no human contribution.

Shapiro added that retail media, which has focused on sales performance at the bottom of the funnel, is likely to look to CTV to provide top of the funnel exposure for brands. “It’s hard to sell a product nobody knows about,” he said.

Because it marries the sight, sound and motion of TV advertising with digital data and targeting, “CTV is going to be the one part of TV that goes up in 2026. The rest is either going to be flat or down,” Shapiro said.

Roku also predicted that TV would collide with the creator economy. More channels will carry creator content, while those creators will become more sophisticated in their production capabilities and begin to resemble studio content.

Finally, Roku predicted that 2026 will be the year that hyperlocal advertisers embrace CTV.

The midterm elections coming up will have a leading role in giving local ads on streaming a boost, Merkin said.

“Streaming has the scale to help regional brands find hyper-local audiences

in a way that affiliate stations in linear TV have done for a while,” he said. “Political campaigns will demonstrate that self-serve TV ads combined with AI-generated creative can help candidates turn out the vote. And seeing this, all sorts of local businesses will come onto our ads manager tool and follow suit.”

CTV already absorbs about $2.8 billion in local ad spending for an 8% share. Merkin sees that going up in 2026.

Donati said that her retail clients are already using CTV.

“In some cases, they’re outspending their linear spend with the CTV spent in local markets because of the targetability and the ability to dynamically insert and all those other capabilities that are offered to them.”

Shapiro said that the sheer volume of the political dollars will clear the local CTV pipeline for small- and mid-sized businesses.

“This is like Roto-Rooter to a lot of the issues that CTV has been having in its pipe over the last number of years,” he said.

# # #

Ho. Ho. Ho. Disney Advertising said that it has sold out its commercial inventory in the five NBA games airing nationally on Christmas Day. The sellout comes despite three NFL games also being played on TV on December 25.

Disney said demand was strong, pushing revenue up 18%. Commercials on a cost-per-thousand-viewers basis cost 12% more. Commercials bought at the last minute in the scatter market cost 20% more.

According to Disney, nearly two-thirds of the 47 returning advertisers increased their spending and there will be 37 new brands appearing during the Christmas NBA games, including Syneos Health, AbbVie, Warner Bros. Discovery and Booking.com.

The presenting sponsor of the NBA games on ESPN and ABC is State Farm. The company’s “Assist of the Game” feature will appear during all five games.

In addition to in-game inventory, spots in Inside the NBA and NBA Tip-Off are sold out for Christmas as well.

A24’s film Marty Supreme will be the exclusive studio partner for Christmas day, with a co-branded spot appearing during NBA Tip-Off and all five games.

DraftKings, which announced a new betting partnership with ESPN earlier this month, is launching a new “Player Pulse” feature.

During the games, Nike’s Jordan brand will be prompting the launch of Luka Doncic’s new sneaker release. ESPN will showcase the shoe during the Lakers Game against Houston.

Hyundai will present halftimes. Hyundai’s “More in the Moment feature will appear during halftime of the 12 p.m. and 10:30 p.m. games and its “Halftime Highlights” feature will appear in the other three games.

# # #

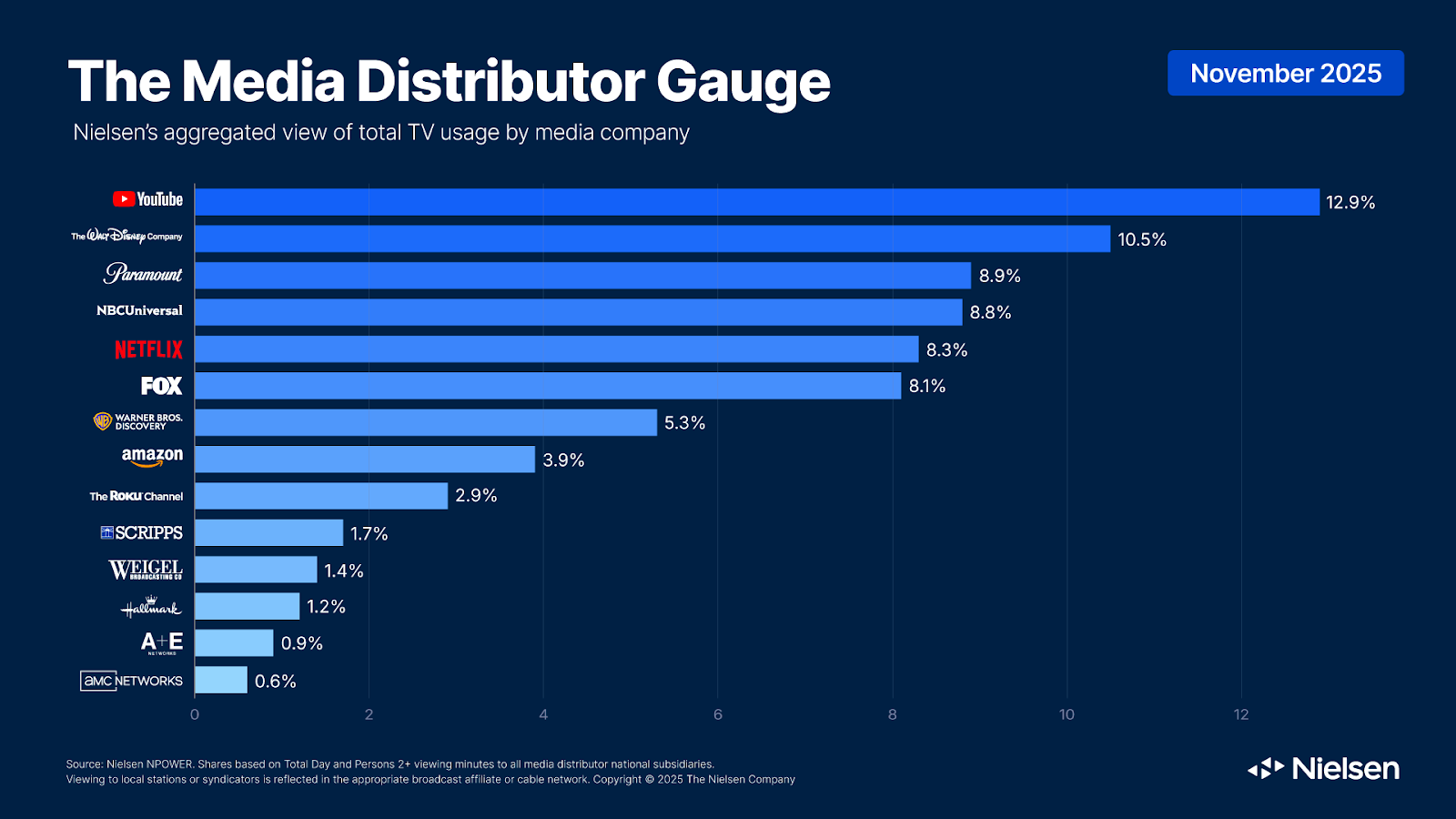

The beginning of the holiday season brought ratings cheer to Paramount, Netflix and Hallmark, according to November media distributor data from Nielsen.

Paramount’s viewing jumped 14% in November, fueled by both its broadcast and streaming properties. CBS affiliates were up 18%, as was Paramount Plus. Paramount’s share of viewing rose to 8.9%

Netflix viewing was up 10% as the return of Stranger Things generated nearly 12 billion viewing minutes. Netflix also got eyeballs from the launch of The Beast in Me and Guillermo de Toro’s Frankenstein.

Christmas came early, as it usually does, for Hallmark, which saw a 28% viewing gain in November as people tuned in to holiday movies and the original series Mistletoe Murders. Hallmark accounted for 1.2% of total watch time.