As It Enters New Era, Big Data is a Big Deal For Nielsen. A Study Finds New System More Forecastable and Stable

“These results reflect just one campaign — but the financial relevance scales significantly,” the datafuelX study says

It is the beginning of a new era of television as Nielsen’s Big Data + Panel becomes the methodology that Nielsen and networks use publicly to talk about how many people are watching TV.

Nielsen’s previous system, relying on meters in thousands of Nielsen homes, was regularly criticized by the industry and the new system has drawn complaints as well.

The VAB, which represents TV networks, over the summer complained the new ratings system is accelerating the loss of linear viewers and demanded changes. Nielsen said it saw no reason to adjust its methodology and plunged ahead.

The National Football League, which creates the highest-rated programming on TV, also took a pre-season swipe at Nielsen. “There are millions of viewers that we believe they are systematically undercounting,” NFL Chief Data and Analytics Officer Paul Ballew told The Wall Street Journal.

As the big data system takes effect a new study by datafuelX examines the suitability of the new Big Data+Panel system for the data-driven linear campaigns it creates for clients. DatafuelX found the new Nielsen system helps enable more accurate forecasting and viewership numbers that were more stable on a week-by-week basis.

Since linear networks estimate the number of viewers a campaign will generate and usually guarantee delivery, more accurate forecasts mean less financial risk for the networks, according to the study.

But before going into the details of the study, let’s go back to what Nielsen is saying about its new Big Data + Panel data.

It’s important to remember that despite industry griping, and an unprecedented number of competitors offering alternative big-data infused audience measurement systems, in the past upfront, it appears that most buyers and sellers primarily relied on Nielsen as they made the upfront buys that account for billions of dollar worth of ad revenue for the upcoming 2025-26 season.

Seven of the largest agencies and one of largest advertisers the recently renewed long-term deals with Nielsen to use Big Data + Panel data, as did several major media companies, according to Nielsen.

“The embrace of Big Data + Panel ratings marks a once in a generation enhancement for the industry,” said Nielsen CEO Karthik Rao in a statement. “Combining the trusted, historical measurement of our Nielsen homes with millions of big data inputs gives us the most accurate numbers ever. We developed this measurement advancement in service of and in collaboration with our clients. We are proud to work with them to deliver these numbers for the new season.”

By the numbers, Big Data is a big deal for Nielsen. The company says that it delivers more than 100 terabytes of data to clients every day and in the typical month measures more than 1 trillion minutes of viewing across all streaming apps.

Nielsen's panel consists of more than 42,000 homes and 100,000 people. Big Data adds viewing information from set-top boxes and smart TVs across 45 million households and 75 million devices. It also incorporates data from servers at the big streamers.

Starting this month, Nielsen says its press policy calls for all public claims by broadcasters, networks and streamers to be based on Big Data + Panel numbers.

Because it takes two to three days to deliver Big Data + Panel numbers, Nielsen is making an exception for overnight numbers for single-day events. In that case, the initial numbers will be referred to as “Nielsen Preliminary Data” and when the Big Data + Panel numbers come in, those will be deemed as “final” for claims being made via the press.

Nielsen notes that with the larger sample size created by adding Big Data, its audience estimates can change from Panel only, but should result in better representation of all audiences, including Hispanic homes.

“Although numbers may be different, macro trends look very similar between Panel-only and Big Data + Panel, giving us confidence that genuine viewing patterns are accurately represented,” a Nielsen spokesperson said.

Now, back to the research done by datafuelX, which had been using Nielsen's panel data to plan data-driven linear campaigns for clients.

The bottom line is that the new, Big Data + Panel data was “usable for targeted audience use and usable for lower rated networks and lower rated programs,” datafuelX head of strategy Howard Shimmel told The Measure.

As a client, datafuelX collaborated with Nielsen, but the study was done independently and not paid for by Nielsen, said Shimmel, the former head of research for Turner Broadcasting.

Shimmel said the research didn’t look at whether ratings for linear networks were bigger or smaller using the new ratings system.

“We have lots of history on [Nielsen’s panel-based data] and how forecastable it is,” Shimmel said. The research was designed to take a side-by-side look at the new Big Data + Panel data and the old data.

With the new methodology’s bigger sample size, Shimmel and datafuelX wanted to know “how much of improvement do you get in terms of forecastability, based on the audience target, whether it’s small or large, and the network size, do they have big ratings or small ratings?”

From the perspective of publishers, the research found that one of the key benefits of the change to Nielsen Big Data + Panel is its ability to improve audience forecast accuracy.

Now a bit of technical stuff. In its study, datafuelX measured the Mean Absolute Percentage Error (MAPE) across each network and daypart for two publishers with multiple networks that vary in terms of rating size. They compared the forecast error under legacy panel data to the Big Data + Panel error rates.

The results “showed a consistent improvement with big data across most time periods and audiences.” For one of the network groups, the improvement across target audiences was 72% and for the other it was 23%.

“Lower-rated networks and dayparts tended to show greater improvement in forecasting accuracy” using Big Data, the study said.

One reason why was the reduction in the number of instances where no viewers showed up for a particular network, a phenomenon known as a zero cell.

“Big data appears to smooth this reporting behavior by incorporating larger, more continuous data sets, reducing the frequency of “jagged” measurement outputs (e.g., sharp spikes or zeros),” the report said. The biggest improvements were found among the lowest-rated selling titles.

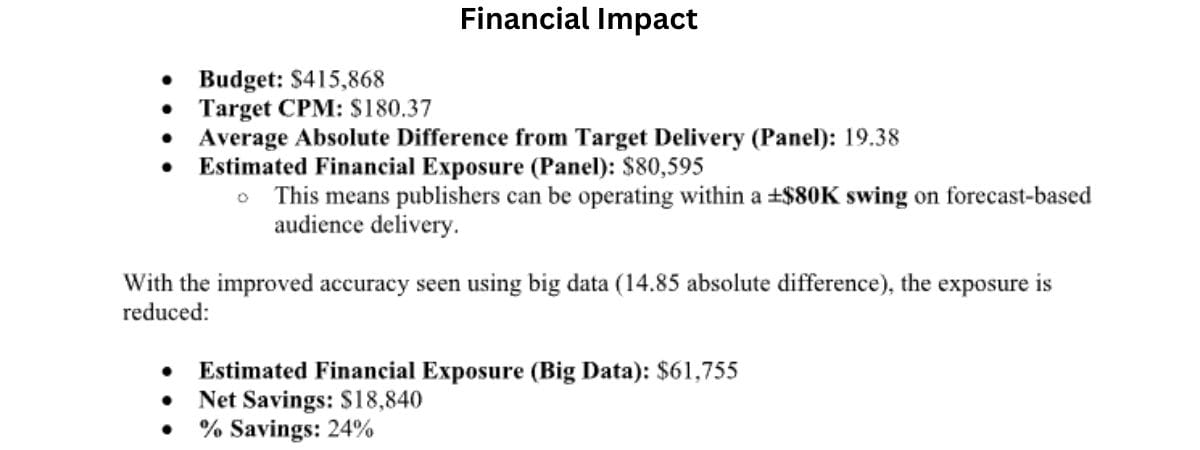

The improved ability to forecast has financial implications for publishers.

“The key metric we analyzed was Estimated Financial Exposure, which represents the dollar value of average variability between forecasted and actual impressions.

If a campaign doesn’t reach the audience levels a network guarantees based on its forecasts, it is on the hook for makegoods, which creates financial risk.

For example, datafuelX looked at a campaign with a $416,000 budget Using the old panel-only data the financial exposure based on the difference between forecast and actual campaign performance was $80,595, Using Big Data + Panel, the estimated financial exposure was $61,755, resulting in net savings of $18,840 or 24%.

“These results reflect just one campaign — but the financial relevance scales significantly,” the study said. “Across larger portfolio deals or quarterly planning cycles, even modest improvements in forecast precision can yield substantial reductions in liability and exposure, delivering real value both operationally and financially.”

The study also looked at the stability of Big Data Plus Panel audience delivery on a week-to-week basis.

While data-driven campaigns are typically looked at quarterly, “weekly forecasts will enable more precise stewardship,” the report said.

The research found that using Big Data + Panel reduced the week-to-week variance in audience delivery by 13%. The reduction was about 3 times higher for lower-rated networks than higher-rated networks.

“The shift from Nielsen Panel to Nielsen Panel + Big Data represents a meaningful improvement in how TV campaigns are targeted, forecasted, and executed,” the study concluded “While forecast accuracy gains are most pronounced in lower-rated areas, the benefits extend across audience types and dayparts, with measurable financial impact and improved operational workflows. Nielsen Panel + Big data also enables persons-based targeting at scale, removes long-standing

limitations in panel methodology, and enhances workflow integration — collectively positioning the industry to better manage complexity and drive more precise outcomes.”

Nielsen was understandably please by these findings.

“Big Data + Panel is the best and most accurate product for measuring TV viewing. We’ve worked hand in hand with clients for years to get to this point and we’re proud that Big Data + Panel is being embraced and that the rigor of our data is being analyzed by industry experts like DataFuelX,” a Nielsen spokesperson said.