Advertisers Spend More On Linear TV As Reach Declines in Q3, iSpot Reports

CBS and Fox News led the way by network TV ad reach, as advertisers and audience continued consolidation around live sports and news.

At the start of a new television season (maybe that’s a quaint notion), iSpot is giving us a quick look at third-quarter advertising data that reinforces some of the trends we knew about–and sheds light on others that we should be pondering.

We knew that viewers are leaving linear TV and the new data from iSpot reinforces that. Total TV ad impressions are down 2.7% in the quarter from a year ago to 1.67 trillion. Not a good sign.

On the other hand, national advertising spending on linear TV is up 4.2% to $8.77 billion. That means advertisers continue to pay more to reach fewer people and are focusing their spending on high-cost properties like live sports, which is propping up the networks but ultimately would seem unsustainable.

To get that extra spending, there were 1.4% more minutes of commercials on linear TV.

The NFL remains the top programming on TV, with a 3% share of impressions in the third quarter. NFL games this season are accounting for 28% of the reach achieved by the Big 4 broadcast networks, up from 25% last season.

iSpot notes that spending on the NFL is also justified because it generates not just viewing but positive outcomes for marketers.

College football was No. 2 by TV ad reach, followed by Major League Baseball.

With syndication, Law & Order: SVU is the No. 4 program, followed by The Big Bang Theory, a constant on Warner Bros. Discovery cable networks.

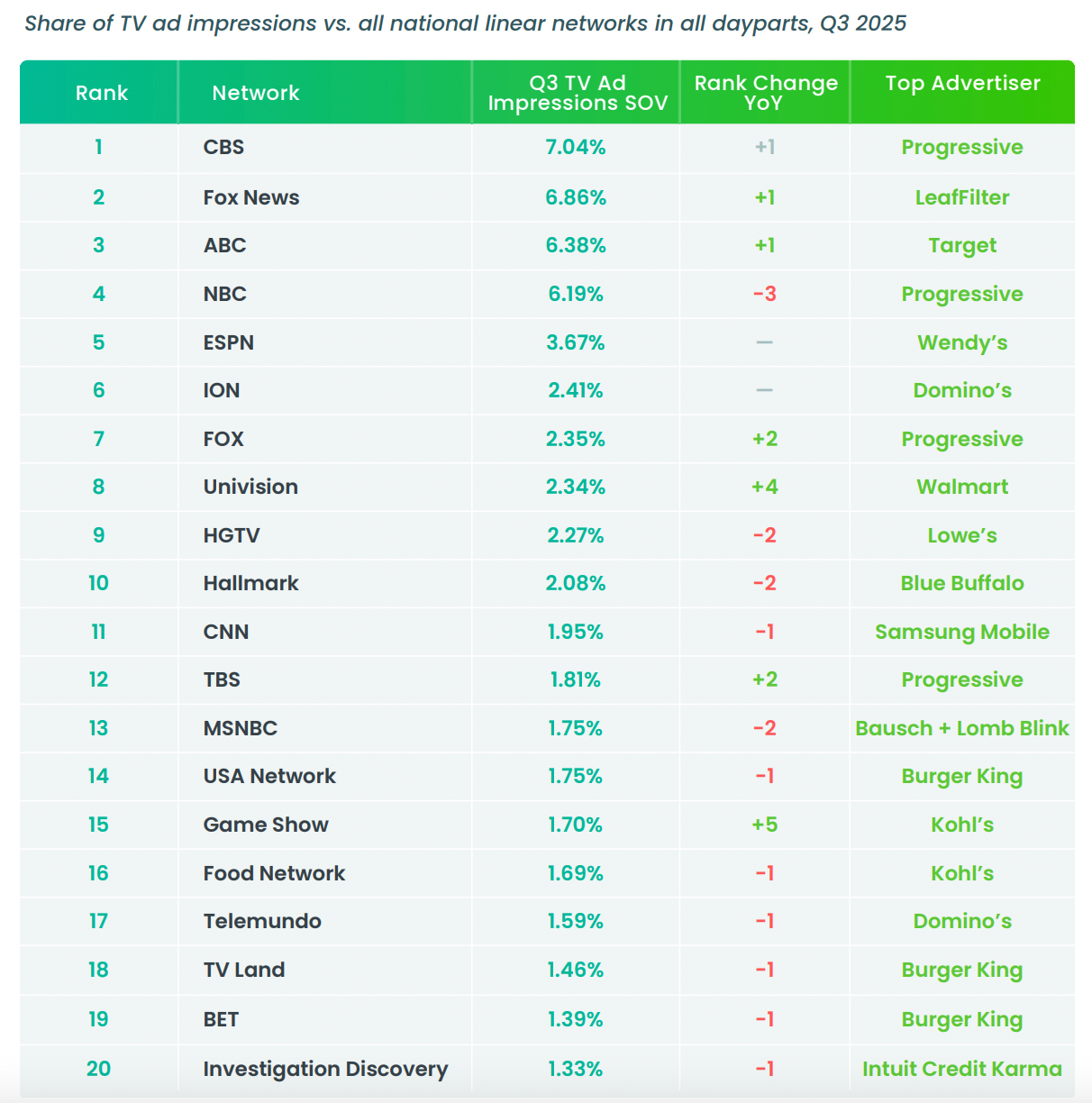

The TV networks generating the biggest share of household TV ad impressions are CBS (7.04%) and Fox News Channel (6.86%). ABC (6.38% of impressions), NBC (6.19%) and ESPN (3.67%) rounded out the top five.

Amid all the headlines about the late-night daypart, with CBS cancelling Stephen Colbert and Jimmy Kimmel being taken off the air by Disney for a few days, iSpot notes that the programs are still among the top 10 shows for ad reach on their respective networks.

Pharmaceutical advertising accounted for 13% of national linear ad spending. The government is considering limiting pharma advertising, which would create “major shifts for how those brands reach consumers and how networks potentially replace those advertisers, especially during news programming," according to iSpot.

IN CASE YOU MISSED IT:

Tubi and Viant said they expanded their relationship in ways the companies say will make CTV advertising more effective.

As part of the deal, Tubi’s content will be enabled with the IRIS_ID, which gives advertising contextual and emotional targeting while making programmatic business.

Viant acquired IRIS.tv last year.

“Advertisers expect transparency along with improved performance as they continue to accelerate their CTV investments,” said Tom Wolfe, senior VP of business development at Viant. “By combining Tubi’s extensive AVOD reach with Viant’s leadership in CTV, identity and measurement, advertisers achieve greater transparency and performance, at scale.”

“As a pioneer in ad-powered streaming, we continue to expand our partnerships with leaders like Viant to ensure advertisers can maximize the performance of their CTV campaigns,” said Vijay Rao, senior VP of Partnerships at Tubi, which is owned by Fox. “Tubi’s massive reach with highly engaged viewers combined with the measurable precision of Viant’s DSP can deliver more meaningful outcomes for marketers.”

# # #

The Trade Desk announced that it found someone to adopt its Ventura TV operating system in DirecTV.

The companies said they planned to develop a custom version of Ventura for DirecTV streaming service.

The companies hope there will be others in the future. ‘This version of Ventura is designed for easy deployment by any third-party TV manufacturer, retailer or hospitality partner seeking a simple OS solution and a stable, recurring revenue model,” they say in the announcement.

Facing competition from companies with inventory, The Trade Desk developed Ventura to embed itself with programmers by promising to unlock new revenues streams for device makers.

“The TV landscape is riddled with friction and fragmentation — viewers are lost in a maze of content choices and marketers face inefficient routes to reach them,” said Amy Leifer, chief advertising sales officer at DirecTV.

“We’ve solved for both problems by creating a seamless ecosystem with best-in-class search and discovery experience for audiences and an advertising platform built on deterministic data that makes it easy for brands to reach them. The Trade Desk shares our vision for ease and simplicity, and this integration with Ventura TV OS will further streamline the process to help brands connect with CTV viewers,” Leifer said.