Advertisers Can Get Primetime Results from Spots in Other Dayparts, Spectrum Reach Report Says

‘Our attribution insights demonstrate that sports are extremely effective at driving website response,’ the report said

Primetime used to be primetime for everyone. Back when NBC’s primetime was must-see TV, tens of millions of people would tune in for hits like Seinfeld and E.R.

Now, thanks to streaming and DVRs, viewers can pick what they want to watch and when they want to watch it.

And a new report from Spectrum Reach, the advertising sales arm of Charter Communications, suggests that primetime might be different time periods for different advertisers.

Spectrum Reach said it is the first “advertising partner” to bring brands deterministic multiscreen attribution at scale. To do that, it matches its aggregated and de-identified first-party data from set-top boxes and streaming devices with third-party website visitation data.

The company said it has studied 820 campaigns in 17 industries.

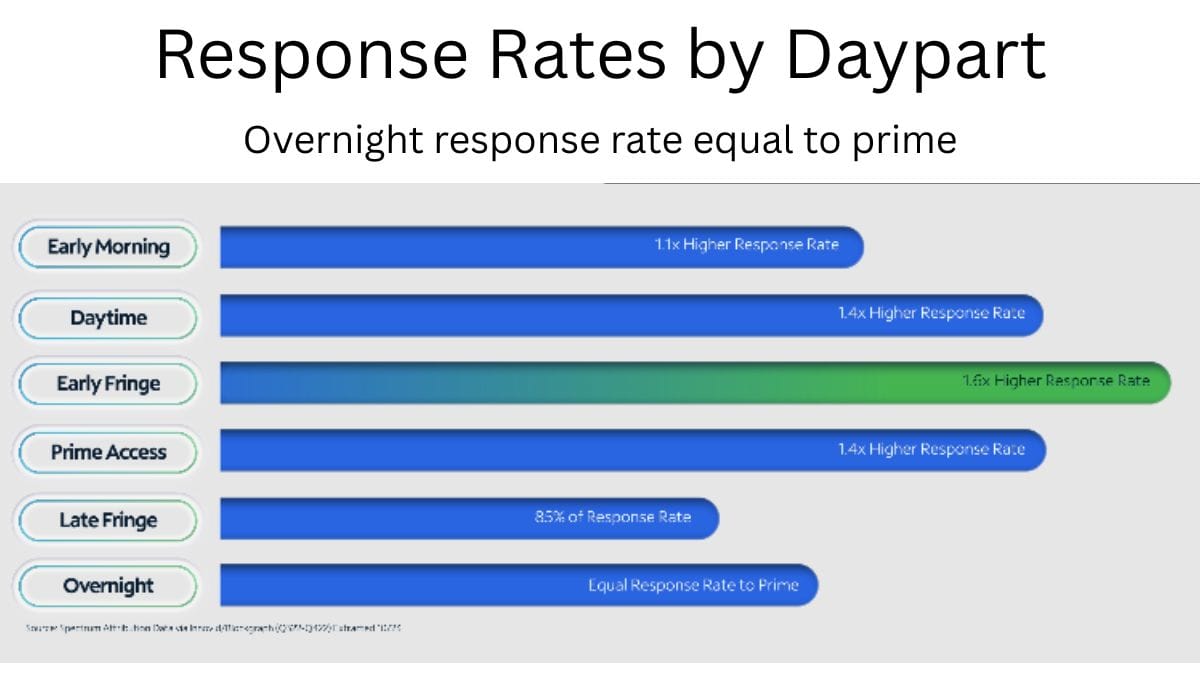

The report, entitled How TV Drives Web Engagement: Learnings from Multiscreen Attribution Insights, said the study found that incremental website visitation rates were higher outside of primetime. Commercials running in early fringe (9 a.m. to 3:59 p.m.) generated 60% more audience response than prime. Prime access and daytime responses were 40% higher and early morning was 10% higher.

Which dayparts generated the highest website visitation rates also varied by industry. For example, the travel and automotive categories got the highest response rates in early fringe. (Perhaps commuting home after a day of work leaves consumers open to message about new vehicles or tropical get-aways, the report theorizes.)

Meanwhile, education industry advertisers got their best responses from viewers in late fringe (11 p.m. to 1:59 a.m).

The report also found that viewers in the early morning daypart are more likely to make a web visit after seeing ads on home and food oriented networks.

“It is important for media planners to think outside the sports-news-entertainment boxes,” the report says. “A more detailed look at programming genres reveals what is more likely to appeal to viewers and drive them to take action at various points in their day.”

On the other hand, the report notes that among the most popular programming genres, sports packs a punch. The response rate for sports is 24% higher than average.

“Sports programming is lean-in content with highly engaged viewers. Third-party studies show what marketers know implicitly, that sports fans are more likely to take action after seeing ads on TV and streaming,” the report said. “Our attribution insights not only support this, but demonstrate that sports are extremely effective at driving website response.”

# # #

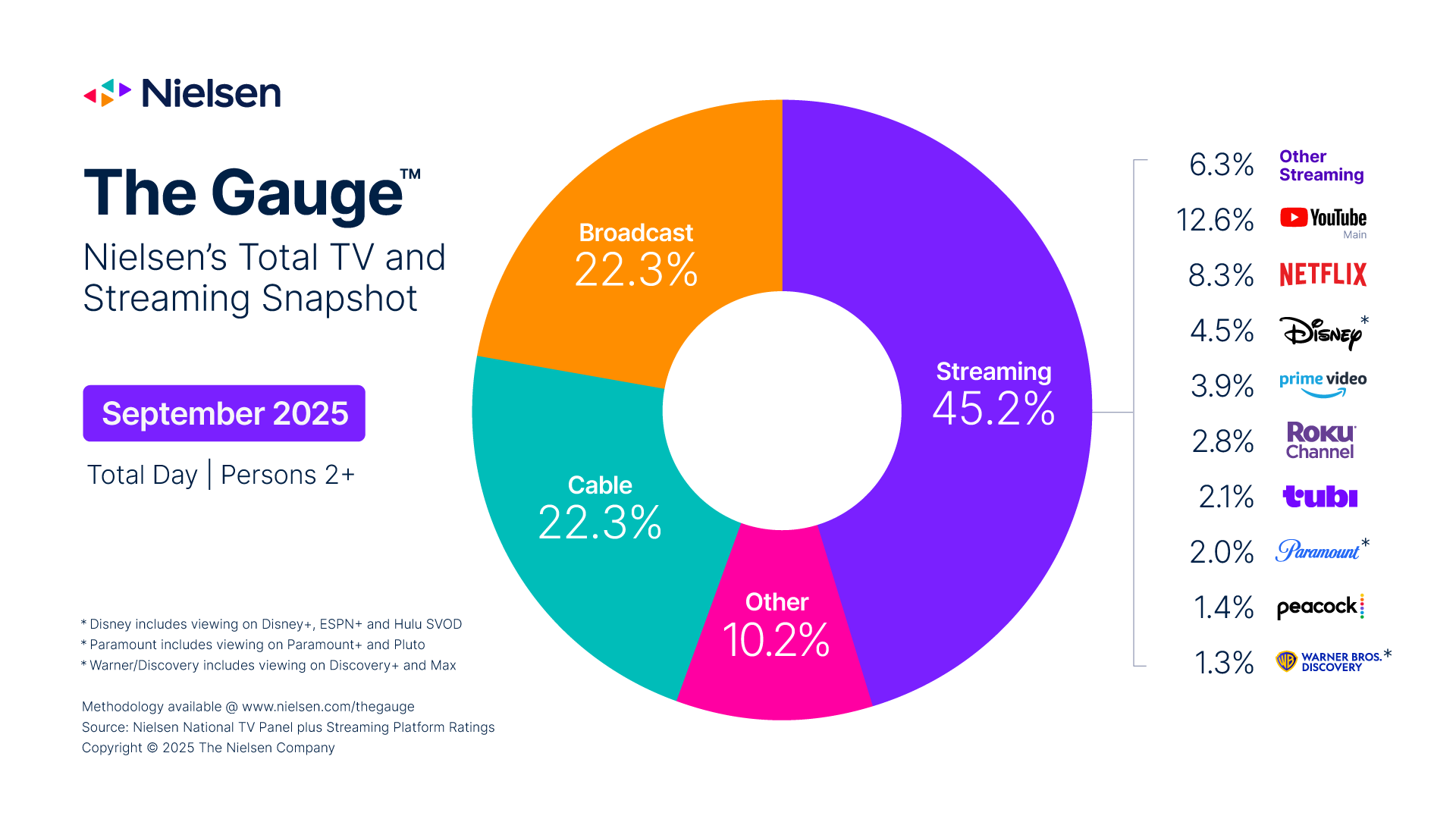

The big money networks pay for football paid off in September with broadcast getting its largest-ever monthly increase in viewing, according to Nielsen.

Traditional TV has been on a long-term losing streak, but time spent watching broadcast rose 20% in September. Broadcast’s share of viewing jumped to 22.3% from 19.1% in August.

NFL and college football boosted broadcast, which topped cable in share of viewing for the first time since Nielsen began making monthly report.

Sports viewership tripled to 33% of broadcast total in September with 15 NFL games on CBS, Fox and NBC getting bigger ratings than the most watched telecast in August.

Overall use of TV increased 3% in September.

Cable viewing also increased, gaining 11%, with NFL games on ESPN and NFL Network leading the way. Cable also saw a 9% increase in news viewing.

Steaming continued to have the largest share of TV usage with a 45.2% share in September, down from 46.4% in August. Amazon Prime Video had its most viewed Thursday Night Football game with the Commanders and Packers drawing more than 3 billion minutes viewed.

YouTube remained the top streamer, but its minutes watched fell 2% in August as kids returned to school.

# # #

Ad-tech company PubMatic said it made a deal with dentsu to deploy pause ad campaigns on connected TV for dentsu’s advertising clients.

Pause ads have been popular with viewers because they appear only when viewers decide to temporarily stop watching. Studies have shown that pause ads are also effective for marketers.

The first pause ad campaign for dentsu is promoting the Halloween movie Stitch Head from Briar Cliff Entertainment.

"Pause ads represent a fundamental shift in how we approach premium CTV inventory," said Rebekah Shalit, VP of partnership, platforms lead at dentsu. "The format addresses two critical challenges for clients: achieving meaningful engagement without disrupting viewer experience, and accessing premium inventory moments that traditional pre-roll simply can't provide. Our active campaigns with PubMatic demonstrate pause advertising's evolution from experimental format to strategic necessity."

PubMatic says its CTV business was up 50% last quarter.

"This collaboration with dentsu reflects our commitment to advertising innovation that benefits the entire ecosystem," said Nicole Scaglione, VP of CTV at PubMatic. "Agencies gain access to high-performing inventory and strategic advantages, and viewers experience relevant, non-intrusive advertising. This represents the future of unified programmatic advertising, built specifically for buyers needs and sophisticated campaign management."