Is Dick's $2.4 Billion Foot Locker Buy The Right Fit?

Dick's Sporting Goods is buying fellow retail brand Foot Locker for $2.4 billion, as was announced this week. The move would marry one of the lone remaining "sporting goods stores" in the U.S. and one of its only national sneaker retailers.

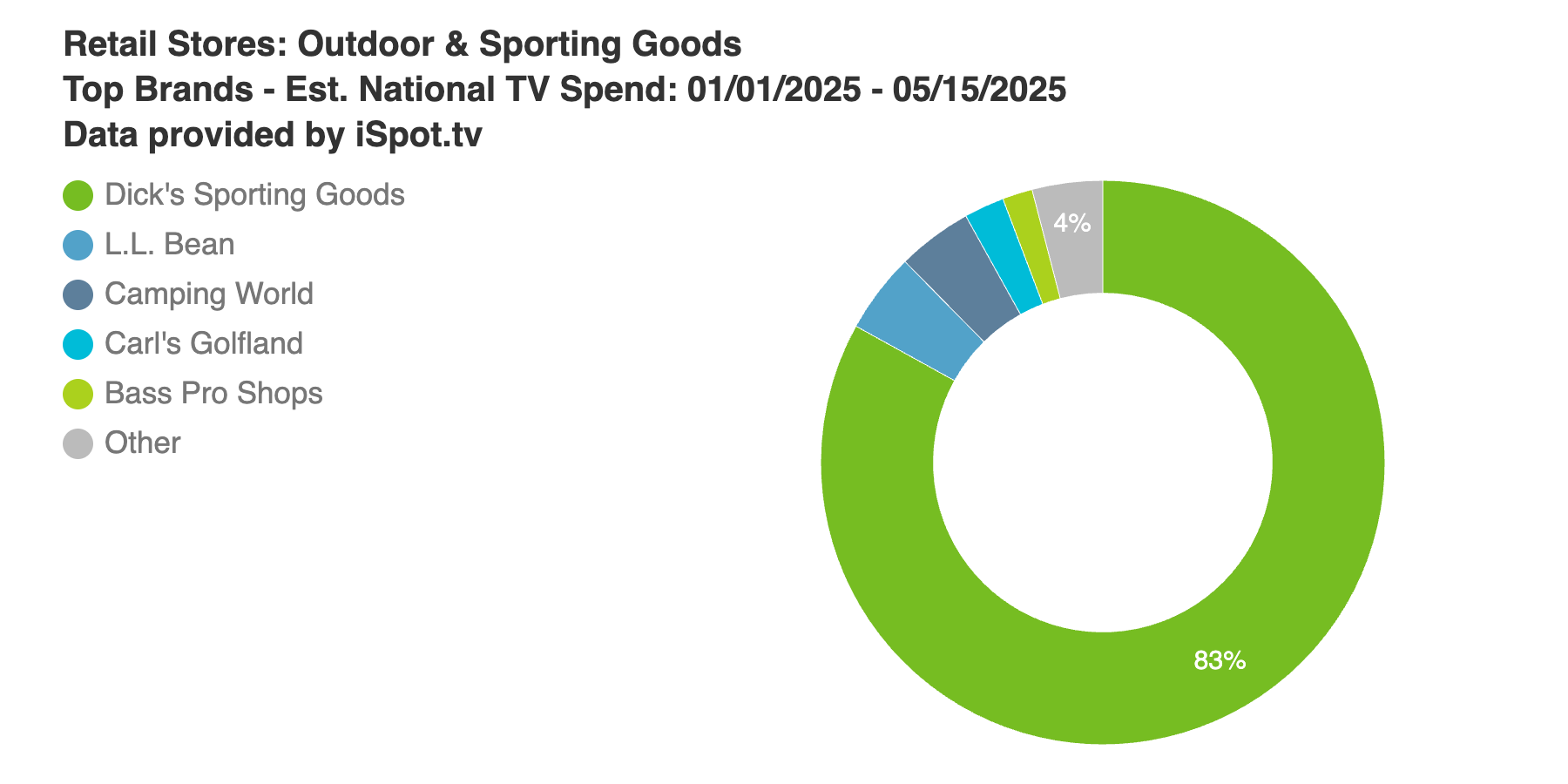

Would the buy create a sportswear and sneaker powerhouse, though? We used iSpot data to take a look at the combined might of the two brands from a TV advertising perspective.

- Dick's Sporting Goods already looms large above the rest of the outdoor & sporting goods store industry, accounting for 83% of est. national linear TV ad spend so far in 2025 – $38.9 million total.

- For full-year 2024, Dick's accounted for 62.4% of outdoor & sporting goods spend, so the brand has spent 2025 expanding its TV investment relative to would-be rivals.

- For (smaller) clothing & footwear retail brands, Foot Locker is No. 4 by spend so far this year at 9.3%, and was No. 11 last year at 0.62%, so the brand's been growing in 2025 – almost exclusively via ads appearing during NBA games.

So while Foot Locker hasn't been a giant on TV recently, they're still among the biggest in a wide category of clothing and shoe retailers, and will now have additional dollars available to advertise more. CNBC also brings up that assuming the buy goes through, the combined company also earns a leg up on competition for sneaker aficionados via cornering the market on Nike shoes (they make up two of the three wholesalers with Nike contracts).